- France

- /

- Communications

- /

- ENXTPA:ATEME

3 European Penny Stocks With A Market Cap Of €20M

Reviewed by Simply Wall St

As European markets continue to navigate a landscape marked by mixed performances and hopes for easing trade tensions, investors are increasingly seeking opportunities in less conventional areas. Penny stocks, although an outdated term, highlight smaller or newer companies that can offer significant potential at lower price points. By focusing on those with strong financials and solid fundamentals, investors may uncover hidden gems with the promise of growth and stability amidst current market conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.285 | SEK2.19B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.13 | SEK300.72M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.80 | SEK284.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.71 | PLN125.75M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.464 | NOK105.21M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.65 | €55.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.63 | €17.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.23 | €307.88M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 449 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

DigiTouch (BIT:DGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DigiTouch S.p.A. offers digital marketing and transformation services in Italy, with a market cap of €24.18 million.

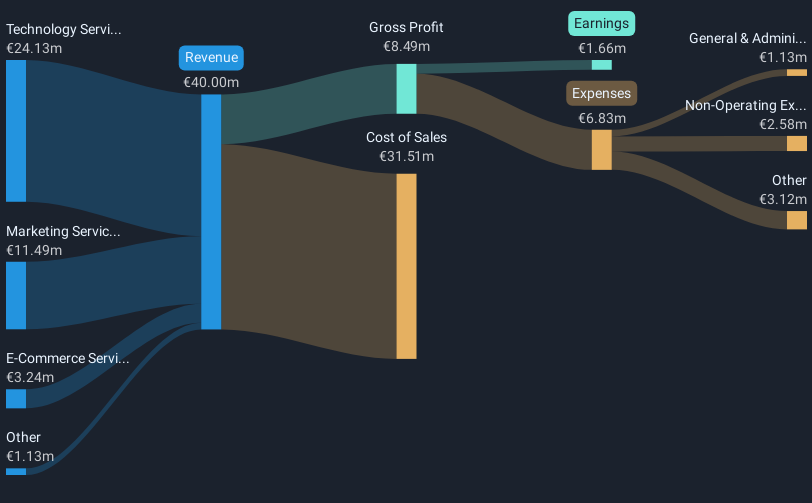

Operations: The company generates revenue through three main segments: Technology Services (€24.13 million), Marketing Services (€11.49 million), and E-Commerce Services (€3.24 million).

Market Cap: €24.18M

DigiTouch S.p.A., with a market cap of €24.18 million, operates in digital marketing and transformation services, generating revenues from technology (€24.13M), marketing (€11.49M), and e-commerce services (€3.24M). Despite facing a slight decline in sales from €44.11 million to €40.01 million over the past year, the company maintains stable financial health with short-term assets exceeding liabilities and satisfactory net debt to equity ratio at 37.5%. Earnings growth is forecasted at 22.59% annually, supported by an experienced management team and board of directors while offering dividends of €0.0300 per share payable June 2025.

- Click to explore a detailed breakdown of our findings in DigiTouch's financial health report.

- Understand DigiTouch's earnings outlook by examining our growth report.

ATEME (ENXTPA:ATEME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ATEME SA, along with its subsidiaries, is involved in the production and sales of electronic and computer devices and instruments globally, with a market cap of €48.49 million.

Operations: The company generates revenue from the marketing of professional compression and video broadcasting solutions, amounting to €93.50 million.

Market Cap: €48.49M

ATEME, with a market cap of €48.49 million, is facing challenges as it remains unprofitable with increasing losses over the past five years. Despite generating €93.50 million in sales last year, its net loss widened to €5.38 million from the previous year. The company's high net debt to equity ratio of 68.4% raises concerns about financial leverage, though it has sufficient cash runway for over three years if maintaining its current free cash flow level. Recent developments include showcasing cloud-based broadcast technology at NAB 2025, highlighting potential efficiencies and cost savings for broadcasters transitioning to ATSC 3.0 standards.

- Take a closer look at ATEME's potential here in our financial health report.

- Learn about ATEME's future growth trajectory here.

Medivir (OM:MVIR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Medivir AB (publ) is a pharmaceutical company that develops and commercializes cancer treatments in the Nordic region, Europe, and internationally, with a market cap of SEK207.51 million.

Operations: The company generates revenue of SEK3.58 million from its pharmaceuticals segment.

Market Cap: SEK207.51M

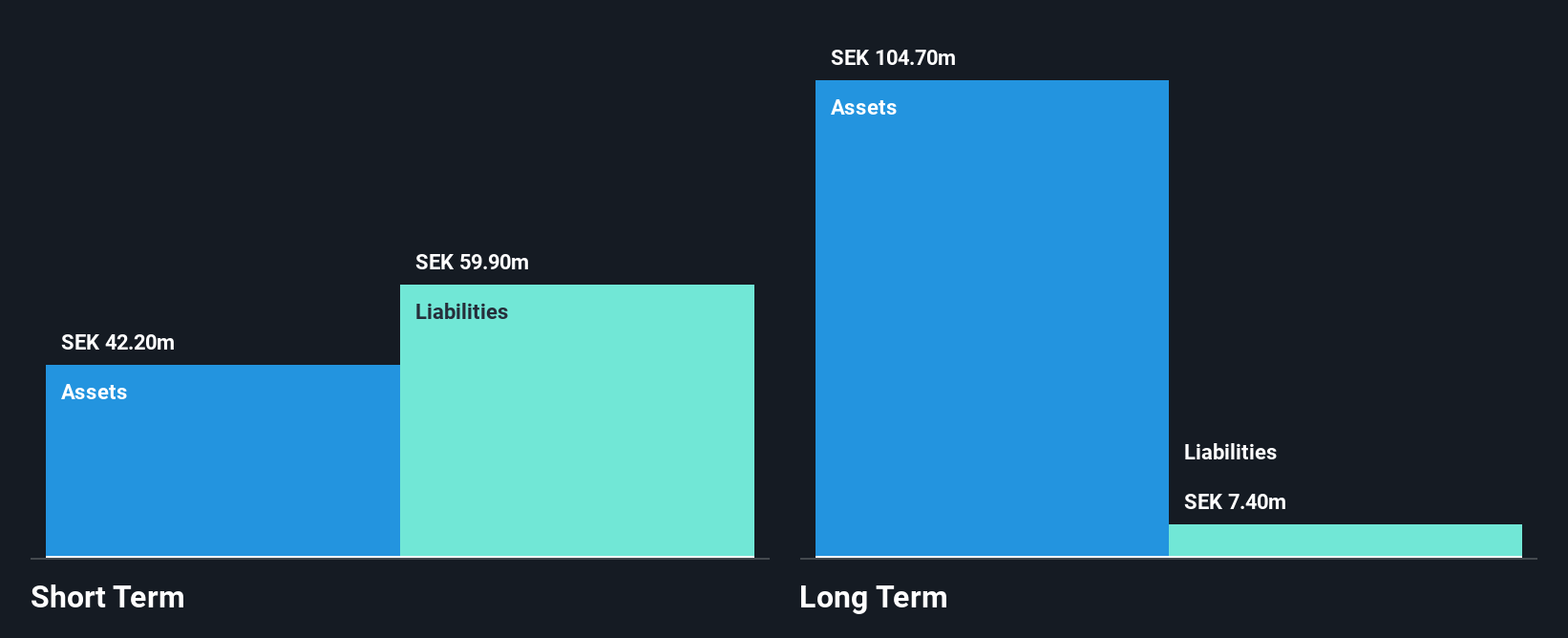

Medivir AB, with a market cap of SEK207.51 million, is navigating the challenges typical of pre-revenue biotech firms. The company reported minimal revenue of SEK0.8 million for Q1 2025 and continues to be unprofitable, with a net loss narrowing to SEK13.3 million from the previous year. Despite financial hurdles, Medivir has made significant strides in its oncology pipeline, securing a European patent for its fostroxacitabine bralpamide combination therapy until 2041 and presenting promising phase 1b/2a trial results for advanced liver cancer treatment at an international summit, indicating potential future growth opportunities in this niche market.

- Get an in-depth perspective on Medivir's performance by reading our balance sheet health report here.

- Examine Medivir's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Dive into all 449 of the European Penny Stocks we have identified here.

- Ready For A Different Approach? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATEME

ATEME

Engages in the production and sales of electronic and computer devices and instruments in Europe, the Middle East, Africa, the United States, Canada, Latin America, and the Asia Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives