- France

- /

- Infrastructure

- /

- ENXTPA:ADP

Aeroports de Paris (ENXTPA:ADP) Valuation: Assessing Shares After Airport Fee Increase Plans for 2026

Reviewed by Simply Wall St

Aeroports de Paris (ENXTPA:ADP) has put forward plans to increase airport fees at Paris airports in 2026. The company aims to support infrastructure upgrades and meet rising operational expenses. The proposal is now with the French Transport Regulatory Authority.

See our latest analysis for Aeroports de Paris.

News of the proposed fee hikes comes as Aeroports de Paris sees its short-term momentum pick up, with a 5.4% share price return over the past month and nearly 10% over the last quarter. In a broader context, the company has delivered a respectable 10.5% total shareholder return over the past year. However, three-year returns remain subdued, highlighting both recent optimism and the impact of previous years’ headwinds. Investors are watching closely to see if these infrastructure investments can spur sustainable growth and improve the long-term outlook.

If you want to uncover more opportunities beyond infrastructure names, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

This brings up the central question for investors: does Aeroports de Paris now trade at an attractive valuation ahead of these upgrades, or has the market already priced in the potential for future growth and higher returns?

Most Popular Narrative: 4.7% Undervalued

Aeroports de Paris recently closed at €117, while the most popular narrative values the shares at €122.73. With this modest gap, attention turns to the bold assumptions shaping this fair value estimate.

Expansion, modernization, and regulation at Paris airports are set to increase efficiency, revenue predictability, and long-term growth through capacity and sustainable infrastructure investments. Diversification into non-aeronautical businesses and global airport partnerships should reduce earnings volatility and drive sustained margin growth.

Want to know what underpins this price target? A future margin leap and accelerated earnings are at the heart of the forecast. The projected profit multiple may surprise even seasoned infrastructure investors. Find out what bold financial moves justify this valuation. See all the details behind the headline numbers and the tensions at play in the full narrative.

Result: Fair Value of €122.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs and growing reliance on debt could limit margins and challenge Aeroports de Paris's ability to deliver the projected long-term growth.

Find out about the key risks to this Aeroports de Paris narrative.

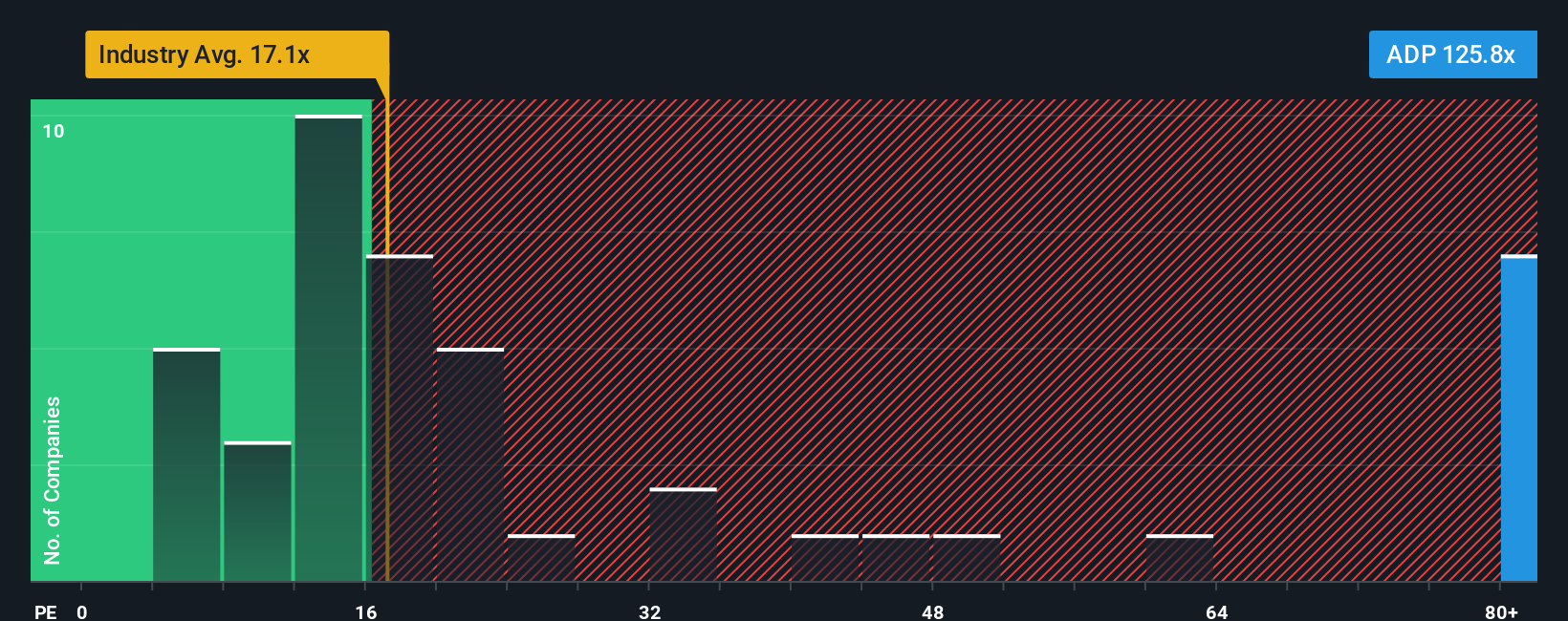

Another View: Using Earnings Ratios

While the fair value estimate offers an optimistic case, a glance at the current earnings ratio paints a different picture. Aeroports de Paris trades at 124.2 times its earnings, which is far higher than both the European infrastructure industry average of 17 and the fair ratio mark of 38.3. This sharp gap raises questions about valuation risk and whether investors are banking too heavily on future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aeroports de Paris Narrative

If you see things differently or want to test your own assumptions, you can craft a personalized narrative in just a few minutes, your way. Do it your way

A great starting point for your Aeroports de Paris research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open the door to new investing opportunities today, or risk missing out while others seize the potential. Browse hand-picked lists designed to help you spot tomorrow’s winners, right now.

- Tap into reliable income and maximize your yield by checking out these 21 dividend stocks with yields > 3% that consistently deliver above-average returns for shareholders.

- Stay ahead of the curve in artificial intelligence by reviewing these 26 AI penny stocks gaining traction as the next big movers in tech innovation.

- Ride the digital revolution and find growth and diversification potential with these 81 cryptocurrency and blockchain stocks shaping the future of finance and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ADP

Aeroports de Paris

Operates and designs airports in France, Turkey, Kazakhstan, Jordan, Georgia, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives