- France

- /

- Entertainment

- /

- ENXTPA:BOL

High Growth Tech Stocks in France to Watch This September 2024

Reviewed by Simply Wall St

As the European Central Bank's recent interest rate cut aims to bolster economic growth, France's CAC 40 Index has seen a positive uptick, reflecting broader optimism in the market. In this environment, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on innovative companies poised for expansion amidst favorable economic conditions.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 14.08% | 28.13% | ★★★★★☆ |

| Cogelec | 11.33% | 23.96% | ★★★★★☆ |

| Valneva | 24.22% | 28.39% | ★★★★★☆ |

| Munic | 26.68% | 149.10% | ★★★★★☆ |

| VusionGroup | 28.35% | 82.32% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bolloré SE operates in transportation and logistics, communications, and industry across multiple continents including Europe, the Americas, Asia, Oceania, and Africa with a market cap of €16.75 billion.

Operations: Bolloré SE generates revenue primarily from its communications segment (€14.86 billion) and Bollore Energy (€2.75 billion), with additional contributions from its industry segment (€353 million). The company operates across various regions, including Europe, the Americas, Asia, Oceania, and Africa.

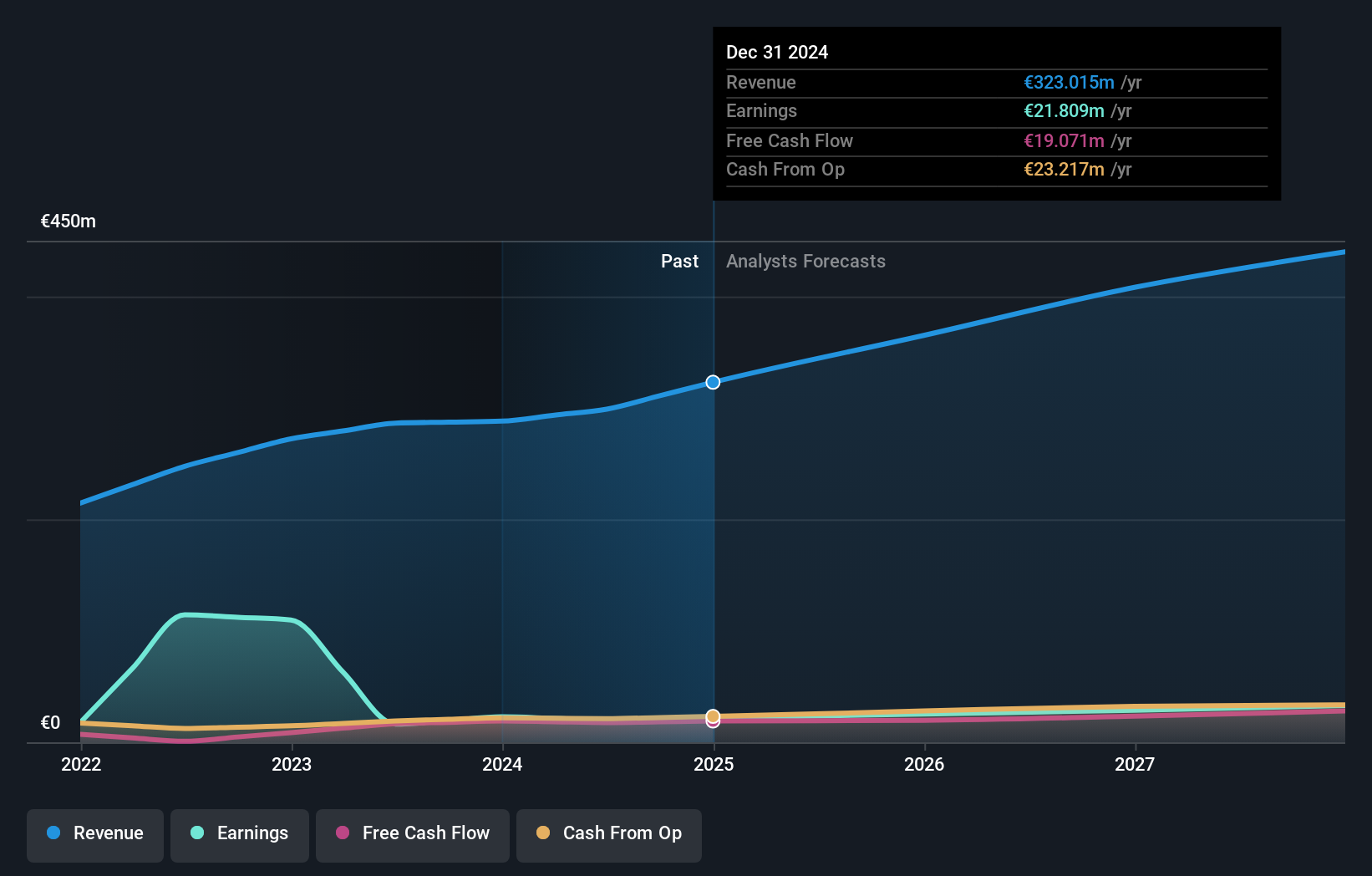

Bolloré's recent financial performance demonstrates significant growth, with half-year sales reaching €10.59 billion compared to €6.23 billion the previous year, and net income soaring to €3.76 billion from €114 million. The company's earnings are forecasted to grow at an impressive 32.7% annually, outpacing the French market's 12.4%. Despite a projected low return on equity of 4.9% in three years, Bolloré has become profitable recently and its revenue is expected to grow by 8.3% per year, faster than the overall market's 5.8%.

- Navigate through the intricacies of Bolloré with our comprehensive health report here.

Assess Bolloré's past performance with our detailed historical performance reports.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. provides IT and software solutions worldwide and has a market cap of €355.03 million.

Operations: Sword Group S.E. generates revenue primarily from IT and software services across three key regions: Belux (€104.26 million), Switzerland (€105.75 million), and the United Kingdom (€88.88 million).

Sword Group's revenue is projected to grow at 13.4% annually, surpassing the French market's 5.8% growth rate. Despite a net income drop to €10.16 million from €12.87 million in the first half of 2023, earnings are expected to rise by 18.4% per year, outpacing the market average of 12.4%. The company has also demonstrated strong R&D investments, with expenses contributing significantly to its technological advancements and future competitiveness in software solutions and AI services.

- Click here and access our complete health analysis report to understand the dynamics of Sword Group.

Evaluate Sword Group's historical performance by accessing our past performance report.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €2.41 billion.

Operations: VusionGroup S.A. specializes in digitalization solutions for the retail sector across Europe, Asia, and North America. With a market cap of €2.41 billion, the company focuses on enhancing operational efficiency and customer experience through its innovative technologies.

VusionGroup's revenue is expected to grow at 28.4% annually, significantly outpacing the French market's 5.8% growth rate. Despite a net loss of €24.4 million in H1 2024, the company's earnings are projected to rise by an impressive 82.32% per year, indicating strong future potential. Their recent partnership with Ace Hardware highlights their innovative digital shelf label (DSL) technology and VusionCloud platform, which enhances operational efficiencies and customer experience across over 5,000 stores in the U.S., showcasing their impactful tech-driven solutions. The company's substantial R&D investments have been pivotal in driving technological advancements; last year alone saw R&D expenses amounting to €50 million or approximately 12% of total sales (€408.9 million). This focus on innovation positions VusionGroup favorably within the tech industry as they continue developing cutting-edge IoT solutions that cater to high-profile clients like Ace Hardware and Hy-Vee. With a forecasted return on equity of 27.2%, VusionGroup is set for robust growth as it leverages its advanced technologies and strategic partnerships for sustained expansion.

- Click to explore a detailed breakdown of our findings in VusionGroup's health report.

Understand VusionGroup's track record by examining our Past report.

Where To Now?

- Reveal the 44 hidden gems among our Euronext Paris High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bolloré might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BOL

Bolloré

Engages in the transportation and logistics, communications, and industry businesses in France, rest of Europe, the Americas, Asia, Oceania, and Africa.

Flawless balance sheet with reasonable growth potential.