- Sweden

- /

- Commercial Services

- /

- OM:ITAB

European Growth Stocks With High Insider Ownership November 2025

Reviewed by Simply Wall St

As the European markets navigate a landscape of mixed stock index performances and steady interest rates from the European Central Bank, investors are keenly observing sectors that can thrive amid these conditions. In such an environment, growth companies with high insider ownership often stand out as they may signal strong internal confidence and commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Let's uncover some gems from our specialized screener.

Trifork Group (CPSE:TRIFOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trifork Group AG offers information technology and business services across Switzerland, Denmark, the United Kingdom, the Netherlands, the United States, and internationally with a market cap of DKK1.66 billion.

Operations: The company's revenue is derived from providing information technology and business services across various regions, including Switzerland, Denmark, the United Kingdom, the Netherlands, and the United States.

Insider Ownership: 21%

Trifork Group is experiencing strong growth prospects, with earnings forecasted to rise significantly over the next three years. Despite recent insider selling, the company maintains high insider ownership, which often aligns management's interests with shareholders. Recent developments include a contract for Denmark’s national Shared Public Treatment Platform, underscoring Trifork's expertise in digital health solutions. The company revised its 2025 revenue guidance upwards to EUR 217.5 million-EUR 222.5 million and expects substantial EBIT growth, highlighting its robust market position and potential for future expansion.

- Delve into the full analysis future growth report here for a deeper understanding of Trifork Group.

- In light of our recent valuation report, it seems possible that Trifork Group is trading behind its estimated value.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VusionGroup S.A. provides digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €4.04 billion.

Operations: The company's revenue is primarily derived from installing and maintaining electronic shelf labels, amounting to €1.16 billion.

Insider Ownership: 12.8%

VusionGroup is poised for significant growth, with earnings expected to increase by 58.3% annually and revenue projected to grow faster than the French market at 19% per year. The company anticipates becoming profitable within three years, supported by high insider ownership aligning management interests with shareholders. Recent partnerships with Morrisons and Asda highlight VusionGroup's innovative digital solutions, reinforcing its strategic position in the retail sector as it targets €1.5 billion in annual revenue for 2025.

- Unlock comprehensive insights into our analysis of VusionGroup stock in this growth report.

- Our expertly prepared valuation report VusionGroup implies its share price may be too high.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) develops, manufactures, sells, and installs store concepts for retail chain stores and has a market cap of SEK5.12 billion.

Operations: ITAB Shop Concept AB's revenue segments include the development, manufacturing, sale, and installation of store concepts for retail chain stores.

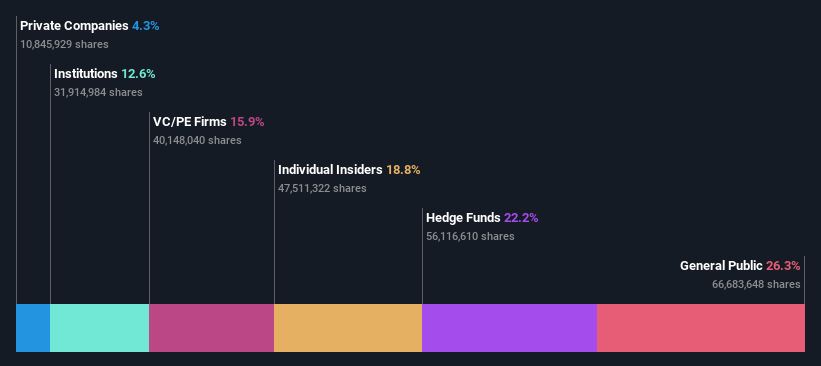

Insider Ownership: 11.9%

ITAB Shop Concept's earnings are forecast to grow significantly, outpacing the Swedish market, while revenue growth is expected at 10.8% annually. Despite lower profit margins recently, ITAB trades well below its estimated fair value and analysts anticipate a price increase of over 50%. The company secured a major deal with a European grocery chain for self-checkout units worth up to €27 million. Leadership changes include Björn Borgman as incoming CEO in May 2026.

- Get an in-depth perspective on ITAB Shop Concept's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report ITAB Shop Concept implies its share price may be lower than expected.

Taking Advantage

- Gain an insight into the universe of 192 Fast Growing European Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives