- China

- /

- Commercial Services

- /

- SZSE:300779

3 Growth Companies With High Insider Ownership Seeing Earnings Growth Up To 140%

Reviewed by Simply Wall St

As global markets navigate the initial policy shifts of the Trump administration, U.S. stocks have surged to record highs, buoyed by optimism around potential trade deals and AI investment initiatives. Amidst this backdrop of economic activity and investor sentiment, growth companies with high insider ownership are capturing attention for their robust earnings performance.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Let's uncover some gems from our specialized screener.

ID Logistics Group (ENXTPA:IDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ID Logistics Group SA offers contract logistics services both in France and internationally, with a market capitalization of approximately €2.59 billion.

Operations: The company's revenue segment includes Transportation - Trucking, which generated €241.88 million.

Insider Ownership: 21.2%

Earnings Growth Forecast: 21.1% p.a.

ID Logistics Group showcases promising growth potential with earnings forecasted to increase by 21.1% annually, outpacing the French market's 12%. Despite a low future return on equity of 11%, the company's revenue is expected to grow at 11.3% per year, surpassing the market's 5.5%. However, interest payments are not well covered by earnings, which could pose financial challenges. The stock trades at a substantial discount compared to its estimated fair value.

- Navigate through the intricacies of ID Logistics Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates ID Logistics Group may be overvalued.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩19.29 trillion.

