- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LBIRD

High Growth Tech Stocks In Europe May 2025

Reviewed by Simply Wall St

The European market has recently faced challenges, with the pan-European STOXX Europe 600 Index ending a streak of gains due to proposed U.S. tariffs on EU goods, while economic growth forecasts have been revised downward amid rising uncertainties. In this environment, identifying high-growth tech stocks involves looking for companies that can navigate trade tensions and leverage innovation to maintain robust performance despite broader market pressures.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Intellego Technologies | 31.55% | 51.31% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.03% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| CD Projekt | 33.21% | 37.35% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Lumibird (ENXTPA:LBIRD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lumibird SA is a company that specializes in designing, manufacturing, and selling lasers for scientific, industrial, and medical applications globally, with a market capitalization of €330.14 million.

Operations: The company generates revenue from two main segments: Medical (€107.75 million) and Photonic (€99.37 million).

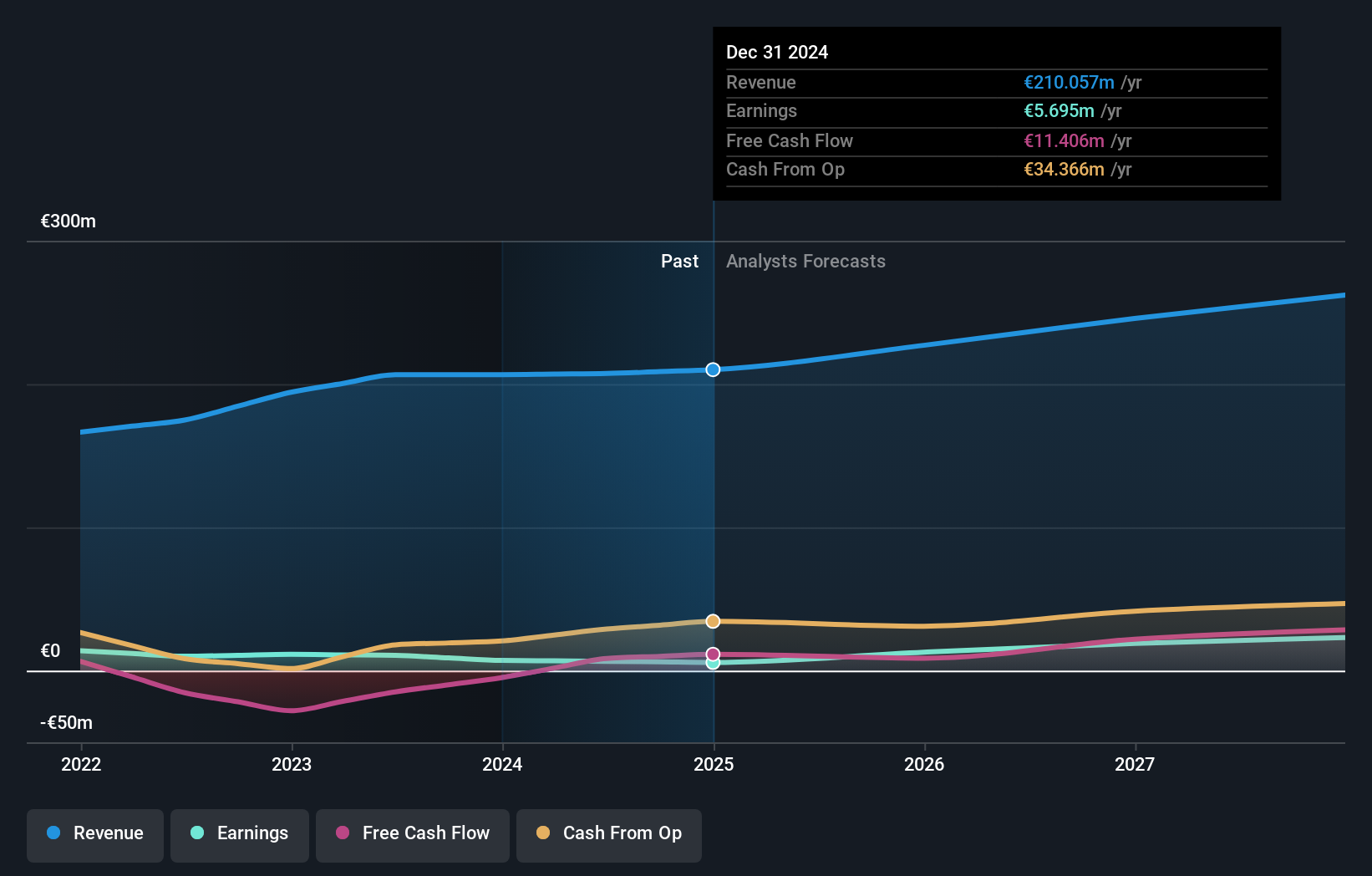

Lumibird, a player in the European tech scene, has demonstrated a mixed financial trajectory recently. Despite a challenging year with earnings declining by 20.1%, forecasts are optimistic with an expected annual earnings growth of 37.3%. This growth rate notably surpasses the French market's average of 12.1%. Additionally, Lumibird's revenue is also set to outpace the local market, projecting an increase of 7.1% per year compared to the broader market's 5%. However, it’s crucial to note that past financial results have been impacted by a significant one-off loss of €3.4 million as of December 2024. With such dynamics at play, Lumibird presents both opportunities and risks within the high-growth tech sector in Europe.

- Click here and access our complete health analysis report to understand the dynamics of Lumibird.

Examine Lumibird's past performance report to understand how it has performed in the past.

BioInvent International (OM:BINV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BioInvent International AB (publ) is a clinical-stage company focused on discovering and developing novel immuno-modulatory antibodies for cancer treatment, with a market cap of approximately SEK2.43 billion.

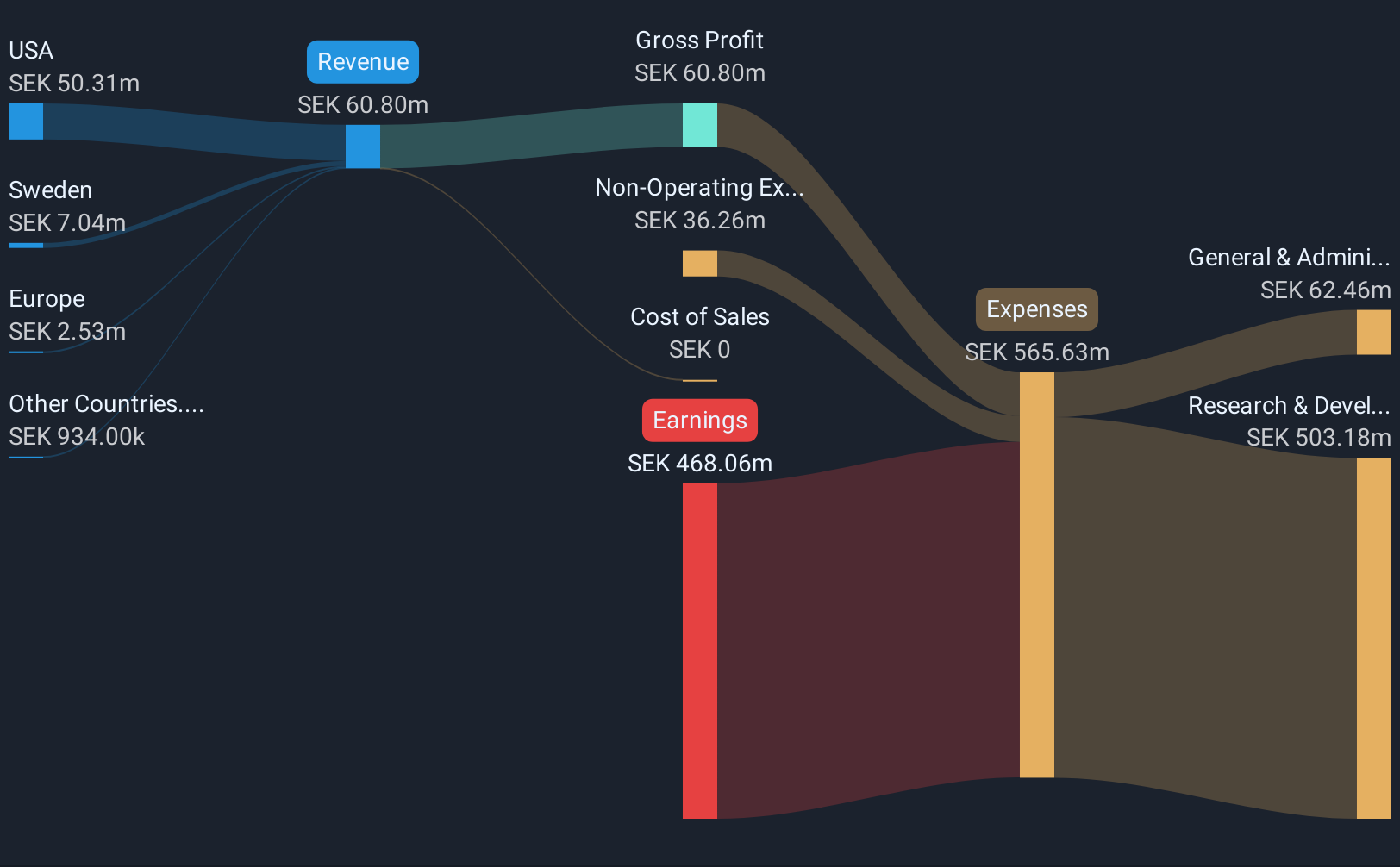

Operations: BioInvent focuses on developing antibody-based drugs, generating revenue of SEK60.80 million from this segment. The company operates in Sweden, Europe, the United States, and other international markets.

BioInvent International, a Swedish biotech firm, is making notable strides in the high-growth tech sector in Europe with an impressive forecasted annual revenue growth rate of 76.6%, significantly outpacing the Swedish market's average of 4.2%. Despite being currently unprofitable, the company is expected to reach profitability within three years, reflecting an anticipated robust annual profit growth. Recent developments include promising Phase 2a study results of BI-1808 for Cutaneous T-cell Lymphoma presented at the EHA congress and FDA's Fast Track Designation for this innovative treatment, highlighting BioInvent's potential to transform therapeutic approaches in oncology through its focused R&D efforts which continue to attract significant investment and interest within the biotechnological landscape.

- Get an in-depth perspective on BioInvent International's performance by reading our health report here.

Assess BioInvent International's past performance with our detailed historical performance reports.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) is a company that offers manufacturing solutions, with a market capitalization of approximately SEK3.76 billion.

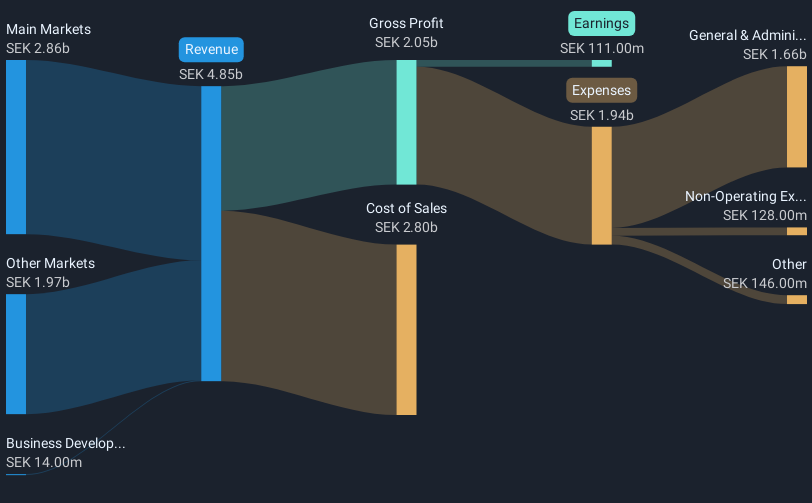

Operations: The company generates revenue primarily from its Main Markets segment, which accounts for SEK2.92 billion, and Other Markets contributing SEK2.06 billion. The Business Development and Services segment adds SEK32 million to the total revenue.

Hanza is distinguishing itself in the European tech sector with an annual revenue growth rate of 9.9%, outstripping the Swedish market average of 4.2%. Despite a challenging past year marked by a 38.1% earnings decline, forecasts suggest robust future earnings growth at an annual rate of 27.7%. The company's recent financials reveal a net income rise to SEK 40 million from SEK 34 million year-over-year, supported by sales increasing to SEK 1,326 million from SEK 1,253 million. These figures underscore Hanza's resilience and potential for sustained growth amidst market adversities.

- Unlock comprehensive insights into our analysis of Hanza stock in this health report.

Explore historical data to track Hanza's performance over time in our Past section.

Next Steps

- Dive into all 226 of the European High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LBIRD

Lumibird

Designs, manufactures, and sells various lasers for scientific, industrial, and medical applications.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives