- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALAUR

AURES Technologies (EPA:AURS) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that AURES Technologies S.A. (EPA:AURS) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for AURES Technologies

What Is AURES Technologies's Net Debt?

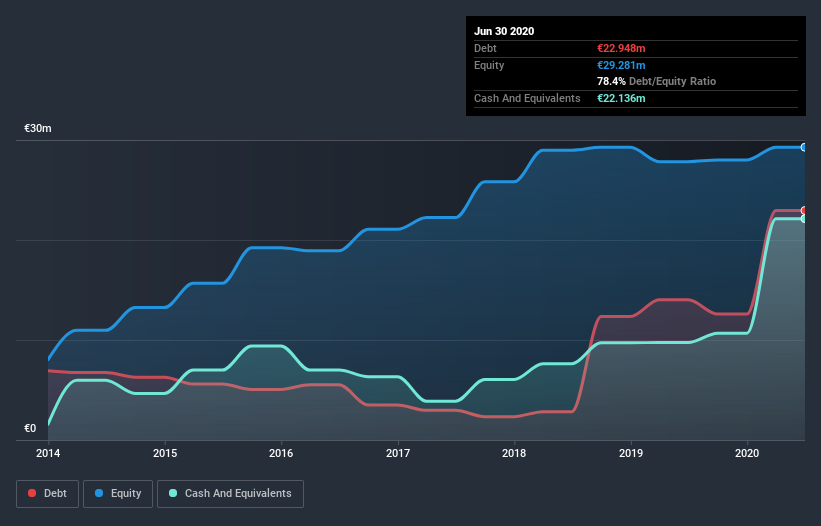

The image below, which you can click on for greater detail, shows that at June 2020 AURES Technologies had debt of €22.9m, up from €14.0m in one year. On the flip side, it has €22.1m in cash leading to net debt of about €812.0k.

How Strong Is AURES Technologies's Balance Sheet?

According to the last reported balance sheet, AURES Technologies had liabilities of €25.9m due within 12 months, and liabilities of €28.1m due beyond 12 months. On the other hand, it had cash of €22.1m and €14.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €17.7m.

Since publicly traded AURES Technologies shares are worth a total of €90.3m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, AURES Technologies has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 0.19 and interest cover of 6.7 times, it seems to us that AURES Technologies is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. In fact AURES Technologies's saving grace is its low debt levels, because its EBIT has tanked 64% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine AURES Technologies's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, AURES Technologies produced sturdy free cash flow equating to 66% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

AURES Technologies's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its net debt to EBITDA. When we consider all the factors mentioned above, we do feel a bit cautious about AURES Technologies's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for AURES Technologies you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade AURES Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALAUR

AURES Technologies

Engages in manufacture of hardware and digital application solutions for point of sale and retail industry.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026