Compagnie de l'Odet (ENXTPA:ODET): Evaluating Valuation Signals Beyond the Headlines

Reviewed by Simply Wall St

Lately, Compagnie de l'Odet (ENXTPA:ODET) has been popping up on some investors’ radars—not because of a headline-making event, but more because its recent movements might be signaling something to pay attention to. Sometimes, when there is no single headline driving the change, you have to dig a little deeper to figure out what is actually shaping sentiment about the stock. In these situations, understanding whether the market is spotting real value or just reacting to noise becomes especially interesting.

Over the past year, the stock has slipped about 7%, but that is not the whole story. The past month has brought modest gains, with a 1% uptick, and the three-year picture paints a very different narrative. Compagnie de l'Odet has delivered a 29% return over that period, and it is up more than 120% over five years. Momentum seems to ebb and flow, with some short-term risk perception changes, but the longer view suggests there may be underlying strengths.

After these price moves and with no major headlines to point to, does this create a genuine buying opportunity for investors, or is the market simply ahead of any future growth the company might generate?

Price-to-Sales of 2x: Is it justified?

Based on the preferred valuation multiple, Compagnie de l'Odet is trading at a price-to-sales ratio of 2x, which is higher than the European Logistics industry average of 0.8x. This suggests the shares could be relatively expensive compared to industry peers.

The price-to-sales ratio compares a company’s market value to its revenue, providing a sense of how much investors are willing to pay for each euro of sales. It is a useful measure in sectors where profits are variable or negative because it sidesteps issues of profitability and instead anchors the valuation to underlying turnover.

With Odet's ratio outpacing the industry average, buyers may be pricing in future growth or unique strengths not found among competitors. Alternatively, it may reflect investor optimism based on the company’s longer-term returns, even if current fundamentals are not as strong as those of its peers.

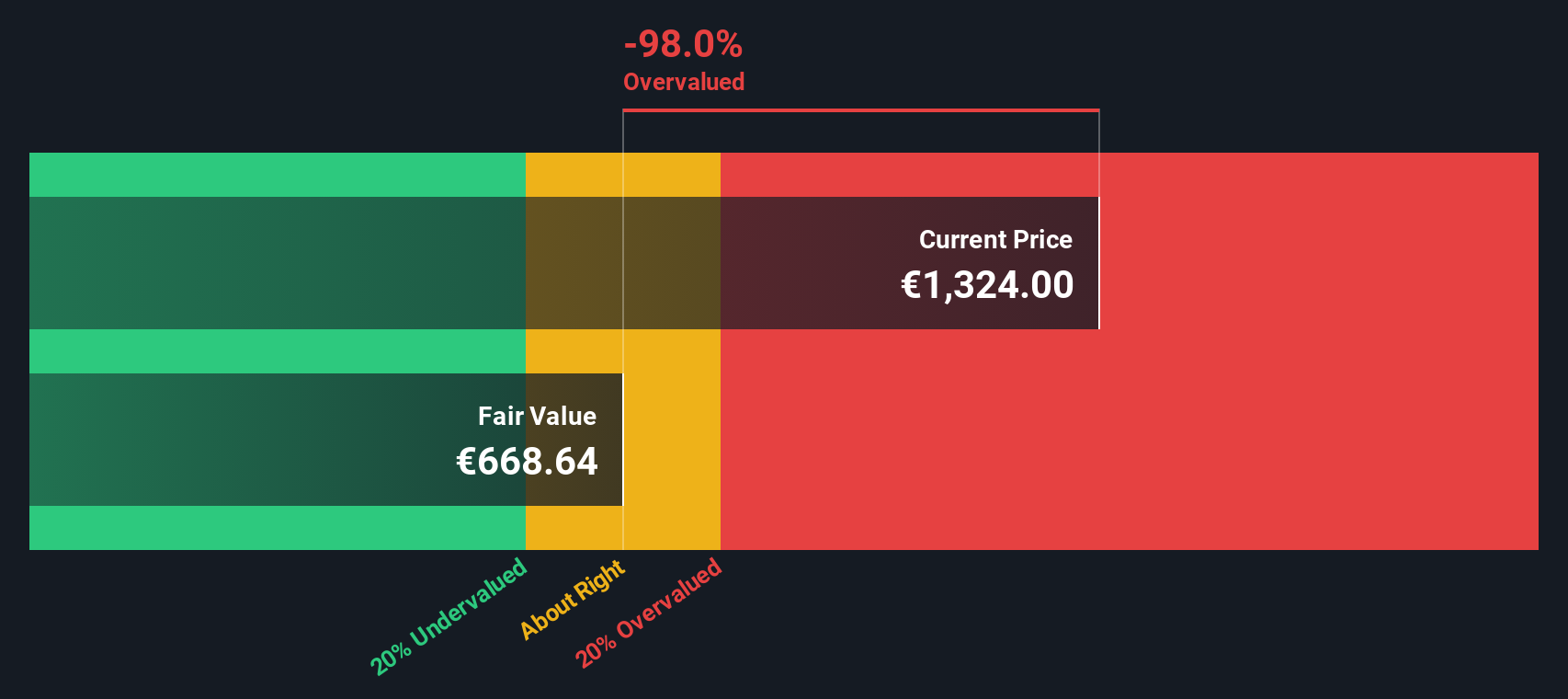

Result: Fair Value of €119.82 (OVERVALUED)

See our latest analysis for Compagnie de l'Odet.However, the company’s negative net income and lack of clear revenue growth could quickly undermine any long-term optimism if these trends persist.

Find out about the key risks to this Compagnie de l'Odet narrative.Another View: The SWS DCF Model

Taking a different approach, our DCF model suggests the shares are trading above what the underlying cash flows would justify. This method points to the stock being overvalued as well. However, does that make the DCF more reliable in this case, or just as limited as any other approach?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Compagnie de l'Odet Narrative

If you see the numbers differently or want to dig into the data yourself, you can piece together your own perspective in just a few minutes. Do it your way.

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for more investment ideas?

Seize your advantage by jumping on opportunities others overlook. With our screeners, you can pinpoint stocks with strong return potential tailored to your interests.

- Unlock overlooked value when you zero in on companies that are currently trading well below their cash flow potential with our undervalued stocks based on cash flows.

- Tap into tomorrow's breakthroughs by tracking innovative firms poised to transform medicine and health using healthcare AI stocks.

- Boost your passive income by steering attention to companies offering yields above 3% through the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ODET

Compagnie de l'Odet

Engages in energy, communication, and industry business in France, Africa, the Americas, the Asia-Pacific, and other European countries.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives