Did Strong Demand for €500M Notes Just Shift Air France-KLM's (ENXTPA:AF) Investment Narrative?

Reviewed by Simply Wall St

- Air France-KLM recently completed the successful placement of €500 million in senior unsecured notes under its Euro Medium Term Notes Programme, with a 3.75% fixed annual coupon and five-year maturity.

- This issuance was met with strong demand, signaling investor confidence in Air France-KLM’s financial structure and its ability to extend debt maturity at favorable conditions.

- We’ll explore how the robust demand for these new notes informs Air France-KLM’s evolving investment narrative and future financial flexibility.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Air France-KLM's Investment Narrative?

To see Air France-KLM as a worthwhile stock holding, you likely need conviction in the group’s continued turnaround story and its ability to translate recent profit and traffic momentum into more durable gains, even in the face of lingering industry risks. The recent €500 million note placement has added flexibility to the company’s financial toolkit and reflects strong external confidence in its balance sheet, following a stretch of positive earnings surprises and steady capacity growth. While this successful financing could reduce near-term refinancing or liquidity concerns, it doesn’t eliminate key risks such as debt leverage, cost inflation, and sensitivity to economic cycles. Near-term catalysts remain tied to upcoming quarters’ operating results and integration of alliance partnerships, with the note issuance marginally tilting the risk-reward toward greater stability, but not fundamentally changing the most important levers for valuation.

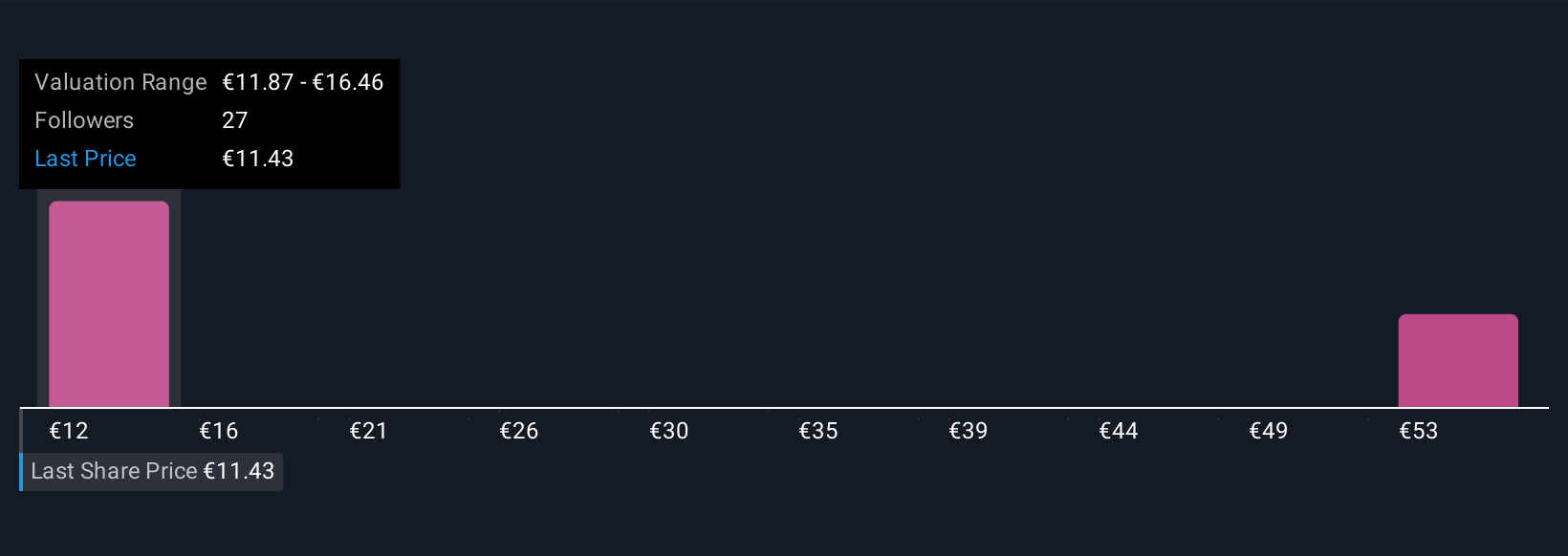

However, don’t overlook the company’s still-elevated debt load and its impact on future profitability. Despite retreating, Air France-KLM's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Air France-KLM - why the stock might be a potential multi-bagger!

Build Your Own Air France-KLM Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air France-KLM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Air France-KLM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air France-KLM's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives