Stock Analysis

High Growth Tech Stocks in France Featuring Lectra and Two More

Reviewed by Simply Wall St

As hopes for a "soft landing" in the U.S. economy grow and European markets, including France's CAC 40 Index, post strong gains, the spotlight turns to high-growth tech stocks that may benefit from this positive sentiment. In this article, we will explore three promising French tech companies, including Lectra, that are well-positioned to thrive in these favorable market conditions due to their innovative capabilities and growth potential.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 16.18% | 35.08% | ★★★★★☆ |

| Cogelec | 11.32% | 24.06% | ★★★★★☆ |

| VusionGroup | 21.32% | 25.74% | ★★★★★★ |

| Munic | 26.68% | 149.17% | ★★★★★☆ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Valneva | 24.43% | 29.59% | ★★★★★☆ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

| beaconsmind | 31.75% | 106.73% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of approximately €1.02 billion.

Operations: Lectra SA generates revenue from providing industrial intelligence solutions to the fashion, automotive, and furniture sectors in regions including Northern Europe, Southern Europe, the Americas, and Asia-Pacific. The company reported revenues of €172.65 million from the Americas and €118.54 million from Asia-Pacific.

Lectra's recent earnings report shows a mixed bag, with sales increasing to €262.29 million from €239.55 million last year, while net income dipped to €12.51 million from €14.47 million. Despite this, the company's revenue is projected to grow at 10.4% annually, outpacing the French market's 5.8%. Their R&D expenses reflect a strong commitment to innovation, contributing significantly to their competitive edge in the tech sector by ensuring continuous product improvement and development. Moreover, Lectra's earnings are forecasted to grow impressively at 29.3% per year over the next three years, suggesting robust future profitability despite past negative growth of -16.8%. The company's strategic focus on high-quality earnings and positive free cash flow positions it well within France’s tech landscape for sustained growth and resilience against market fluctuations.

- Dive into the specifics of Lectra here with our thorough health report.

Explore historical data to track Lectra's performance over time in our Past section.

Valneva (ENXTPA:VLA)

Simply Wall St Growth Rating: ★★★★★☆

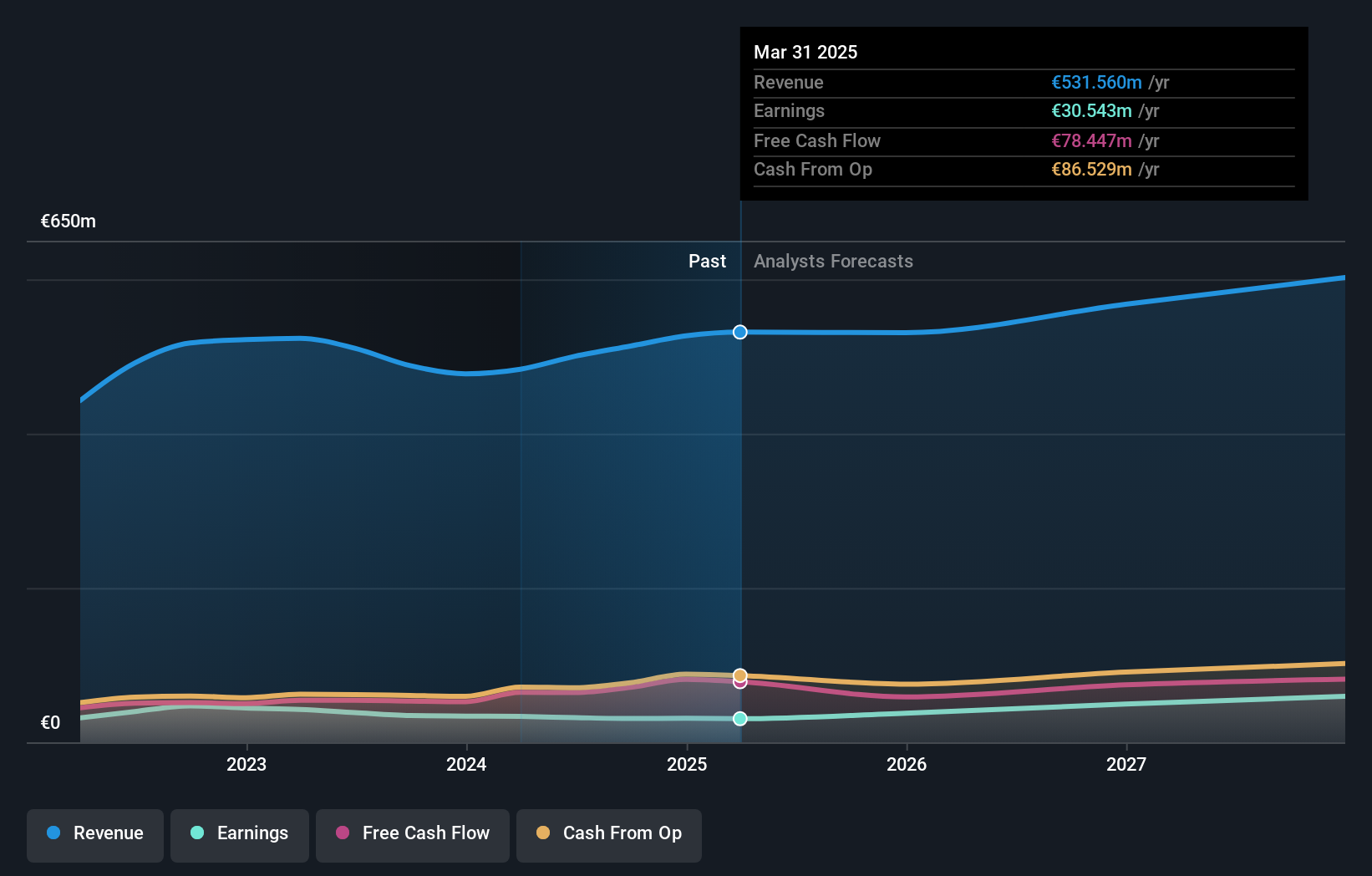

Overview: Valneva SE is a specialty vaccine company that develops, manufactures, and commercializes prophylactic vaccines for infectious diseases with unmet needs and has a market cap of €526.55 million.

Operations: The company focuses on developing, manufacturing, and commercializing prophylactic vaccines for infectious diseases with unmet needs. It generated €156.47 million in revenue from these activities.

Valneva's half-year revenue reached €70.81 million, slightly down from €73.74 million last year, yet net income surged to €33.98 million from a previous loss of €35.05 million. The company’s R&D expenses underscore its commitment to innovation, with significant investments in developing vaccines like the Shigella4V and Lyme disease candidates. Valneva's forecasted annual revenue growth of 24.4% surpasses the French market average of 5.8%, while earnings are projected to rise by 29.6% per year over the next three years, indicating robust future profitability prospects.

- Click to explore a detailed breakdown of our findings in Valneva's health report.

Evaluate Valneva's historical performance by accessing our past performance report.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. provides digitalization solutions for commerce in Europe, Asia, and North America with a market cap of €2.21 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €801.96 million. The company operates across Europe, Asia, and North America.

VusionGroup's recent partnership with Ace Hardware to deploy advanced digital shelf label (DSL) technology across over 5,000 U.S. stores exemplifies its innovative edge in the retail tech sector. With forecasted revenue growth of 21.3% per year and earnings expected to rise by 25.7%, VusionGroup is outpacing the French market averages significantly. Their R&D expenses highlight a commitment to innovation, contributing €18 million in H1 2024 alone, driving advancements like their VusionCloud IoT platform.

Turning Ideas Into Actions

- Access the full spectrum of 43 Euronext Paris High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VLA

Valneva

A specialty vaccine company, develops, manufactures, and commercializes prophylactic vaccines for infectious diseases with unmet needs.