- France

- /

- Transportation

- /

- ENXTPA:ALTOO

Take Care Before Jumping Onto Toosla Société Anonyme (EPA:ALTOO) Even Though It's 27% Cheaper

Toosla Société Anonyme (EPA:ALTOO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 2.8% over that longer period.

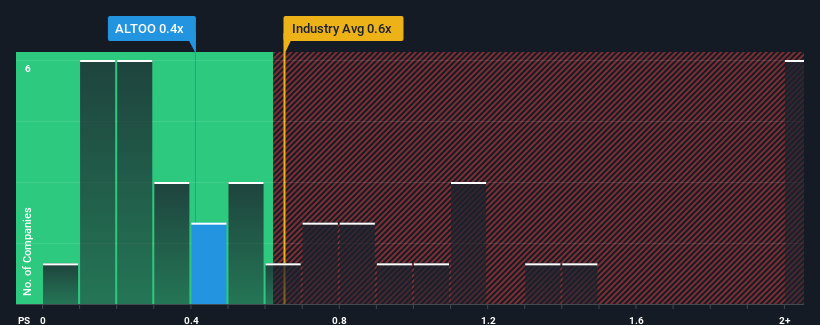

Even after such a large drop in price, there still wouldn't be many who think Toosla Société Anonyme's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in France's Transportation industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Toosla Société Anonyme

What Does Toosla Société Anonyme's Recent Performance Look Like?

Revenue has risen firmly for Toosla Société Anonyme recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Toosla Société Anonyme, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Toosla Société Anonyme's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 231% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 2.7%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Toosla Société Anonyme's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Toosla Société Anonyme's P/S

With its share price dropping off a cliff, the P/S for Toosla Société Anonyme looks to be in line with the rest of the Transportation industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Toosla Société Anonyme's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Toosla Société Anonyme (at least 4 which are a bit unpleasant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Toosla Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALTOO

Toosla Société Anonyme

Operates an app for short-term car rental primarily in France.

Slight risk and slightly overvalued.

Market Insights

Community Narratives