The board of Quadient S.A. (EPA:QDT) has announced that it will be increasing its dividend on the 8th of August to €0.55. This takes the dividend yield from 3.1% to 3.1%, which shareholders will be pleased with.

See our latest analysis for Quadient

Quadient's Dividend Is Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. However, prior to this announcement, Quadient's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 1.3% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 13% by next year, which is in a pretty sustainable range.

Dividend Volatility

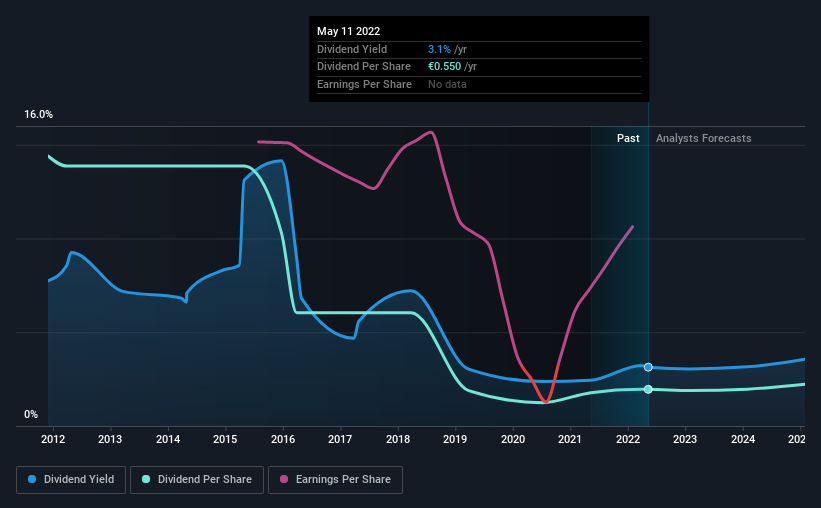

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2012, the dividend has gone from €4.05 to €0.55. The dividend has fallen 86% over that period. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth May Be Hard To Achieve

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Over the past five years, it looks as though Quadient's EPS has declined at around 4.2% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Our Thoughts On Quadient's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Quadient's payments are rock solid. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for Quadient that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Quadient might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:QDT

Quadient

Provides digital, mail, and lockers for customers through digital and physical channels in North America, France, Benelux, the United Kingdom, Ireland and Germany, Austria, Italy, Switzerland, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026