David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Technicolor SA (EPA:TCH) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Technicolor

What Is Technicolor's Debt?

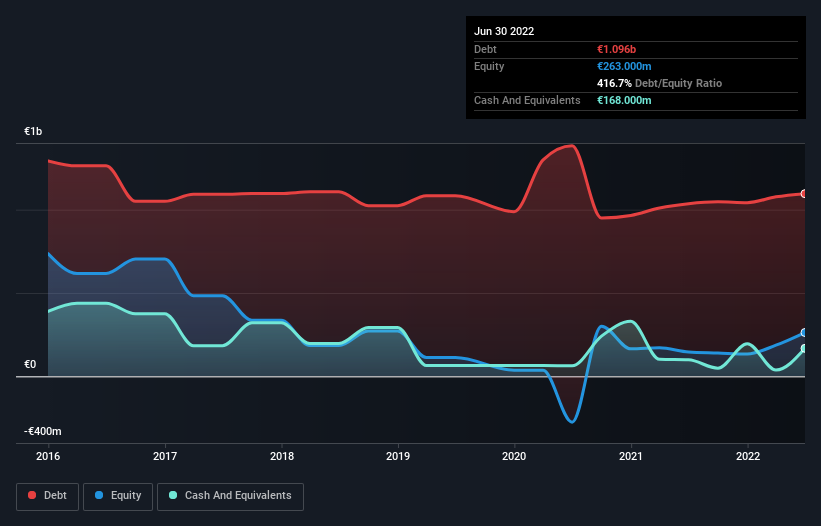

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Technicolor had €1.10b of debt, an increase on €1.04b, over one year. However, it does have €168.0m in cash offsetting this, leading to net debt of about €928.0m.

A Look At Technicolor's Liabilities

According to the last reported balance sheet, Technicolor had liabilities of €1.50b due within 12 months, and liabilities of €1.50b due beyond 12 months. On the other hand, it had cash of €168.0m and €511.0m worth of receivables due within a year. So it has liabilities totalling €2.33b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the €636.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Technicolor would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Technicolor's debt to EBITDA ratio (4.0) suggests that it uses some debt, its interest cover is very weak, at 0.68, suggesting high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. However, the silver lining was that Technicolor achieved a positive EBIT of €92m in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Technicolor can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the most recent year, Technicolor recorded free cash flow worth 63% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

On the face of it, Technicolor's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Overall, it seems to us that Technicolor's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Even though Technicolor lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VANTI

Vantiva

Designs, develops, and supplies software solutions to pay-TV operators and network service providers in France, the United Kingdom, rest of Europe, the United States, rest of the Americas, the Asia-Pacific, and South Africa.

Undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion