3 European Stocks Estimated To Be Up To 44.2% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets experience a modest upswing, with the pan-European STOXX Europe 600 Index rising by 1.03% amid expectations of U.S. Federal Reserve interest rate cuts, investors are turning their attention to potential opportunities in undervalued stocks. In this context, identifying stocks that are trading below their intrinsic value can be crucial for investors looking to capitalize on market inefficiencies and position themselves advantageously in the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Green Oleo (BIT:GRN) | €0.785 | €1.52 | 48.2% |

| Gofore Oyj (HLSE:GOFORE) | €14.72 | €29.33 | 49.8% |

| Echo Investment (WSE:ECH) | PLN5.50 | PLN10.71 | 48.6% |

| DSV (CPSE:DSV) | DKK1383.00 | DKK2701.33 | 48.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.40 | €6.76 | 49.7% |

| cyan (XTRA:CYR) | €2.30 | €4.42 | 48% |

| Brockhaus Technologies (XTRA:BKHT) | €9.94 | €19.22 | 48.3% |

| Atea (OB:ATEA) | NOK142.00 | NOK277.95 | 48.9% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.955 | €3.79 | 48.4% |

| adidas (XTRA:ADS) | €175.75 | €350.24 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Iveco Group (BIT:IVG)

Overview: Iveco Group N.V. is involved in the design, production, marketing, sale, servicing, and financing of a wide range of vehicles and related systems across various regions globally with a market cap of €4.88 billion.

Operations: The company's revenue is primarily derived from its Truck segment (€9.35 billion), followed by Powertrain (€3.26 billion), Bus (€2.76 billion), Defence (€1.25 billion), and Financial Services (€498 million).

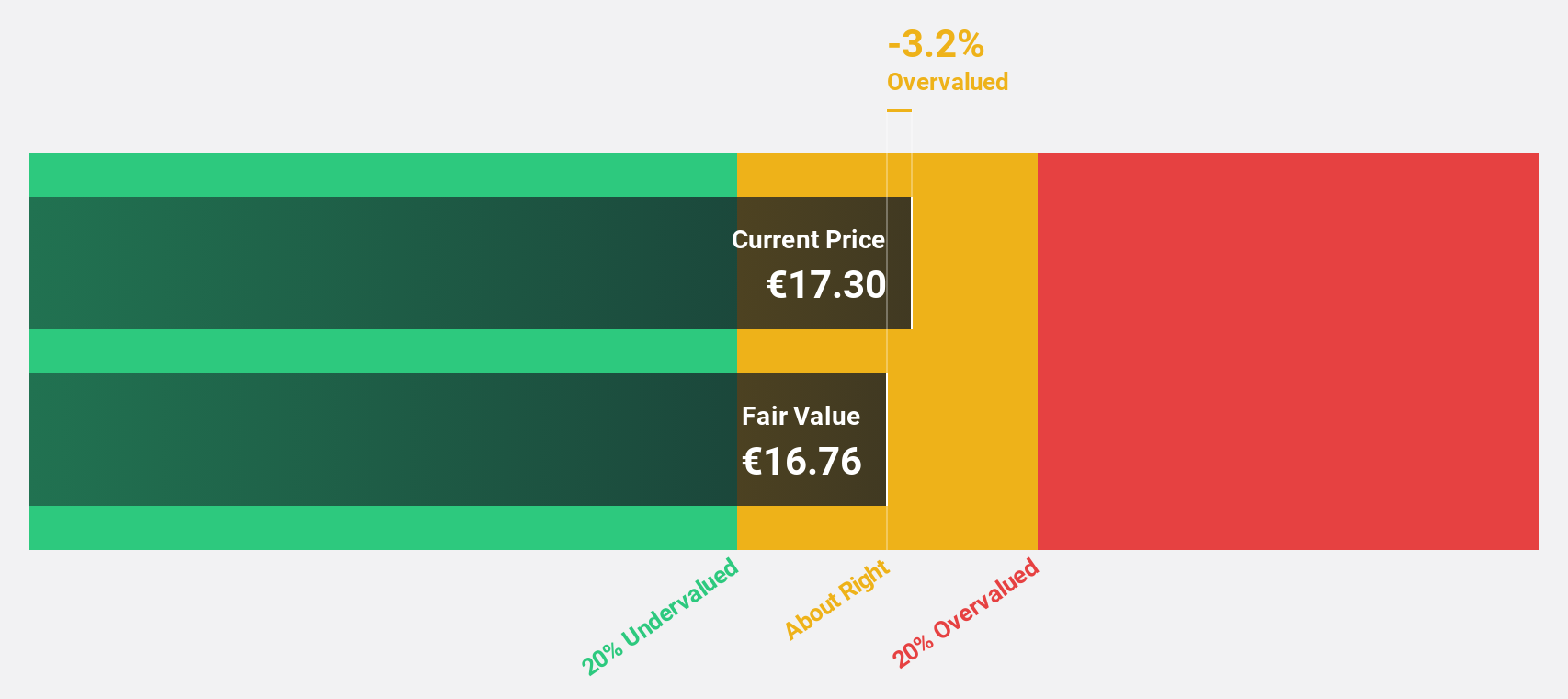

Estimated Discount To Fair Value: 11.8%

Iveco Group, trading at €18.33, is undervalued relative to its estimated fair value of €20.79. Despite recent volatility, its earnings are forecasted to grow significantly at 21.5% annually over the next three years, outpacing the Italian market's growth rate. However, interest payments are not well covered by earnings and dividends aren't fully supported by free cash flows. The upcoming acquisition by Tata Motors for $4.4 billion adds strategic value but involves delisting from Euronext Milan after restructuring efforts including a defense unit sale.

- Upon reviewing our latest growth report, Iveco Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Iveco Group with our comprehensive financial health report here.

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets globally, with a market cap of €904.53 million.

Operations: The company's revenue is segmented into €170.21 million from the Americas, €134.93 million from the Asia-Pacific region, and €220.52 million from EMEA (Europe, Middle East and Africa).

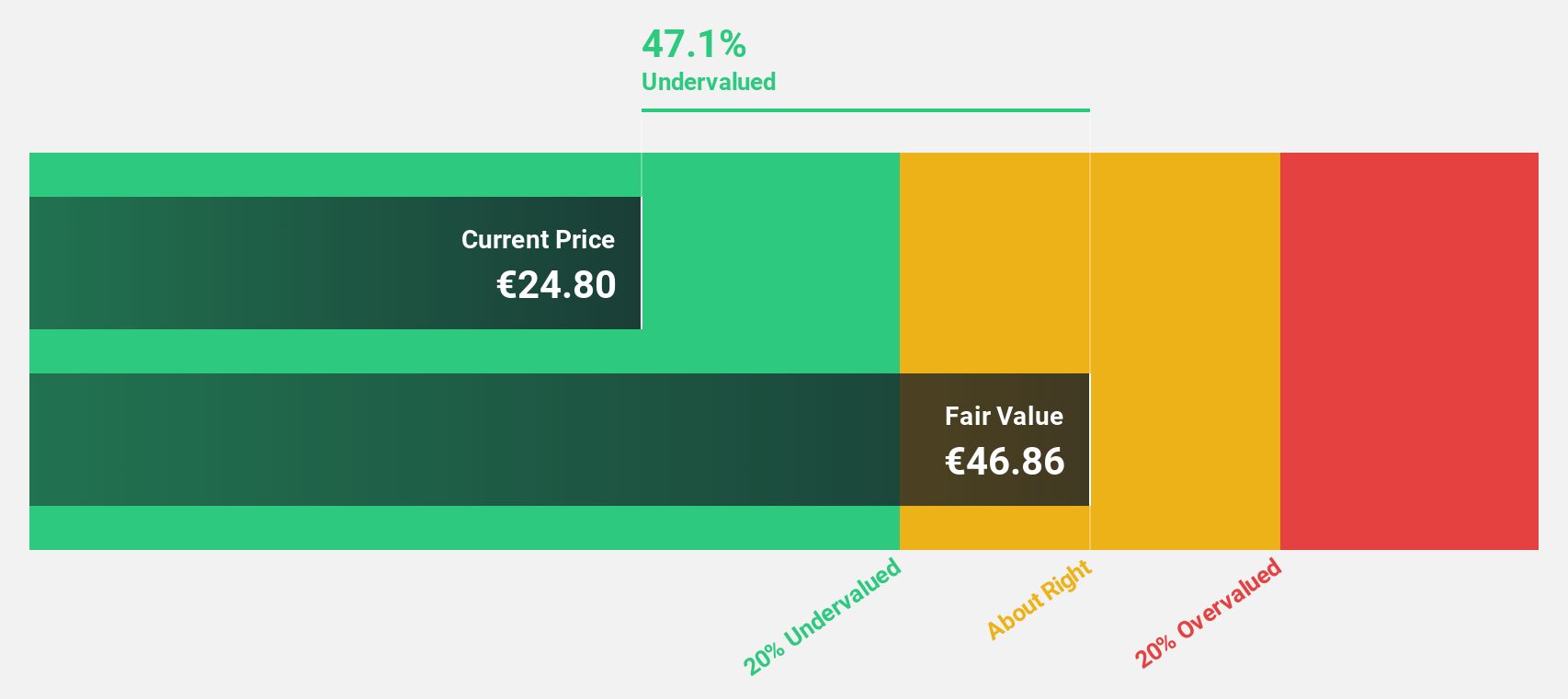

Estimated Discount To Fair Value: 44.2%

Lectra, trading at €23.8, is significantly undervalued with an estimated fair value of €42.68. Its earnings are projected to grow 21% annually over the next three years, surpassing the French market's growth rate of 12.2%. Recent implementations of Lectra's Valia Furniture platform have enhanced client operations, optimizing production efficiency and reducing lead times. Despite stable revenue figures, these strategic advancements position Lectra favorably in terms of cash flow valuation metrics.

- Our comprehensive growth report raises the possibility that Lectra is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Lectra stock in this financial health report.

VusionGroup (ENXTPA:VU)

Overview: VusionGroup S.A. provides digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €4.06 billion.

Operations: The company's revenue segments include digitalization solutions for commerce in Europe, Asia, and North America.

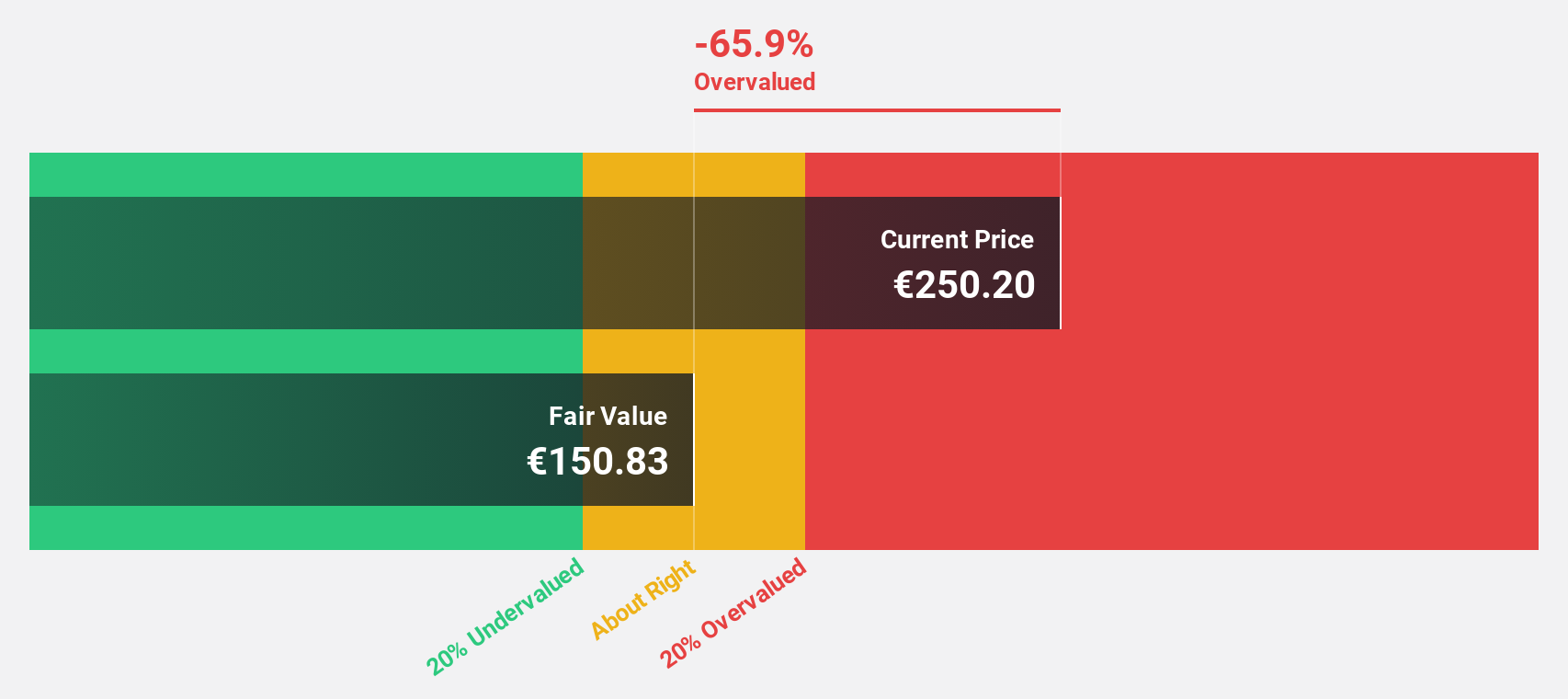

Estimated Discount To Fair Value: 35%

VusionGroup, trading at €241, is significantly undervalued with a fair value estimate of €371.02. The company reported half-year sales of €614.1 million, up from €408.9 million the previous year, and reduced its net loss to €9.7 million from €24.4 million. With earnings forecasted to grow 76% annually and expected profitability within three years, VusionGroup's strategic rollout with Eroski enhances operational efficiency and positions it well for future cash flow improvements despite slower revenue growth projections.

- The analysis detailed in our VusionGroup growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of VusionGroup.

Where To Now?

- Get an in-depth perspective on all 210 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, furniture markets, and other industries in Europe, the Americas, the Asia Pacific, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives