3 Growth Companies With High Insider Ownership On Euronext Paris Expect To Grow Profits Up To 101%

Reviewed by Simply Wall St

As the European Central Bank's recent interest rate cuts have buoyed major stock indexes, including France's CAC 40, investor sentiment in the region is cautiously optimistic with expectations for further monetary easing. In this environment of potential economic support, growth companies with high insider ownership on Euronext Paris may present appealing opportunities as they align interests between company insiders and shareholders, potentially driving profitability.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.4% | 81.7% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 33.9% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 26.6% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 22.9% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| Munic (ENXTPA:ALMUN) | 27.1% | 174.1% |

| WALLIX GROUP (ENXTPA:ALLIX) | 19.6% | 94.8% |

| Adocia (ENXTPA:ADOC) | 11.7% | 64% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 103.8% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focused on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company's revenue segments include €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

Insider Ownership: 13.1%

Earnings Growth Forecast: 33.5% p.a.

Exclusive Networks is undergoing a significant transition as Clayton, Dubilier & Rice and Permira plan to take it private in a €2.2 billion deal. This move underscores the company's high insider ownership, with 66.7% held by Permira's entity and its founder. Despite recent declines in profit margins, Exclusive Networks' earnings are projected to grow significantly at 33.5% annually, outpacing the French market's growth rate of 12.2%.

- Delve into the full analysis future growth report here for a deeper understanding of Exclusive Networks.

- Our comprehensive valuation report raises the possibility that Exclusive Networks is priced higher than what may be justified by its financials.

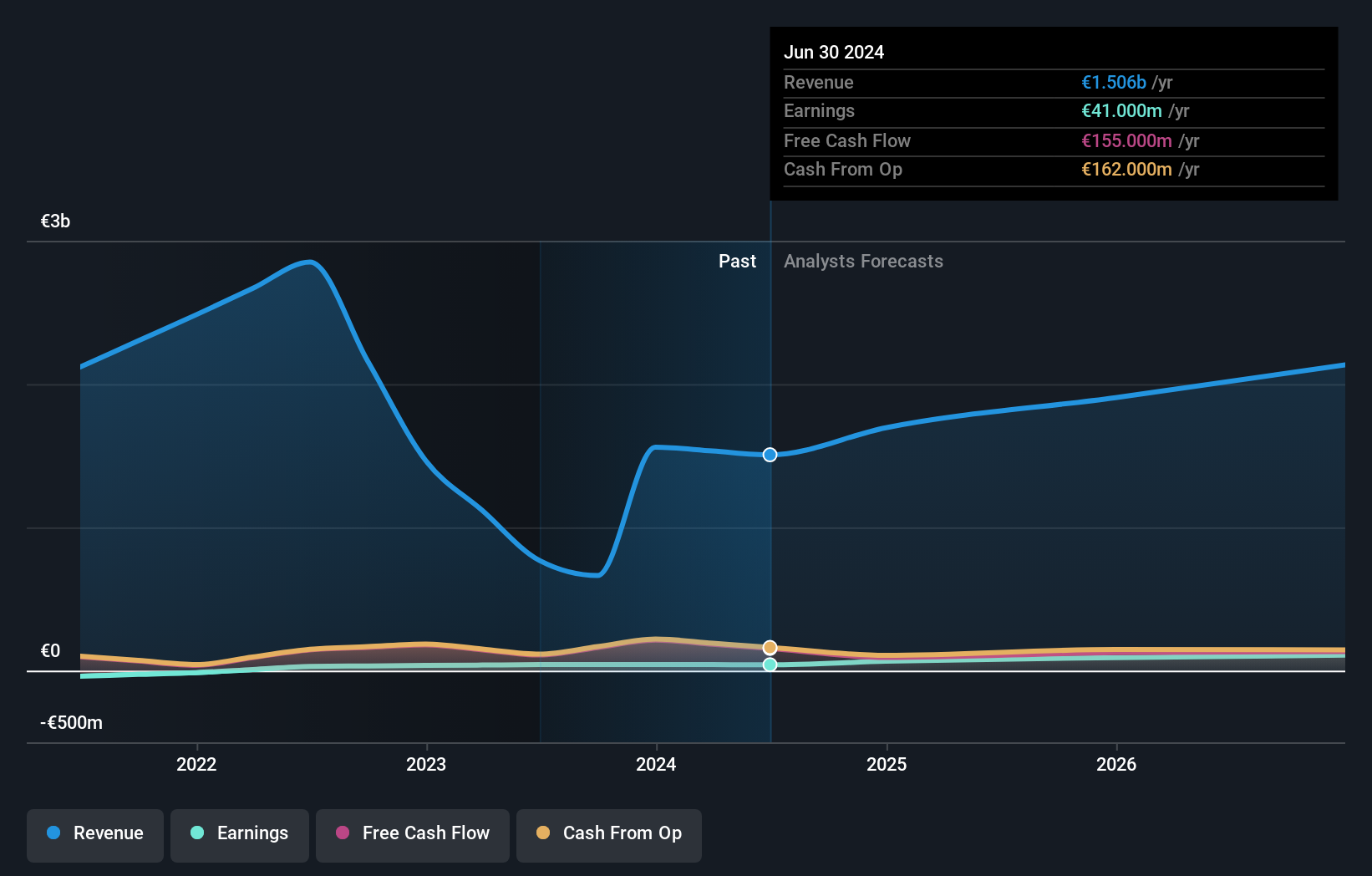

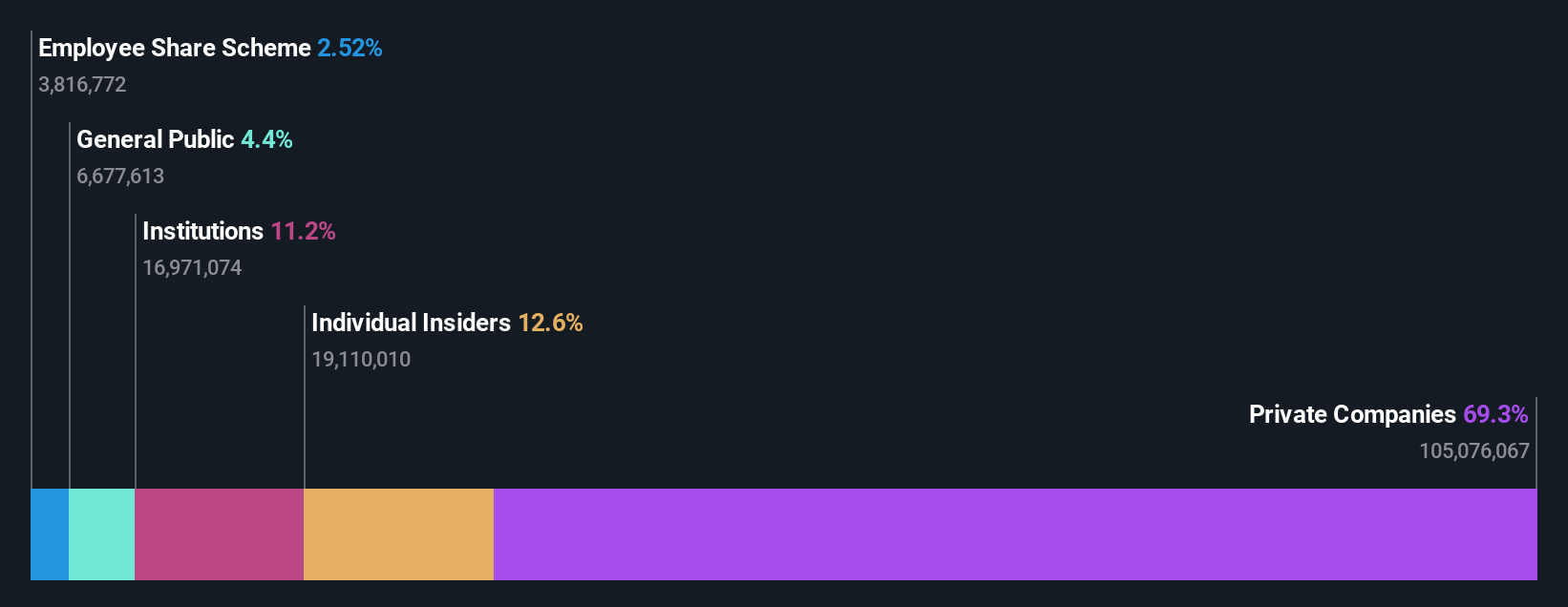

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.36 billion.

Operations: The company's revenue is primarily derived from its Private Cloud segment (€589.61 million), followed by Web Cloud (€185.43 million) and Public Cloud services (€169.01 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.4% p.a.

OVH Groupe is expected to experience substantial profit growth, with earnings projected to increase by 101.37% annually, surpassing the French market's average. While its revenue growth forecast of 9.7% per year exceeds the market rate, it remains below high-growth benchmarks. Despite trading at a significant discount to fair value and lacking recent insider trading activity, OVH's share price has been highly volatile recently. The company anticipates achieving profitability within three years.

- Dive into the specifics of OVH Groupe here with our thorough growth forecast report.

- Our expertly prepared valuation report OVH Groupe implies its share price may be lower than expected.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €2.26 billion.

Operations: The company generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €830.16 million.

Insider Ownership: 13.4%

Earnings Growth Forecast: 81.7% p.a.

VusionGroup is positioned for significant growth with a forecasted revenue increase of 28.4% annually, outpacing the French market. The company's earnings are expected to grow by 81.72% per year, with profitability anticipated within three years. Recent developments include a strategic partnership with Ace Hardware to implement digital shelf label technology across its stores, enhancing operational efficiency and customer experience. Despite recent losses, analysts expect the stock price to rise significantly based on future potential.

- Click here and access our complete growth analysis report to understand the dynamics of VusionGroup.

- Upon reviewing our latest valuation report, VusionGroup's share price might be too optimistic.

Key Takeaways

- Access the full spectrum of 23 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Exclusive Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXN

Exclusive Networks

Operates as a global cybersecurity specialist for digital infrastructure in Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives