European Penny Stocks Spotlight: Pearl Gold And Two More Hidden Opportunities

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and fluctuating inflation rates, investor attention is turning to smaller opportunities that may offer significant potential. Though the term 'penny stock' might sound like a relic of past trading days, it still points to relevant opportunities within the investment landscape. These stocks, often representing smaller or newer companies with solid financials, can uncover hidden value and offer promising prospects for those willing to explore beyond traditional investments.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.60 | SEK219.02M | ✅ 2 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.95 | €62.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.934 | €31.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.20 | €9.32M | ✅ 2 ⚠️ 5 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.59 | €17.16M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.16 | €298.22M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 449 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pearl Gold (DB:02P)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pearl Gold AG is a holding company that invests in gold mining projects in Africa, with a market cap of €13.25 million.

Operations: No revenue segments are reported for this company.

Market Cap: €13.25M

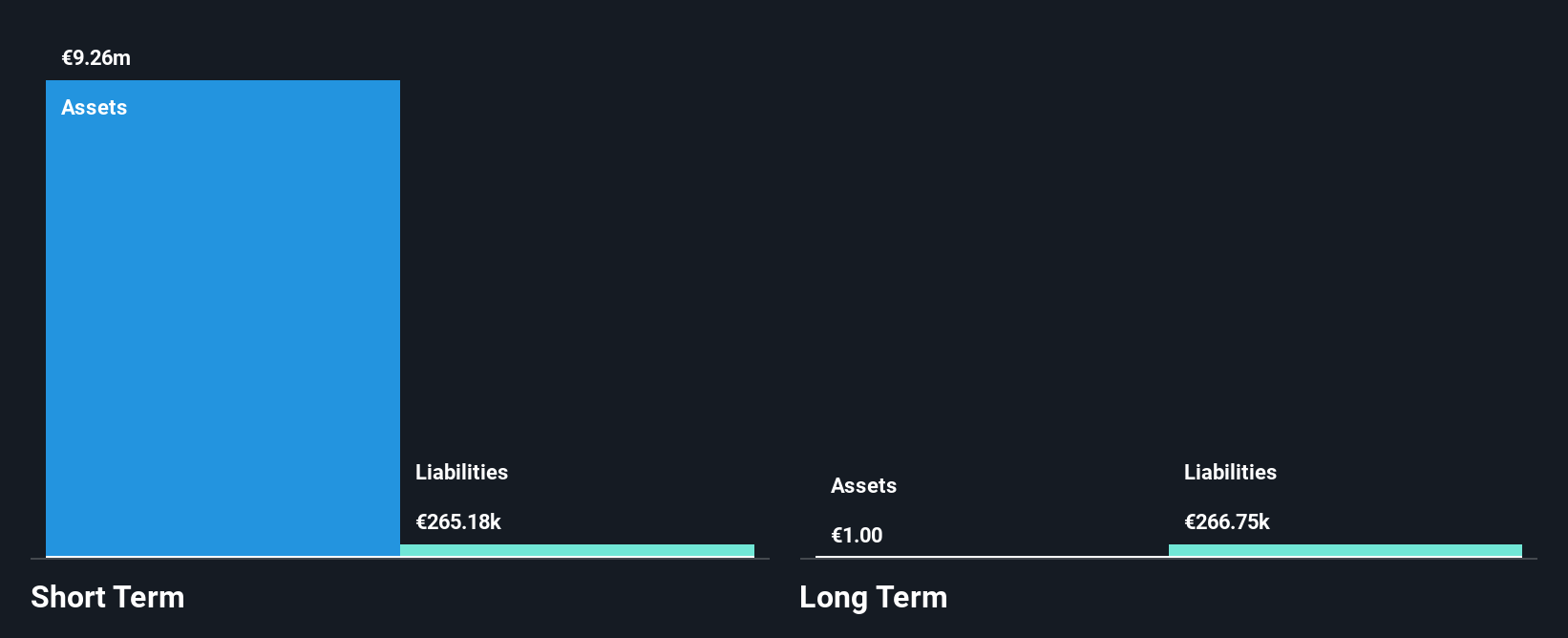

Pearl Gold AG, a pre-revenue company with a market cap of €13.25 million, focuses on gold mining investments in Africa. Despite having no debt and short-term assets of €9.3 million exceeding liabilities, it remains unprofitable with a significant net loss of €4.22 million for 2024, compared to the previous year's loss of €0.54 million. The company's shares have experienced high volatility over recent months and its negative return on equity stands at -48.35%. Although there has been no shareholder dilution recently, the earnings decline poses challenges for potential investors in this penny stock category.

- Dive into the specifics of Pearl Gold here with our thorough balance sheet health report.

- Understand Pearl Gold's track record by examining our performance history report.

Munic (ENXTPA:ALMUN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MUNIC S.A. is a company focused on vehicle data collection, processing, and monetization in Europe and North America, with a market cap of €5.57 million.

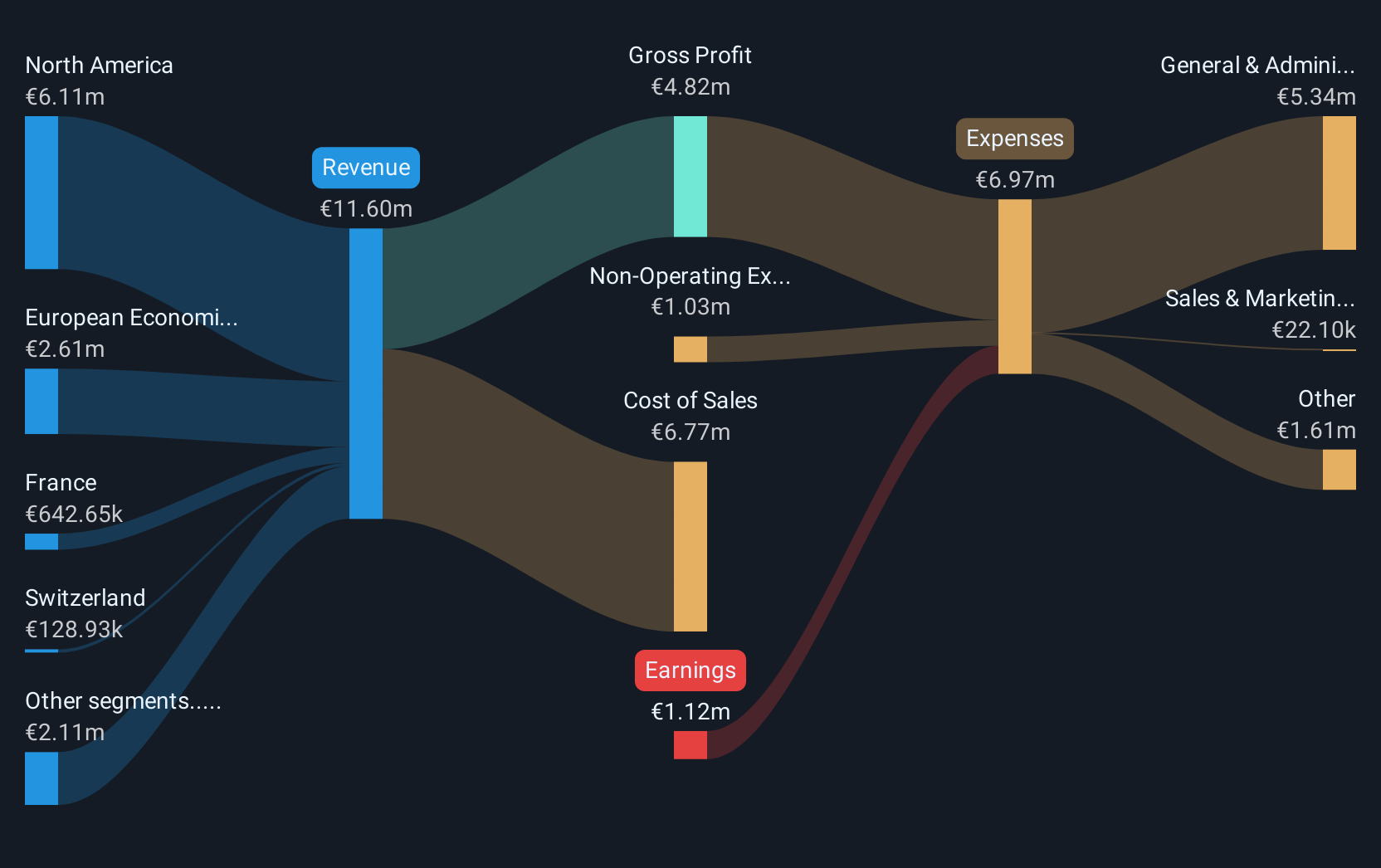

Operations: The company's revenue is derived entirely from its Auto Parts & Accessories segment, generating €11.60 million.

Market Cap: €5.57M

Munic S.A., with a market cap of €5.57 million, operates in vehicle data collection and monetization, generating €13.09 million in revenue for 2024 but remains unprofitable with a net loss of €1.12 million. Despite reducing its debt to equity ratio significantly over five years, the company continues to face high share price volatility and negative return on equity at -9.83%. However, Munic has managed to extend its cash runway beyond three years while maintaining positive free cash flow, offering some financial stability amidst the challenges typical of penny stocks in this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Munic.

- Gain insights into Munic's historical outcomes by reviewing our past performance report.

Atende (WSE:ATD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atende S.A. specializes in integrating IT systems and developing ICT infrastructures in Poland, with a market cap of PLN118.84 million.

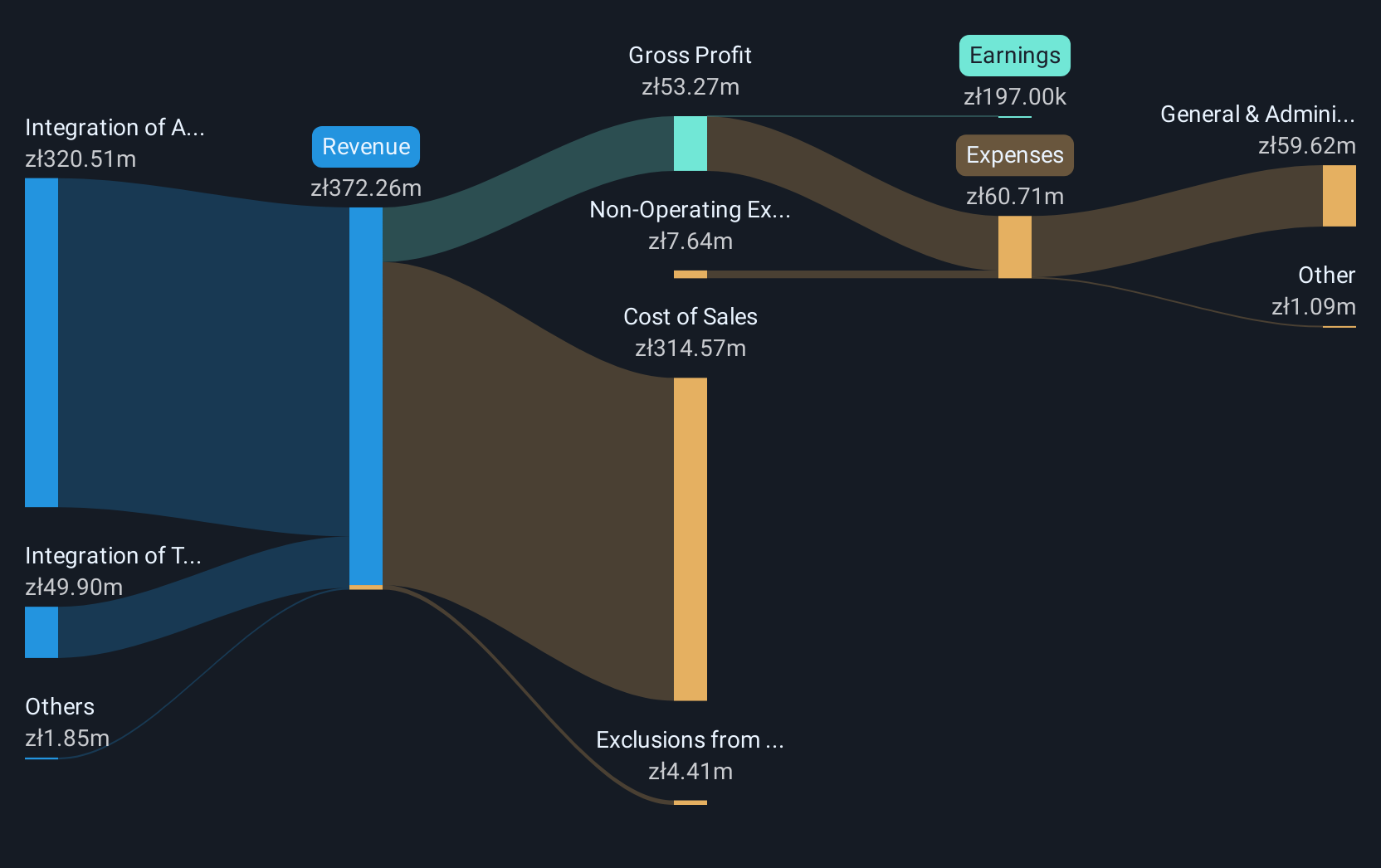

Operations: The company's revenue is primarily derived from the integration of ICT systems, including technical infrastructure, amounting to PLN320.51 million, and the integration of tele-information systems by subsidiary entities, contributing PLN49.90 million.

Market Cap: PLN118.84M

Atende S.A., with a market cap of PLN118.84 million, reported improved first-quarter results for 2025, achieving sales of PLN77.74 million and net income of PLN1.91 million compared to a loss the previous year. Despite this positive development, Atende has experienced declining earnings over the past five years and negative earnings growth last year, indicating challenges in profitability. The company's debt is well-managed with cash exceeding total debt and operating cash flow covering 70.8% of its debt obligations. However, return on equity remains low at -13.1%, reflecting ongoing financial hurdles typical for penny stocks in this sector.

- Click here to discover the nuances of Atende with our detailed analytical financial health report.

- Explore historical data to track Atende's performance over time in our past results report.

Taking Advantage

- Explore the 449 names from our European Penny Stocks screener here.

- Contemplating Other Strategies? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ATD

Adequate balance sheet with low risk.

Market Insights

Community Narratives