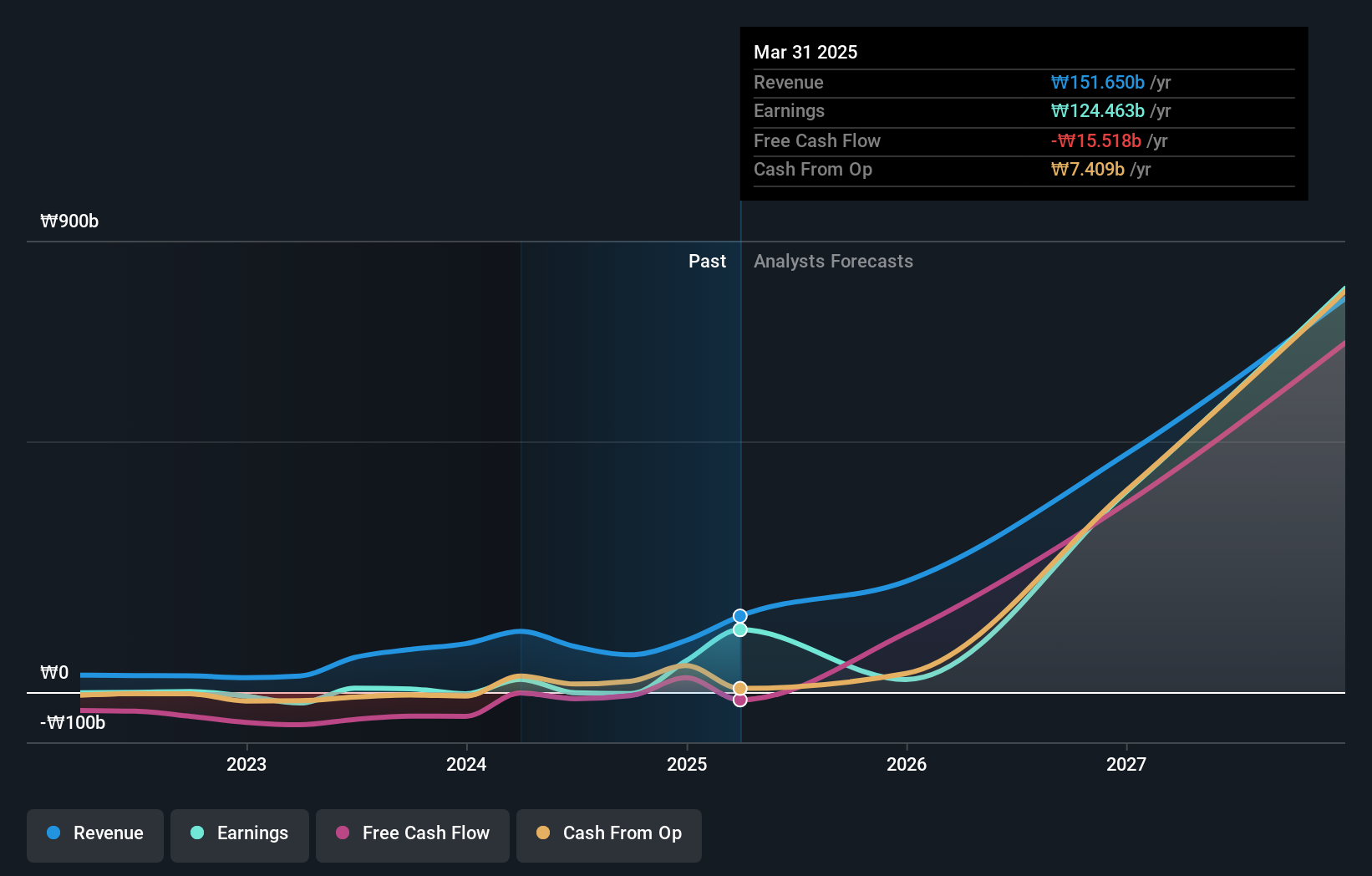

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩74.38 billion.

Insider Ownership: 25.9%

Earnings Growth Forecast: 140.6% p.a.

Alteogen is poised for significant growth, with revenue projected to increase by 84.2% annually, far outpacing the South Korean market's 9.2%. The company is expected to become profitable within three years and boasts a very high forecasted return on equity of 67.6%. Recent developments include an exclusive license agreement with Daiichi Sankyo for ALT-B4, potentially enhancing future revenue streams through milestone payments and royalties. Despite these positives, the stock remains highly volatile yet trades significantly below its fair value estimate.

- Unlock comprehensive insights into our analysis of ALTEOGEN stock in this growth report.

- According our valuation report, there's an indication that ALTEOGEN's share price might be on the expensive side.

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★★

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. operates in the environmental technology sector, focusing on providing solutions for pollution control and resource recycling, with a market cap of CN¥17.49 billion.

Operations: Qingdao Huicheng Environmental Technology Group Co., Ltd. derives its revenue from segments focused on pollution control solutions and resource recycling initiatives.

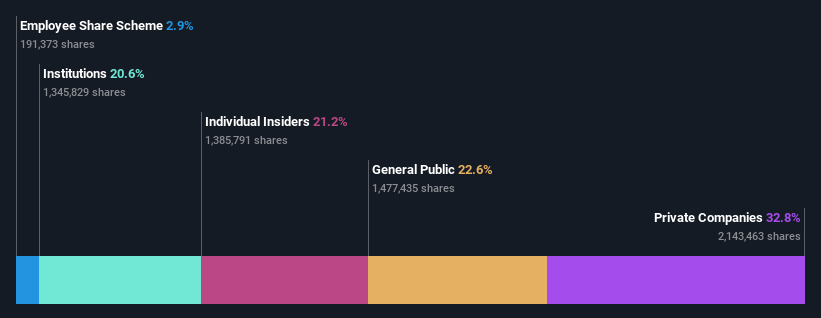

Insider Ownership: 31.8%

Earnings Growth Forecast: 65.2% p.a.

Qingdao Huicheng Environmental Technology Group is set for robust growth, with earnings forecasted to rise 65.23% annually, outpacing the Chinese market's 25%. The company's projected revenue increase of 34.5% per year also exceeds the market average of 13.3%. Despite a decline in profit margins from last year, insider ownership remains high without recent substantial trading activity. The company completed a buyback tranche, acquiring shares worth CNY 45.52 million by December 2024.

- Click here and access our complete growth analysis report to understand the dynamics of Qingdao Huicheng Environmental Technology Group.

- The valuation report we've compiled suggests that Qingdao Huicheng Environmental Technology Group's current price could be inflated.

Turning Ideas Into Actions

- Access the full spectrum of 1482 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Huicheng Environmental Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300779

Qingdao Huicheng Environmental Technology Group

Qingdao Huicheng Environmental Technology Group Co., Ltd.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives