Exploring Growth Companies On Euronext Paris With Up To 19% Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of economic fluctuations and political shifts, the French market has shown resilience, with the CAC 40 Index climbing 2.62%. This growth highlights an environment where well-positioned companies can thrive. In this context, exploring growth companies on Euronext Paris with high insider ownership offers a unique lens through which to view potential stability and commitment in uncertain times.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

| Adocia (ENXTPA:ADOC) | 12.1% | 59.8% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.4% | 150% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 70.6% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Let's dive into some prime choices out of from the screener.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focused on digital infrastructure, with a market capitalization of approximately €1.97 billion.

Operations: Exclusive Networks SA generates its revenue primarily from three geographical segments: the Americas (€689 million), APAC (€420 million), and EMEA (€4.04 billion).

Insider Ownership: 13.2%

Exclusive Networks, a French company, is expected to see significant earnings growth at 28.4% per year, outpacing the French market's 10.9%. Similarly, its revenue growth forecast at 14.4% annually also exceeds the broader market's 5.7%. However, its Return on Equity is projected to be low at 14.3% in three years. Recent developments include a switch in auditors to KPMG and a revenue guidance for fiscal year 2024 projecting sales growth between 10% and 12%.

- Click to explore a detailed breakdown of our findings in Exclusive Networks' earnings growth report.

- According our valuation report, there's an indication that Exclusive Networks' share price might be on the expensive side.

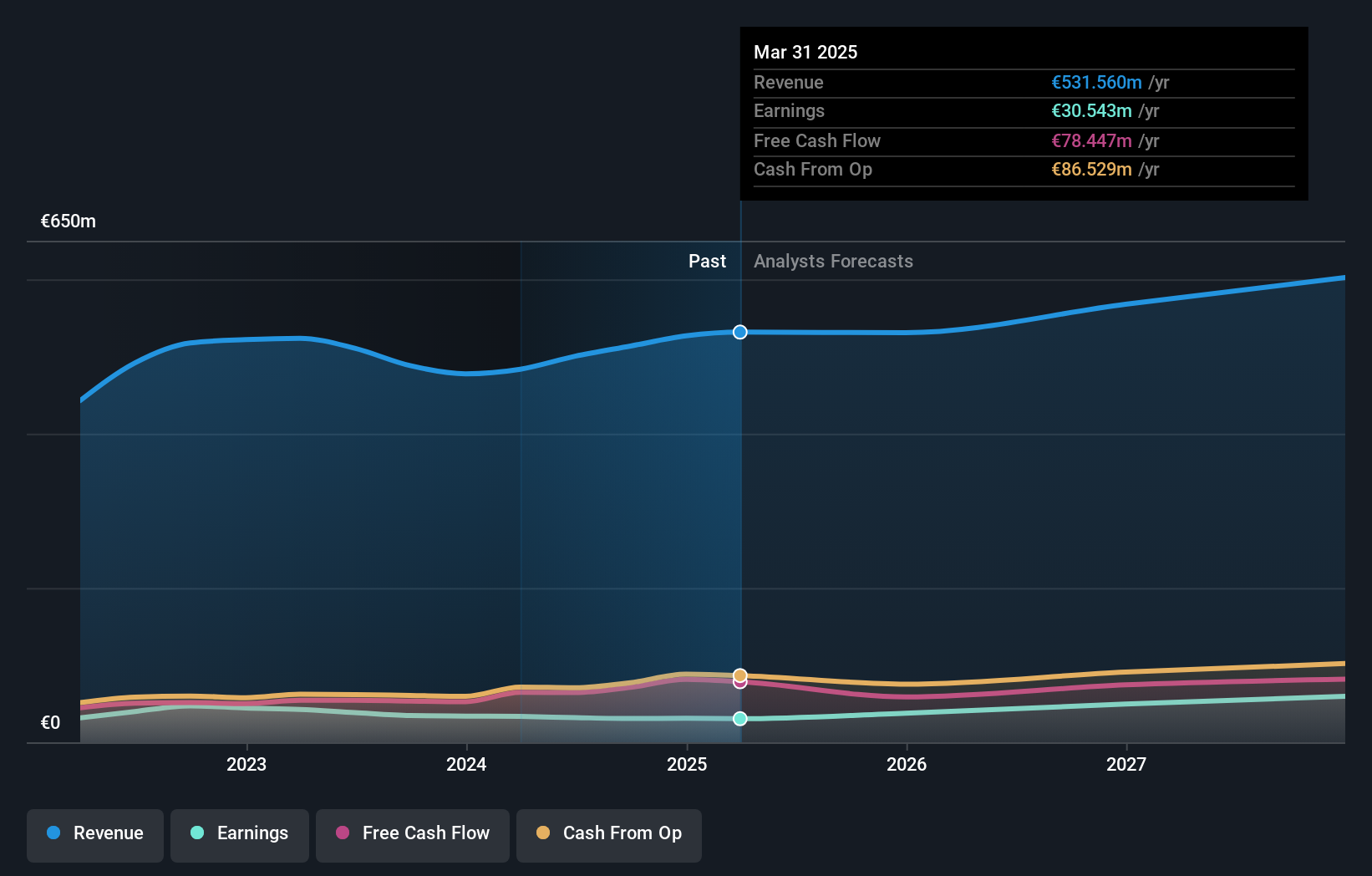

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA, with a market cap of €1.14 billion, offers industrial intelligence solutions across the fashion, automotive, and furniture sectors in regions including Northern Europe, Southern Europe, the Americas, and Asia Pacific.

Operations: The company generates revenue across various regions, with €170.33 million from the Americas and €110.28 million from the Asia Pacific.

Insider Ownership: 19.6%

Lectra is trading at 31.8% below its estimated fair value, presenting a potentially attractive entry point. The company's revenue and earnings are forecast to grow at 11.3% and 28.6% per year respectively, both outstripping the French market averages of 5.7% and 10.9%. However, its projected Return on Equity of 13.3% in three years is modest. Recent financials show a slight dip in net income from €7.63 million to €7.17 million despite an increase in sales to €129.56 million for Q1 2024.

- Delve into the full analysis future growth report here for a deeper understanding of Lectra.

- The valuation report we've compiled suggests that Lectra's current price could be quite moderate.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. specializes in offering digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of €2.31 billion.

Operations: The company generates €801.96 million from installing and maintaining electronic shelf labels.

Insider Ownership: 13.5%

VusionGroup S.A. showcases robust growth with earnings surging by 320.8% last year and forecasted to climb at 25.2% annually, outpacing the French market's 10.9%. Revenue growth is also strong at 21.9% yearly, significantly higher than the market average of 5.7%. Despite these positives, the company's share price has been highly volatile recently. Recent events include a substantial increase in annual sales to €801.96 million and net income rising to €79.77 million as of December 2023.

- Get an in-depth perspective on VusionGroup's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that VusionGroup is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Delve into our full catalog of 22 Fast Growing Euronext Paris Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.

Good value with reasonable growth potential.