- France

- /

- Transportation

- /

- ENXTPA:ALTOO

A Piece Of The Puzzle Missing From Toosla Société Anonyme's (EPA:ALTOO) 33% Share Price Climb

Toosla Société Anonyme (EPA:ALTOO) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 61% share price drop in the last twelve months.

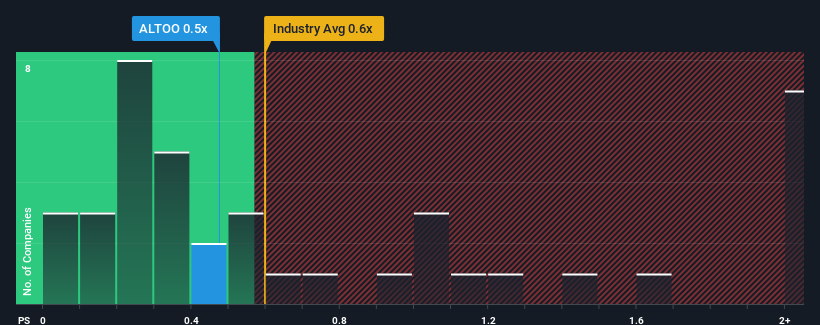

Although its price has surged higher, you could still be forgiven for feeling indifferent about Toosla Société Anonyme's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Transportation industry in France is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Toosla Société Anonyme

How Has Toosla Société Anonyme Performed Recently?

With revenue growth that's exceedingly strong of late, Toosla Société Anonyme has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Toosla Société Anonyme will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Toosla Société Anonyme, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Toosla Société Anonyme?

The only time you'd be comfortable seeing a P/S like Toosla Société Anonyme's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 48%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Toosla Société Anonyme is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Toosla Société Anonyme appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Toosla Société Anonyme currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 6 warning signs for Toosla Société Anonyme you should be aware of, and 4 of them can't be ignored.

If these risks are making you reconsider your opinion on Toosla Société Anonyme, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Toosla Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALTOO

Toosla Société Anonyme

Operates an app for short-term car rental primarily in France.

Slight risk and slightly overvalued.

Market Insights

Community Narratives