- New Zealand

- /

- Software

- /

- NZSE:VGL

VusionGroup And 2 Other Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with major indices like the S&P 500 and Nasdaq Composite reaching record highs on hopes of growth and tax incentives. Amidst these market dynamics, identifying stocks that are trading below their fair value can offer potential opportunities for investors seeking to capitalize on underappreciated assets. In this context, understanding what constitutes a good stock involves assessing its intrinsic value relative to its current market price, especially during periods of economic optimism and policy changes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.53 | CN¥18.84 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | US$123.80 | US$245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.32 | US$99.93 | 49.6% |

| Decisive Dividend (TSXV:DE) | CA$6.18 | CA$12.23 | 49.5% |

| JYP Entertainment (KOSDAQ:A035900) | ₩53700.00 | ₩106760.01 | 49.7% |

| XPEL (NasdaqCM:XPEL) | US$45.62 | US$91.03 | 49.9% |

| Pinterest (NYSE:PINS) | US$29.98 | US$59.53 | 49.6% |

| GRCS (TSE:9250) | ¥1500.00 | ¥2976.24 | 49.6% |

| Medios (XTRA:ILM1) | €14.88 | €29.67 | 49.8% |

| Hotel ShillaLtd (KOSE:A008770) | ₩36900.00 | ₩73388.97 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

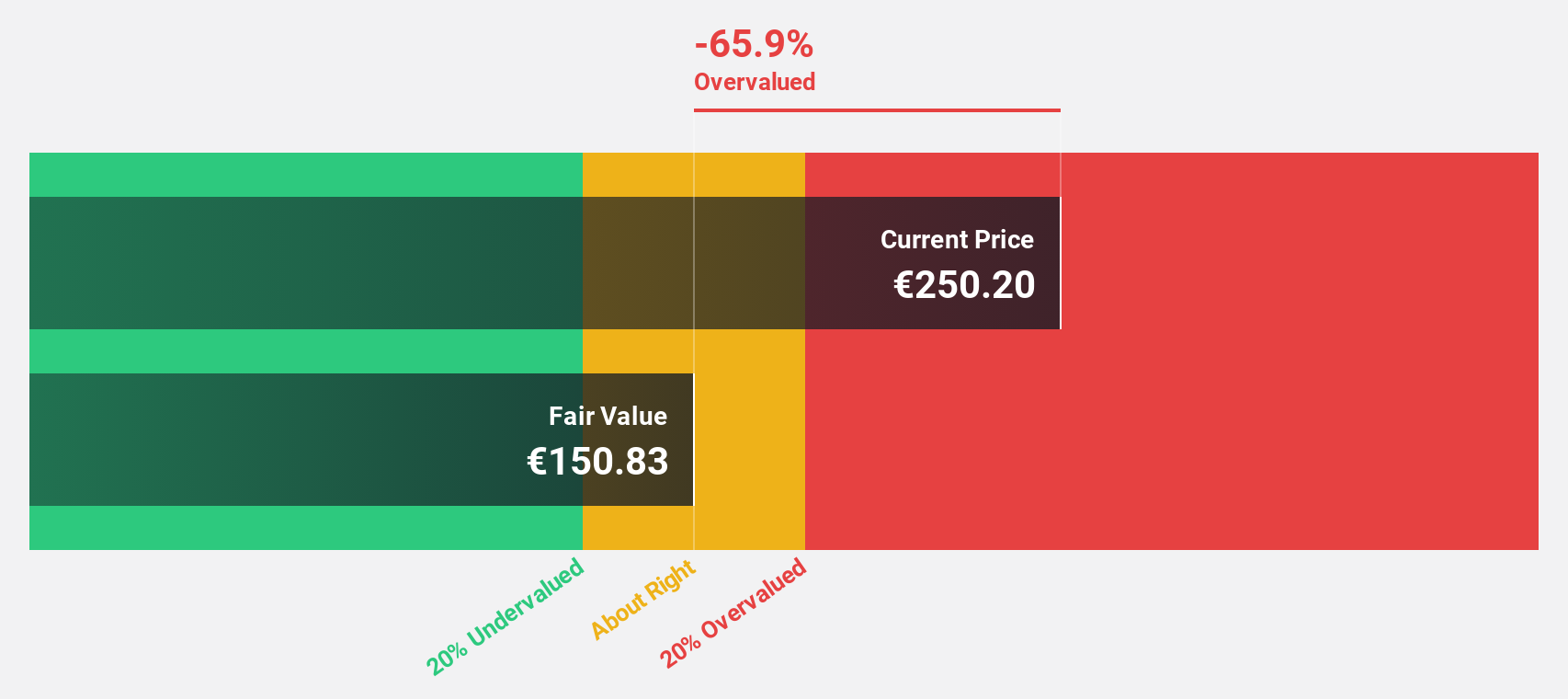

VusionGroup (ENXTPA:VU)

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €2.21 billion.

Operations: The company's revenue primarily comes from installing and maintaining electronic shelf labels, generating €830.16 million.

Estimated Discount To Fair Value: 33%

VusionGroup is trading at €138.2, significantly below its estimated fair value of €206.19, indicating potential undervaluation based on cash flows. Despite a recent net loss of €24.4 million for H1 2024, revenue growth is projected at 23.4% annually, outpacing the French market's 5.6%. Analysts predict the company will become profitable within three years with an expected earnings growth rate of 81.94% per year and a high future Return on Equity of 25.7%.

- Insights from our recent growth report point to a promising forecast for VusionGroup's business outlook.

- Unlock comprehensive insights into our analysis of VusionGroup stock in this financial health report.

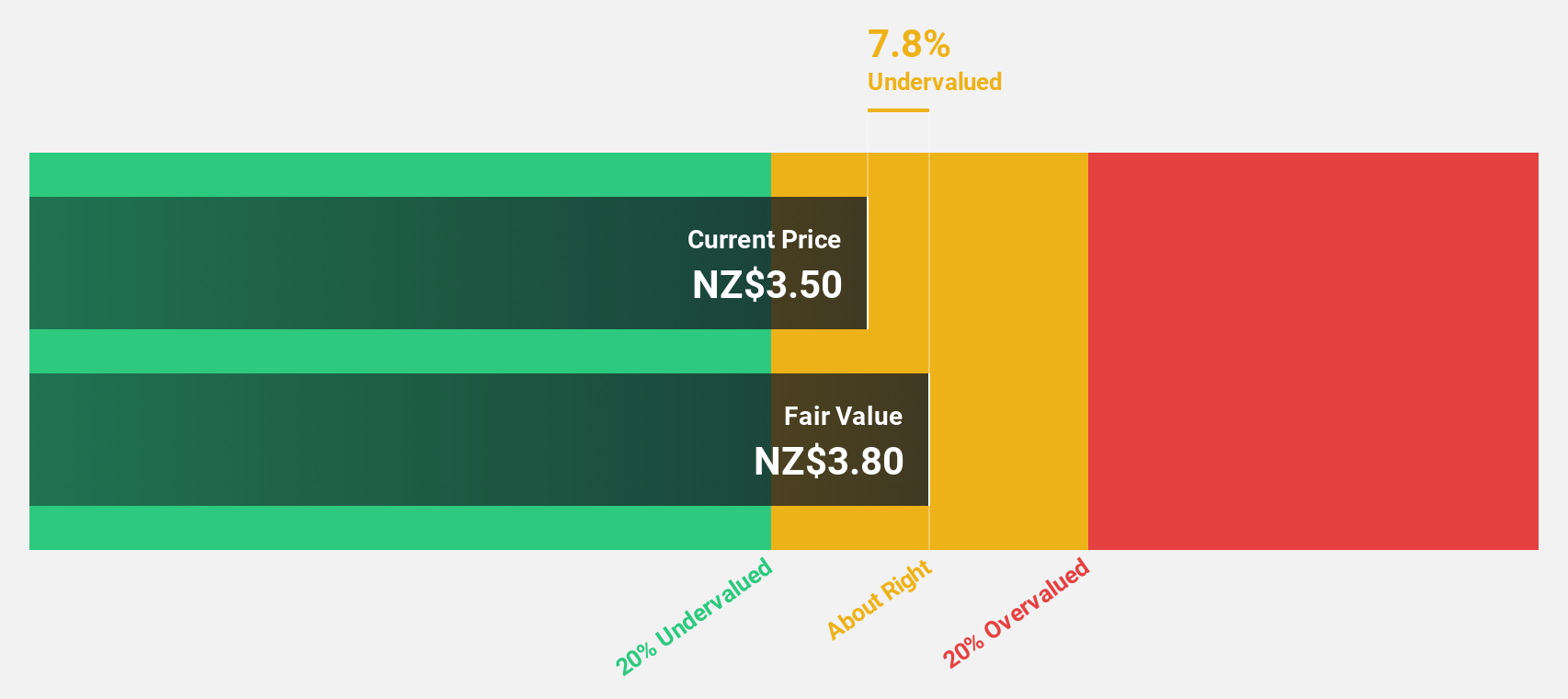

Vista Group International (NZSE:VGL)

Overview: Vista Group International Limited offers software and data analytics solutions to the global film industry, with a market cap of NZ$684.51 million.

Operations: Vista Group's revenue segments include software solutions and data analytics services tailored for the global film industry.

Estimated Discount To Fair Value: 23.5%

Vista Group International is trading at NZ$2.97, below its estimated fair value of NZ$3.88, suggesting it may be undervalued based on cash flows. The company is expected to become profitable within three years and achieve earnings growth of 59.87% annually, surpassing the average market growth rate. However, its Return on Equity is forecasted to remain low at 10.8%. Recent investor activism has been resolved with the withdrawal of proposed board changes by Admetus Capital Limited.

