- Germany

- /

- Medical Equipment

- /

- XTRA:SBS

European Growth Companies With High Insider Ownership Growing Earnings Up To 57%

Reviewed by Simply Wall St

As European markets show resilience, with the pan-European STOXX Europe 600 Index remaining steady amid interest rate policy assessments and trade concerns, investors are increasingly focused on identifying promising opportunities within this complex landscape. In such a climate, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.7% |

| KebNi (OM:KEBNI B) | 38% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Underneath we present a selection of stocks filtered out by our screen.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VusionGroup S.A. provides digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €4.27 billion.

Operations: The company's revenue is primarily generated from installing and maintaining electronic shelf labels, totaling €1.16 billion.

Insider Ownership: 12.8%

Earnings Growth Forecast: 58.0% p.a.

VusionGroup is poised for significant growth, with revenue projected to increase by 19% annually, outpacing the French market. Despite not reaching a 20% growth rate, its earnings are forecasted to grow nearly 58% per year. Recent corporate guidance raised the annual revenue target to €1.5 billion, reflecting robust sales and profitability in H1 2025. The company anticipates becoming profitable within three years and boasts high insider ownership, enhancing investor confidence.

- Take a closer look at VusionGroup's potential here in our earnings growth report.

- The analysis detailed in our VusionGroup valuation report hints at an inflated share price compared to its estimated value.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper S.A. offers Software as a Service solutions for e-commerce in Poland, with a market cap of PLN1.40 billion.

Operations: The company's revenue segments include Solutions, generating PLN163.88 million, and Subscriptions, contributing PLN44.03 million.

Insider Ownership: 23.1%

Earnings Growth Forecast: 21.7% p.a.

Shoper demonstrates promising growth potential, with earnings projected to increase significantly at 21.7% annually, surpassing the Polish market's growth rate. Despite slower revenue growth of 14.9%, it still outpaces the local market average. The company's recent inclusion in the S&P Global BMI Index underscores its expanding influence. Shoper's strong financial performance is highlighted by a substantial rise in net income and earnings per share for H1 2025, enhancing its investment appeal.

- Click here and access our complete growth analysis report to understand the dynamics of Shoper.

- Insights from our recent valuation report point to the potential overvaluation of Shoper shares in the market.

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE, with a market cap of €348.27 million, provides automation solutions for in-vitro diagnostics and life science companies in Germany, the European Union, and internationally.

Operations: The company's revenue segment primarily consists of €263.52 million from automation solutions for highly regulated laboratories.

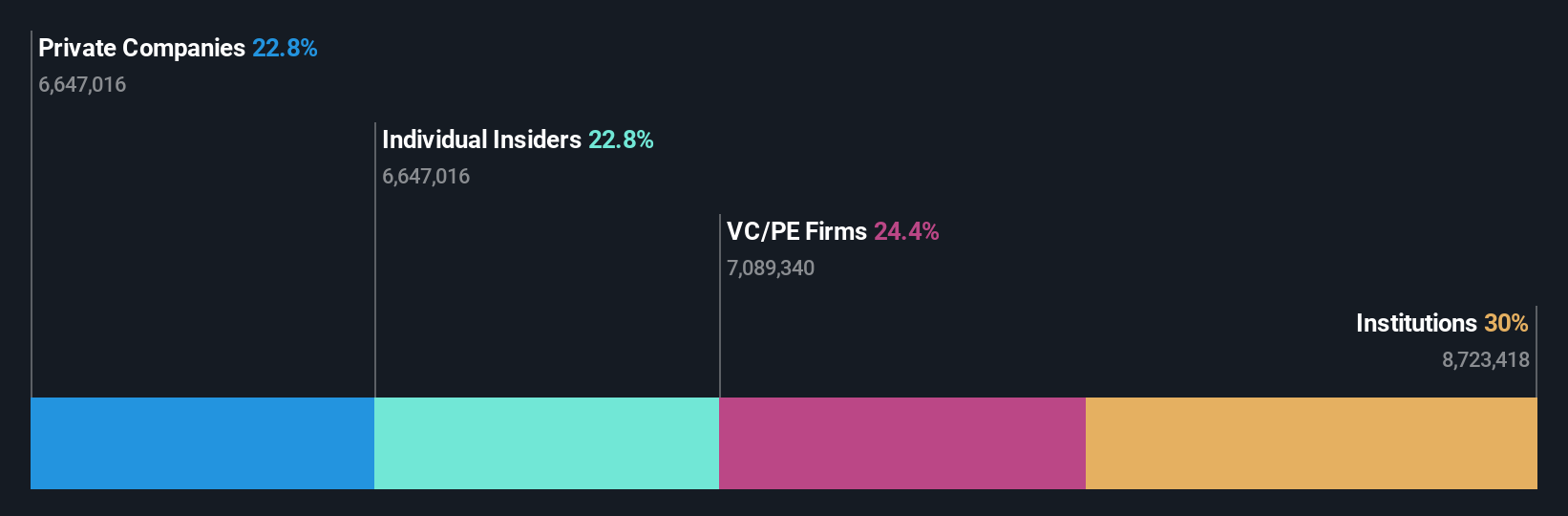

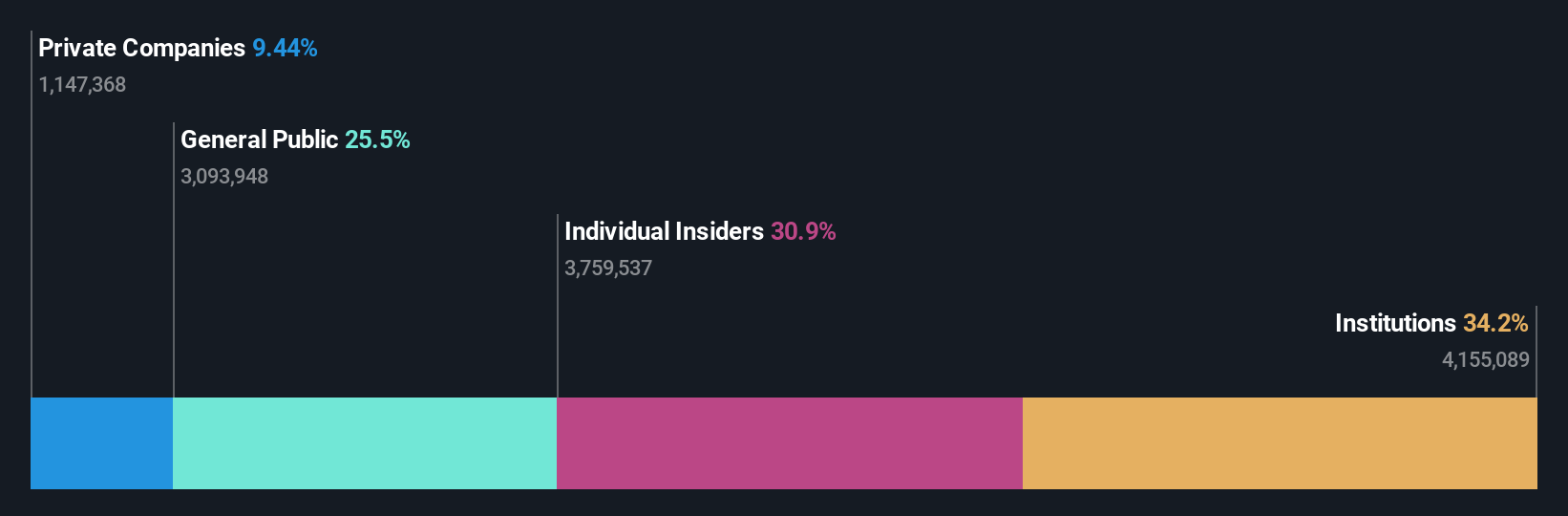

Insider Ownership: 30.9%

Earnings Growth Forecast: 21.5% p.a.

Stratec SE's growth prospects are underscored by forecasted earnings growth of 21.5% annually, outpacing the German market. However, recent financial results show a decline in net income and earnings per share for H1 2025 compared to the previous year. The company trades at a significant discount to its estimated fair value but faces challenges with debt coverage by operating cash flow. The appointment of Tanja Bücherl as CFO is expected to enhance financial management efficiency.

- Navigate through the intricacies of Stratec with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Stratec is priced lower than what may be justified by its financials.

Next Steps

- Unlock our comprehensive list of 218 Fast Growing European Companies With High Insider Ownership by clicking here.

- Curious About Other Options? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SBS

Stratec

Provides automation solutions for in-vitro diagnostics and life science companies in Germany, the European Union, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success