- Sweden

- /

- Entertainment

- /

- OM:FLEXM

3 European Penny Stocks With Market Caps Under €60M

Reviewed by Simply Wall St

The European markets have recently faced challenges, with the STOXX Europe 600 Index and major stock indexes experiencing declines amid concerns over inflated AI stock valuations and shifting interest rate expectations. Despite these broader market pressures, investors continue to seek opportunities in lesser-known areas such as penny stocks. While the term "penny stock" might seem outdated, it remains a relevant category for those looking to uncover potential growth in smaller or newer companies that demonstrate financial resilience.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.932 | €1.36B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.79 | €85.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €239.2M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.12 | €66.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.34 | SEK203.2M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.29 | €378.29M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.96 | €77.23M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.19 | €302.7M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.854 | €28.6M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Guillemot (ENXTPA:GUI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guillemot Corporation S.A. designs, manufactures, and sells interactive entertainment equipment and accessories across the European Union, the United Kingdom, North America, and internationally, with a market cap of €68.62 million.

Operations: The company generates revenue through its Hercules segment, which accounts for €12.25 million, and its Thrustmaster segment, contributing €108.57 million.

Market Cap: €68.62M

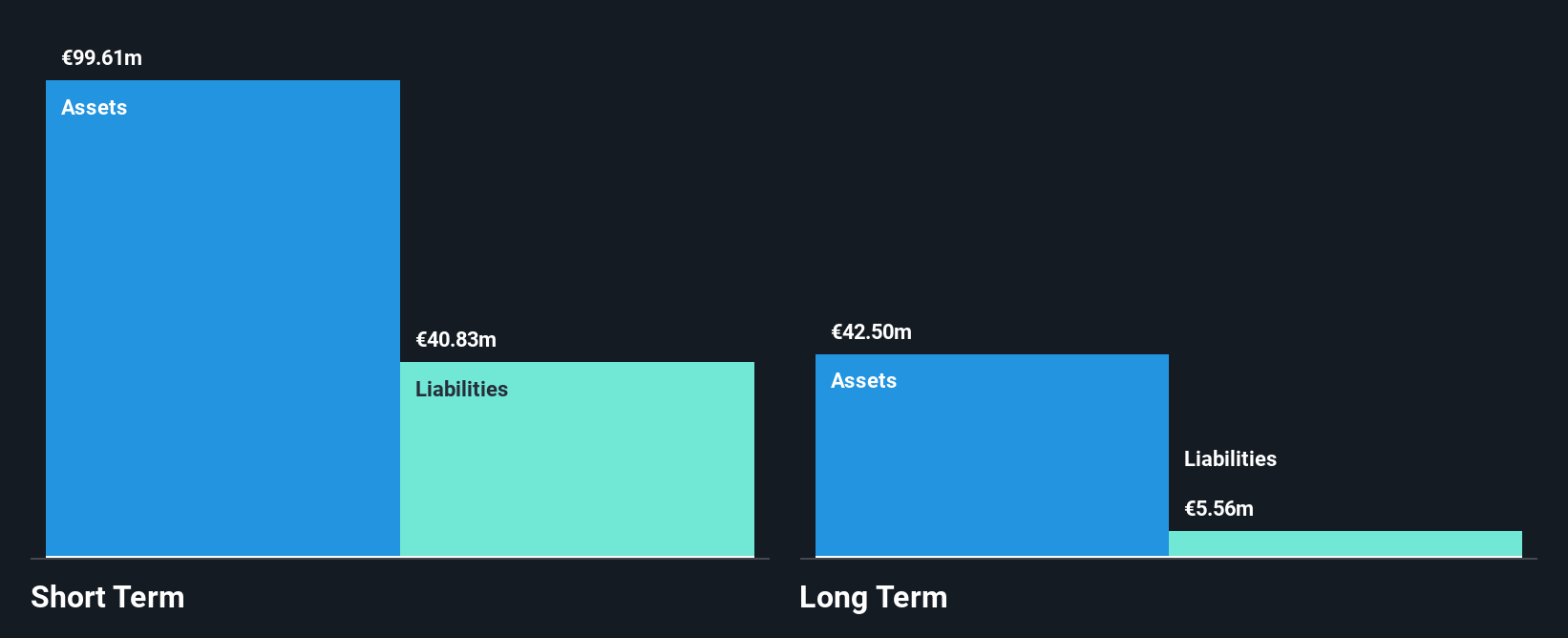

Guillemot Corporation S.A., with a market cap of €68.62 million, has experienced recent challenges, reporting a net loss of €3.59 million for the half year ended June 30, 2025, compared to a profit the previous year. Despite being unprofitable and having negative return on equity, the company maintains strong liquidity with short-term assets exceeding liabilities and cash surpassing total debt. Guillemot's management is highly experienced with an average tenure of 28 years. The company forecasts turnover exceeding €120 million for full-year 2025 and anticipates improved financial performance in fiscal 2026.

- Click to explore a detailed breakdown of our findings in Guillemot's financial health report.

- Gain insights into Guillemot's outlook and expected performance with our report on the company's earnings estimates.

Flexion Mobile (OM:FLEXM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Flexion Mobile Plc operates a game distribution platform for developers globally, with a market cap of SEK176.30 million.

Operations: Flexion Mobile Plc does not report specific revenue segments.

Market Cap: SEK176.3M

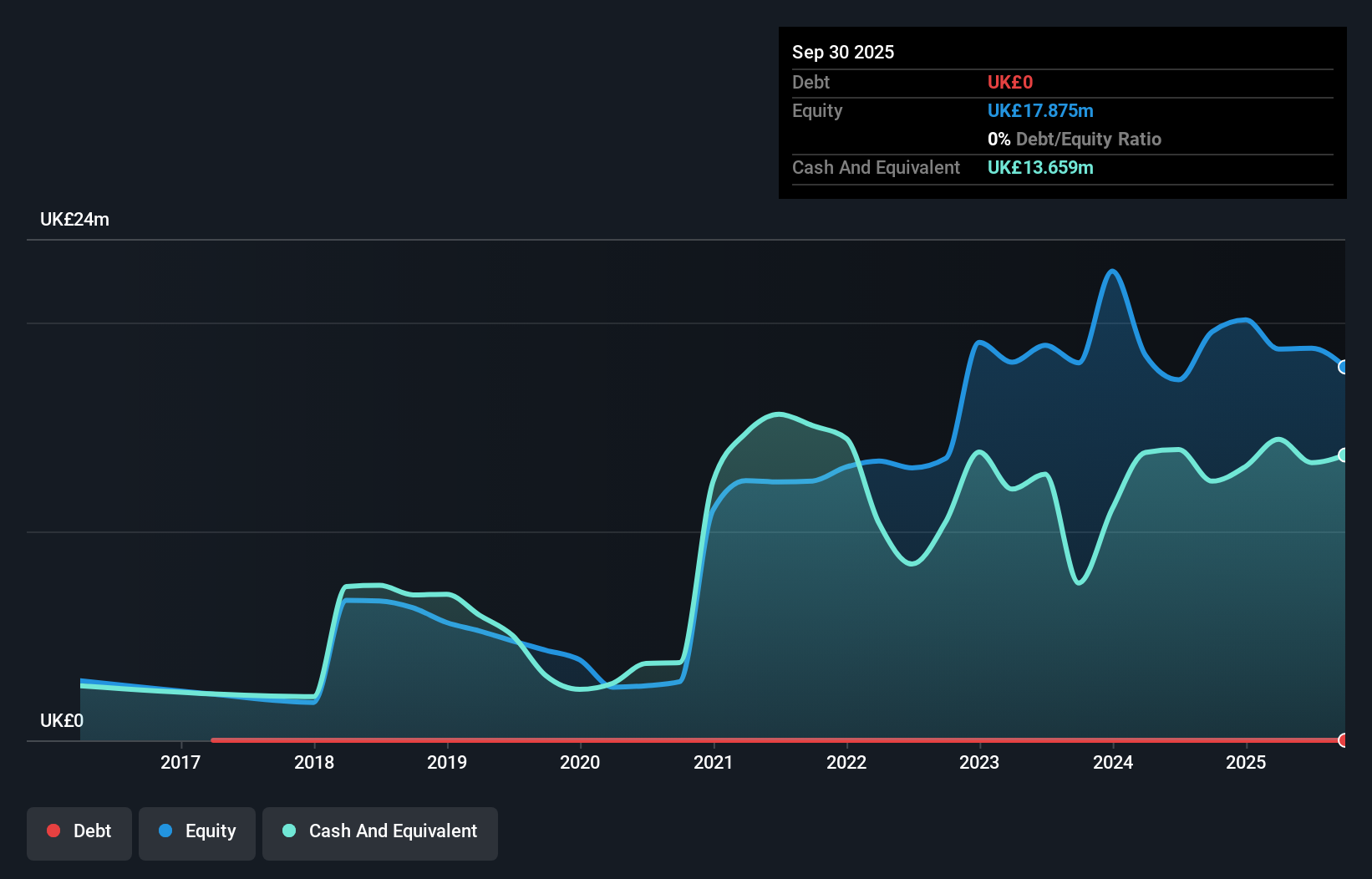

Flexion Mobile Plc, with a market cap of SEK176.30 million, is navigating the penny stock landscape by leveraging strategic partnerships to enhance its distribution capabilities. Despite being unprofitable, Flexion has maintained a stable financial position with no debt and sufficient cash runway for over three years. Recent collaborations with Xsolla and Microfun aim to expand revenue streams by tapping into alternative markets, promising incremental revenue boosts compared to traditional platforms like Google Play. While sales have slightly declined year-on-year, net losses have narrowed, reflecting potential operational efficiencies and strategic growth opportunities in diverse global markets.

- Get an in-depth perspective on Flexion Mobile's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Flexion Mobile's future.

Atende (WSE:ATD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atende S.A. specializes in the integration of IT systems in Poland and has a market cap of PLN110.48 million.

Operations: Revenue Segments: Not reported.

Market Cap: PLN110.48M

Atende S.A., with a market cap of PLN110.48 million, faces challenges in the penny stock realm due to its unprofitability and volatile share price. Although recent earnings show net income growth, the company struggles with profitability as losses have increased significantly over five years. The management team is experienced, indicating potential for strategic improvements. Atende's financial structure shows short-term assets exceeding liabilities, but debt levels have risen over time. Despite trading slightly below estimated fair value and having satisfactory debt coverage by operating cash flow, high volatility may concern risk-averse investors seeking stability in their portfolios.

- Jump into the full analysis health report here for a deeper understanding of Atende.

- Review our historical performance report to gain insights into Atende's track record.

Where To Now?

- Discover the full array of 277 European Penny Stocks right here.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FLEXM

Flexion Mobile

Operates game distribution platform for game developers worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives