- France

- /

- Diversified Financial

- /

- ENXTPA:RF

3 High Growth Companies With Significant Insider Ownership On Euronext Paris

Reviewed by Simply Wall St

The French market has been experiencing robust gains, with the CAC 40 Index advancing by 2.48% amid growing hopes for interest rate cuts. This positive economic sentiment provides a fertile ground for growth companies, particularly those with significant insider ownership, which often signals strong confidence in the business's future prospects. When evaluating stocks in such a favorable market environment, it's crucial to consider companies that not only exhibit high growth potential but also have substantial insider ownership. This combination can indicate alignment between management and shareholder interests, potentially leading to more prudent and strategic decision-making.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.2% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 71.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €511.36 million.

Operations: MedinCell's revenue primarily comes from its pharmaceuticals segment, totaling €11.95 million.

Insider Ownership: 15.8%

Earnings Growth Forecast: 71.1% p.a.

MedinCell, a French growth company with high insider ownership, is expected to see substantial revenue growth at 44.7% per year, significantly outpacing the French market's 5.8%. Despite reporting a net loss of €25.04 million for the fiscal year ending March 31, 2024, down from €32.01 million the previous year, MedinCell's earnings are forecasted to grow by 71.06% annually and become profitable within three years. The stock trades at an estimated fair value discount of 87.2%.

- Click here to discover the nuances of MedinCell with our detailed analytical future growth report.

- Our valuation report unveils the possibility MedinCell's shares may be trading at a premium.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of €1.12 billion.

Operations: The company generates revenue from three main segments: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.1% p.a.

OVH Groupe, a French growth company with high insider ownership, is forecasted to achieve revenue growth of 10% per year, outpacing the French market's 5.8%. Despite its highly volatile share price and trading at a 32.4% discount to estimated fair value, OVH is expected to become profitable within three years. Recent innovations include new dedicated servers powered by AMD EPYC processors, enhancing performance and sustainability in their data centers.

- Delve into the full analysis future growth report here for a deeper understanding of OVH Groupe.

- Our comprehensive valuation report raises the possibility that OVH Groupe is priced lower than what may be justified by its financials.

Eurazeo (ENXTPA:RF)

Simply Wall St Growth Rating: ★★★★★☆

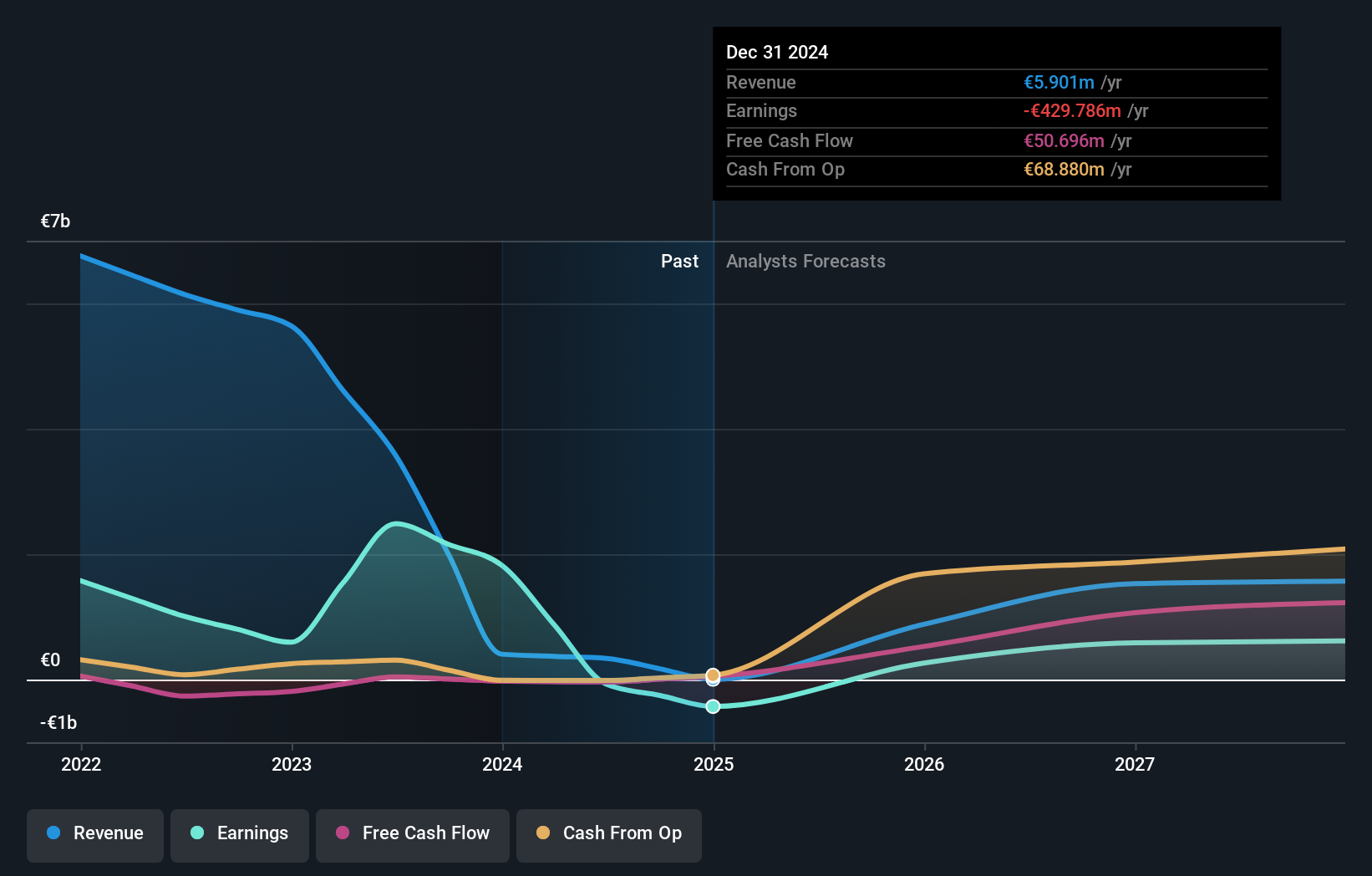

Overview: Eurazeo SE is a private equity and venture capital firm focusing on growth capital, acquisitions, leveraged buyouts, and investments in mid-market and listed public companies, with a market cap of €5.16 billion.

Operations: The firm's revenue segments include growth capital, acquisitions, leveraged buyouts, and investments in mid-market and listed public companies.

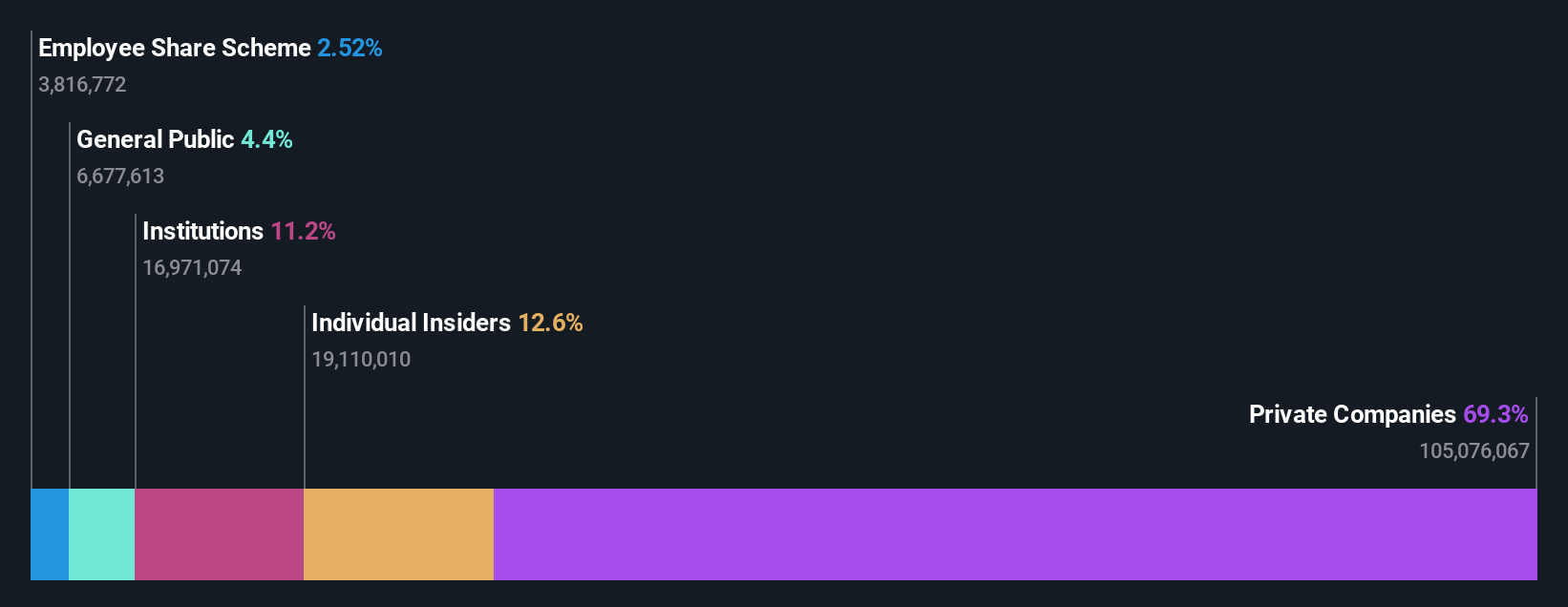

Insider Ownership: 12.1%

Earnings Growth Forecast: 49.9% p.a.

Eurazeo SE, with substantial insider ownership, reported H1 2024 earnings showing sales of €180.71 million but a net loss of €104.56 million. Despite this, analysts expect the stock price to rise by 29.2%. The company is trading at 84% below its estimated fair value and is forecasted to achieve annual profit growth above market averages within three years, driven by expected revenue growth of 47.4% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Eurazeo.

- The analysis detailed in our Eurazeo valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Gain an insight into the universe of 23 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eurazeo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RF

Eurazeo

A private equity and venture capital firm specializing in growth capital, acquisitions, leveraged buyouts, and buy-ins of a private company, and investments in mid-market and listed public companies.

High growth potential and fair value.