The Bull Case For ID Logistics Group (ENXTPA:IDL) Could Change Following Double-Digit Revenue Growth in Q3 2025 – Learn Why

Reviewed by Sasha Jovanovic

- ID Logistics Group SA reported its third quarter 2025 revenue at €937.8 million, up from €827.3 million a year earlier, and nine-month revenue of €2.70 billion compared to €2.35 billion for the prior-year period.

- This substantial increase signals ongoing momentum in the company’s core contract logistics operations across its markets.

- We'll explore how ID Logistics Group's robust revenue growth shapes its investment narrative and signals ongoing operational strength.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is ID Logistics Group's Investment Narrative?

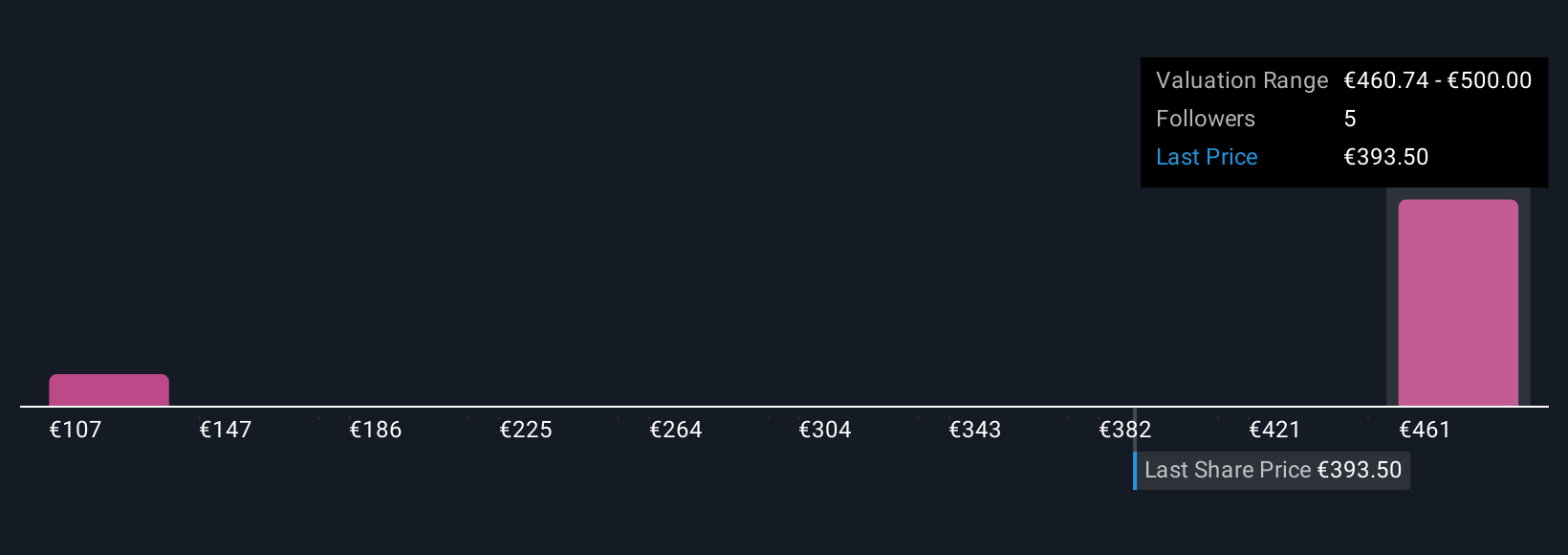

For anyone interested in the ID Logistics Group story, believing in the company's ability to deliver steady growth across contract logistics markets remains core. The just-announced Q3 and nine-month revenue gains extend an already positive sales trend, building on prior earnings-driven optimism and supplementing recent expansions into Canada. This latest data point might boost confidence in ID Logistics’ short-term revenue momentum, a meaningful catalyst for sentiment, though it doesn't address concerns about valuation, given the company's price-to-earnings ratio remains well above its sector peers. While operational performance is robust, key risks such as consistently low profit margins and returns on equity still linger, and recent share price softness shows market participants aren't ignoring these challenges. The new revenue results slightly improve the narrative, but the bigger picture of expensive valuation and modest profit growth still weighs on near-term expectations.

Yet, even with growth in focus, less obvious profitability pressures deserve close attention.

Exploring Other Perspectives

Explore 4 other fair value estimates on ID Logistics Group - why the stock might be worth as much as 28% more than the current price!

Build Your Own ID Logistics Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ID Logistics Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ID Logistics Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ID Logistics Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IDL

ID Logistics Group

Provides contract logistics services in France and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives