- France

- /

- Infrastructure

- /

- ENXTPA:GET

Assessing Getlink (ENXTPA:GET) Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

What’s Driving Getlink’s Latest Share Moves?

Getlink (ENXTPA:GET) has been making waves with recent shifts in its share price, catching the eye of investors who are deciding whether to make a move. While there’s no single headline-grabbing event pushing the stock this week, the steady and sometimes choppy action has put Getlink back on the radar for many. These kinds of shifts often cause investors to pause and wonder if this is just market noise or if there is something deeper in play worth a closer look.

Put into context, Getlink’s performance this year has been a mixed bag. Shares have managed a slight gain year to date, building on a moderate growth streak over five years but basically flat across the past twelve months. The stock has seen some short-term declines over the month and past quarter, suggesting that momentum has cooled off for now, even as long-term returns still outpace many peers in the sector. This pattern makes it important to take a deeper look at how the company’s fundamentals may or may not justify its current valuation.

So with recent movements raising eyebrows, the key question is whether Getlink is undervalued at this point or if the market is already looking ahead and pricing in all the future growth that’s possible.

Price-to-Earnings of 33.1x: Is it justified?

Getlink's current valuation stands out when measured by its price-to-earnings (P/E) ratio of 33.1x. This is noticeably higher than the European Infrastructure industry average, which sits at 18.1x. Compared to the peer average of 37.7x, however, Getlink's valuation actually looks more in line with its direct competitors.

The price-to-earnings ratio tells investors how much they are paying for each euro of the company’s earnings. In sectors like infrastructure, where profit growth often happens gradually, a high P/E can signal the market has high expectations for future improvements in earnings or unique strategic advantages that warrant a premium.

At these levels, the market seems to be pricing in a scenario where Getlink delivers stable but not necessarily market-leading growth. The company is seen as expensive on a European sector basis, but not compared to its immediate peers. Investors should weigh if this premium is justified, especially considering the company's recent performance and slowing momentum.

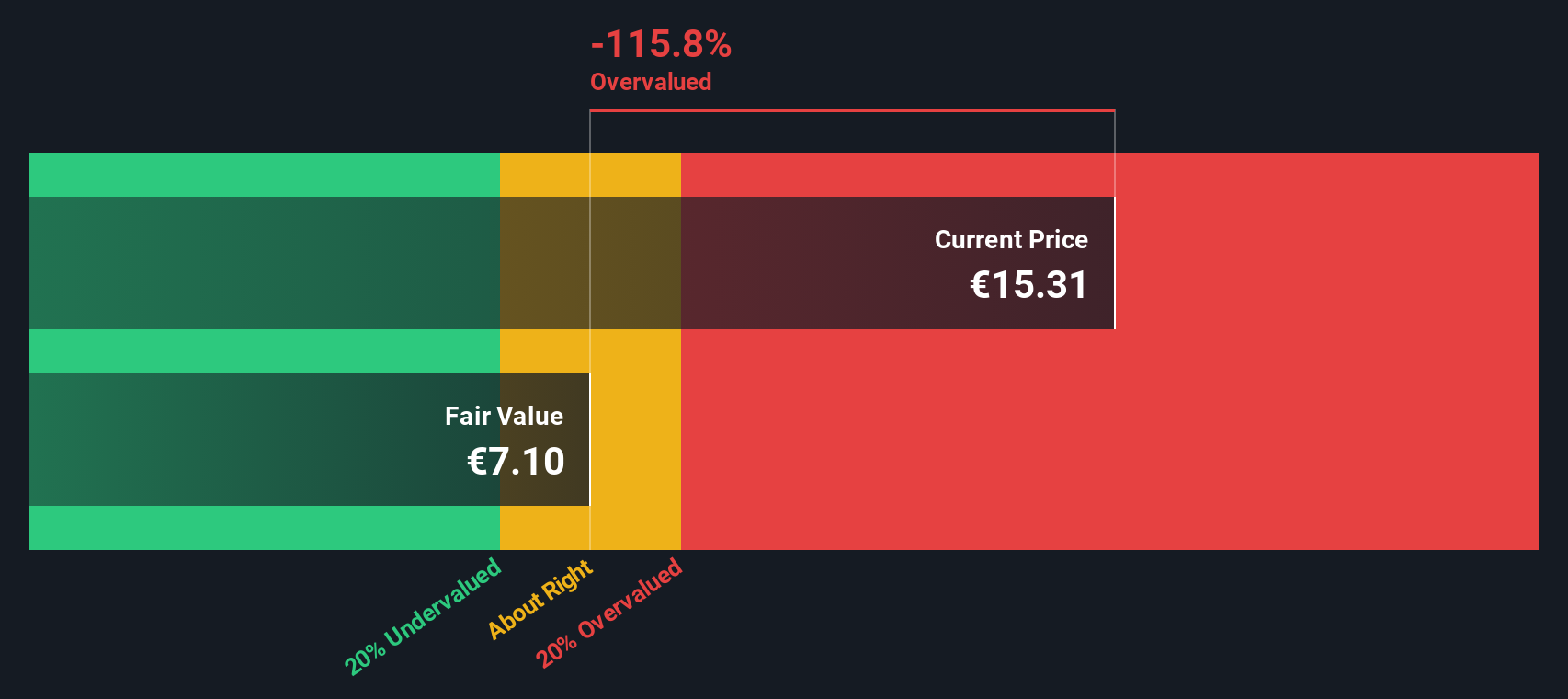

Result: Fair Value of €6.88 (OVERVALUEED)

See our latest analysis for Getlink.However, sustained slow growth in net income or a failure to close the gap to analyst price targets could quickly shift investor sentiment in the months ahead.

Find out about the key risks to this Getlink narrative.Another View: What Does the SWS DCF Model Show?

Taking a fresh look, the SWS DCF model offers a very different answer. It suggests Getlink may be valued quite differently than what the market is signalling right now. Could this disconnect reveal hidden risks or potential opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Getlink Narrative

If you find these perspectives don't quite match your own or enjoy coming to your own conclusions, you can draft your own narrative in just a few minutes. Do it your way.

A great starting point for your Getlink research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Put your money to work by scanning new markets and industries for standout opportunities. Don’t let a great stock idea slip through your fingers while others get ahead.

- Target untapped potential and catch tomorrow’s breakout companies early by checking out penny stocks with strong financials with robust financials and hidden growth stories.

- Unearth top stocks set to capitalize on the future of healthcare innovation by browsing healthcare AI stocks transforming patient care and medical technology with artificial intelligence.

- Maximize your returns with reliable income. Scan for dividend stocks with yields > 3% that offer attractive yields above 3% and proven cash-generating track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GET

Getlink

Engages in the design, finance, construction, and operation of fixed link infrastructure and transport system in France and the United Kingdom.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026