- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LACR

Should Lacroix (EPA:LACR) Be Disappointed With Their 26% Profit?

Investors can buy low cost index fund if they want to receive the average market return. But across the board there are plenty of stocks that underperform the market. That's what has happened with the Lacroix SA (EPA:LACR) share price. It's up 26% over three years, but that is below the market return. Disappointingly, the share price is down 25% in the last year.

View our latest analysis for Lacroix

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

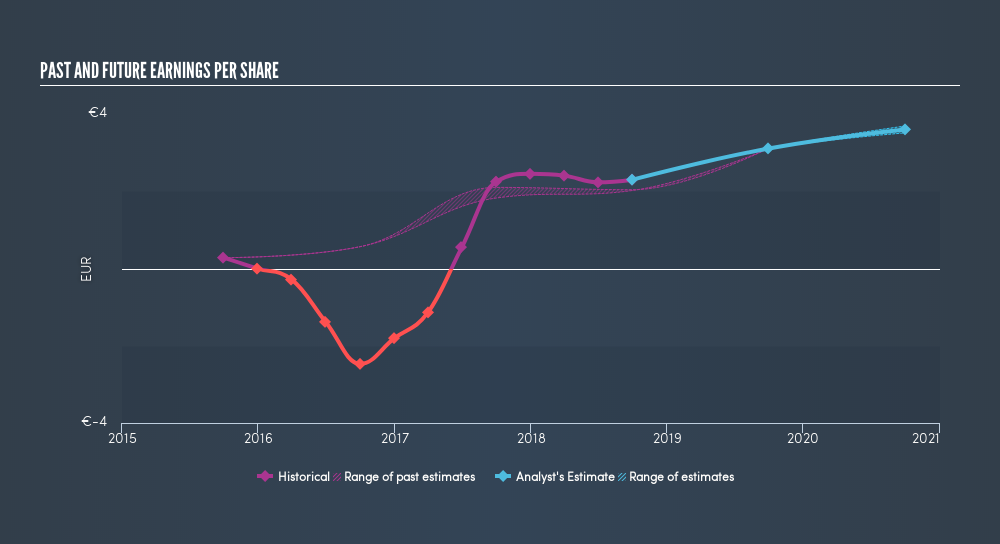

During three years of share price growth, Lacroix achieved compound earnings per share growth of 102% per year. This EPS growth is higher than the 8.1% average annual increase in the share price. So it seems investors have become more cautious about the company, over time. This cautious sentiment is reflected in its (fairly low) P/E ratio of 10.04.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Lacroix has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Lacroix the TSR over the last 3 years was 35%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 6.7% in the last year, Lacroix shareholders lost 23% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 2.5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Importantly, we haven't analysed Lacroix's dividend history. This freevisual report on its dividends is a must-read if you're thinking of buying.

Of course Lacroix may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:LACR

LACROIX Group

Engages in the conception and supply of electronic equipment and industrial IoT solutions in France, Germany, the United States, Poland, and Tunisia.

Undervalued with moderate growth potential.

Market Insights

Community Narratives