- Our growth report here indicates Vista Group International may be poised for an improving outlook.

- Get an in-depth perspective on Vista Group International's balance sheet by reading our health report here.

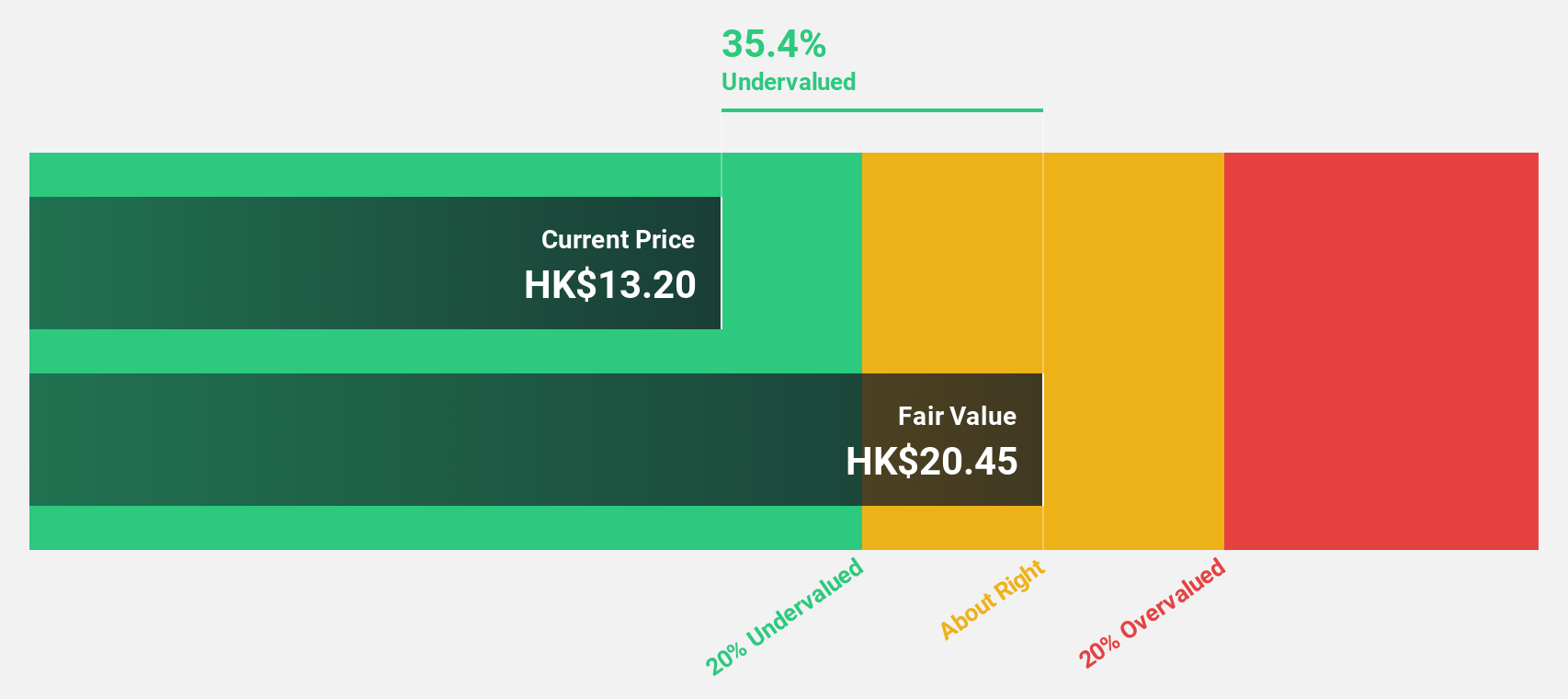

Beijing Chunlizhengda Medical Instruments (SEHK:1858)

Overview: Beijing Chunlizhengda Medical Instruments Co., Ltd. is an orthopedic medical device company involved in the R&D, production, and trading of surgical implants and instruments in China, with a market cap of approximately HK$5.46 billion.

Operations: The company's revenue segment primarily consists of the manufacture and trading of surgical implants, instruments, and related products, amounting to CN¥924.65 million.

Estimated Discount To Fair Value: 38.2%

Beijing Chunlizhengda Medical Instruments is trading at HK$8.5, below its fair value estimate of HK$13.74, highlighting potential undervaluation based on cash flows. Despite recent declines in revenue and net income for the nine months ending September 2024, earnings are projected to grow significantly at 29.6% annually over the next three years, outpacing the Hong Kong market's growth rate. However, future Return on Equity is expected to be modest at 10.4%.

- Our earnings growth report unveils the potential for significant increases in Beijing Chunlizhengda Medical Instruments' future results.

- Navigate through the intricacies of Beijing Chunlizhengda Medical Instruments with our comprehensive financial health report here.

Taking Advantage

- Investigate our full lineup of 906 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:VGL

Vista Group International

Provides software and data analytics solutions to the film industry.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives