Compagnie de l'Odet (ENXTPA:ODET): Exploring Valuation After Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

Compagnie de l'Odet (ENXTPA:ODET) has caught investors’ eyes this week, not because of a splashy announcement or headline-grabbing news, but due to a recent string of declines in its share price. While there is no single event driving the move, the persistent downward trend is beginning to prompt questions from shareholders and prospective buyers alike. When prices shift without a clear catalyst, it often sparks a debate: is the market anticipating something coming, or is it simply an overreaction to broader factors?

This backdrop comes after a challenging year for Compagnie de l'Odet, with the stock drifting down over the past several months. The share price has fallen roughly 14% year-to-date and slipped by 11% over the last year. Even so, if you zoom out to the last five years, the stock has returned over 100%, showing that long-term holders have still enjoyed solid growth. The recent pullback may suggest that momentum is cooling, at least for now.

So after a year spent trending lower, could this set up an attractive opportunity for value-focused investors, or is the market already betting on weaker prospects ahead?

Price-to-Earnings of 5.1x: Is it justified?

Based on its price-to-earnings (P/E) ratio, Compagnie de l'Odet’s shares appear notably undervalued relative to both the French market and global logistics peers. The company trades at 5.1 times earnings, while the French market average is around 16x and the global logistics sector averages 16.1x.

The price-to-earnings multiple is a common way investors assess whether a stock’s price reflects its underlying earnings power, especially for established companies in mature sectors like logistics. A low P/E can indicate that the market is pricing in lower future growth, applying a discount for risk, or overlooking fundamental strengths.

The substantially lower P/E compared to peers suggests investors may be underestimating current or future profitability, or possibly assigning a penalty for perceived risks. In either case, the metric indicates the shares are trading at a steep discount versus the industry norm.

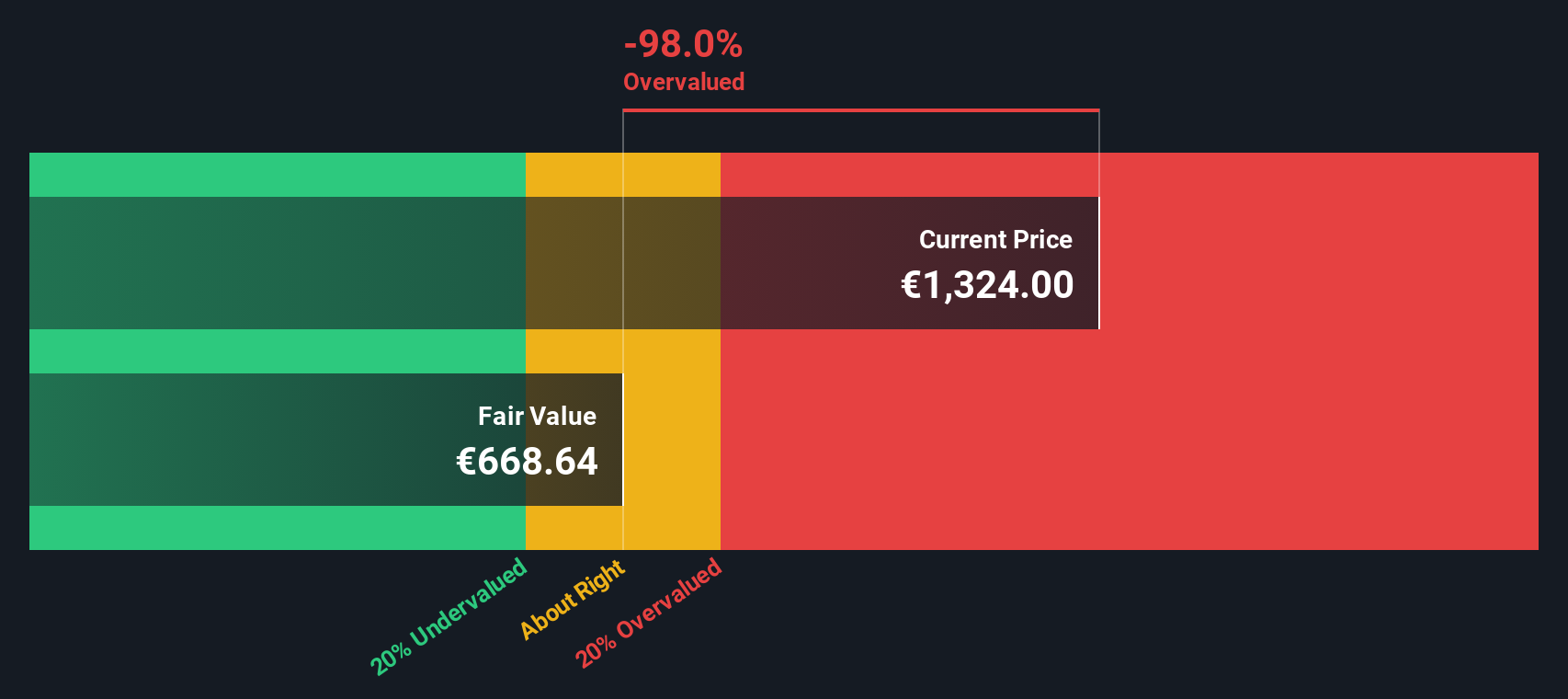

Result: Fair Value of $416.81 (OVERVALUED)

See our latest analysis for Compagnie de l'Odet.However, potential risks such as lack of earnings growth visibility or sector-wide uncertainty could quickly shift investor sentiment and put additional pressure on the shares.

Find out about the key risks to this Compagnie de l'Odet narrative.Another View: Our DCF Model Challenges the Discount

Looking beyond earnings multiples, our DCF model arrives at a very different conclusion. It indicates that the shares may actually be trading above their estimated fair value. Is the apparent bargain just an illusion?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Compagnie de l'Odet Narrative

If you see the story differently or want to dive into the numbers on your own terms, you can build a personalized outlook on Compagnie de l'Odet in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Compagnie de l'Odet.

Looking for more investment ideas?

Don’t settle for just one opportunity when there’s a world of potential waiting. The right screener can put today’s brightest opportunities at your fingertips in seconds.

- Target promising up-and-coming companies with strong balance sheets by going through our selection of penny stocks with strong financials.

- Access top picks for yield-focused investors and grow your income stream with market leaders in our curated set of dividend stocks with yields > 3%.

- Jump on the competitive edge of medicine and technology by finding the innovators reshaping health in our exclusive healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ODET

Compagnie de l'Odet

Engages in energy, communication, and industry business in France, Africa, the Americas, the Asia-Pacific, and other European countries.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives