- Germany

- /

- Commercial Services

- /

- XTRA:FPH

European Penny Stock Spotlight: 3 Picks With Market Caps Under €200M

Reviewed by Simply Wall St

As the European market experiences a boost from strong corporate earnings and optimism surrounding geopolitical resolutions, investors are increasingly looking for opportunities in less conventional areas. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing potential despite their somewhat outdated label. When these companies possess solid financial foundations and demonstrate growth potential, they can provide unique investment opportunities worth exploring.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.06 | €23.09M | ✅ 2 ⚠️ 4 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.39 | €45.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €298.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.10 | €65.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.285 | SEK3.14B | ✅ 4 ⚠️ 1 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.205 | €304.43M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.956 | €32.24M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 341 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Munic (ENXTPA:ALMUN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Munic S.A. is a company that specializes in the collection, processing, and monetization of vehicle data across Europe and North America with a market cap of €8.89 million.

Operations: The company's revenue is derived entirely from its Auto Parts & Accessories segment, amounting to €11.60 million.

Market Cap: €8.89M

Munic S.A., with a market cap of €8.89 million, operates in the vehicle data sector and generates €11.60 million from its Auto Parts & Accessories segment. Despite being unprofitable, the company has reduced losses by 20.4% annually over five years and maintains a satisfactory net debt to equity ratio of 27%. Its short-term assets exceed both short- and long-term liabilities, providing financial stability. The cash runway extends beyond three years even if free cash flow slightly declines, though profitability is not expected soon. The board's experience averages 5.9 years, but share price volatility remains high compared to peers.

- Click here to discover the nuances of Munic with our detailed analytical financial health report.

- Explore historical data to track Munic's performance over time in our past results report.

Francotyp-Postalia Holding (XTRA:FPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Francotyp-Postalia Holding AG offers business mail and digital solutions to companies and authorities both in Germany and internationally, with a market cap of €49.37 million.

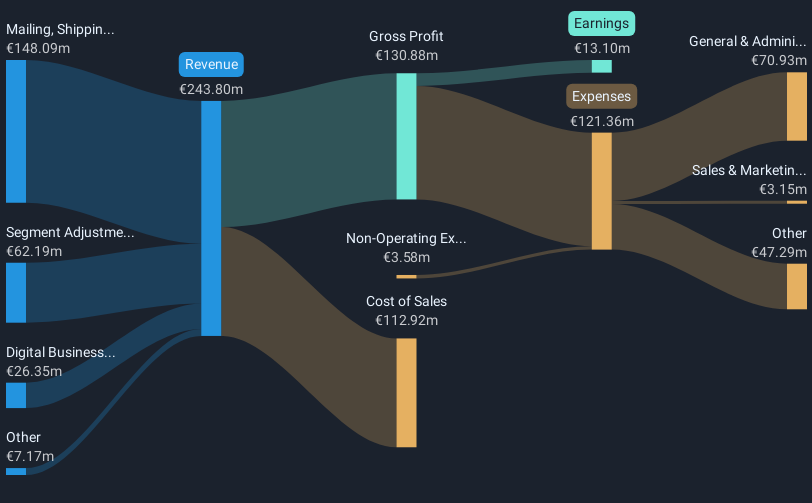

Operations: The company generates revenue from two main segments: Digital Business Solutions, contributing €27.9 million, and Mailing, Shipping & Office Solutions, which accounts for €144.12 million.

Market Cap: €49.37M

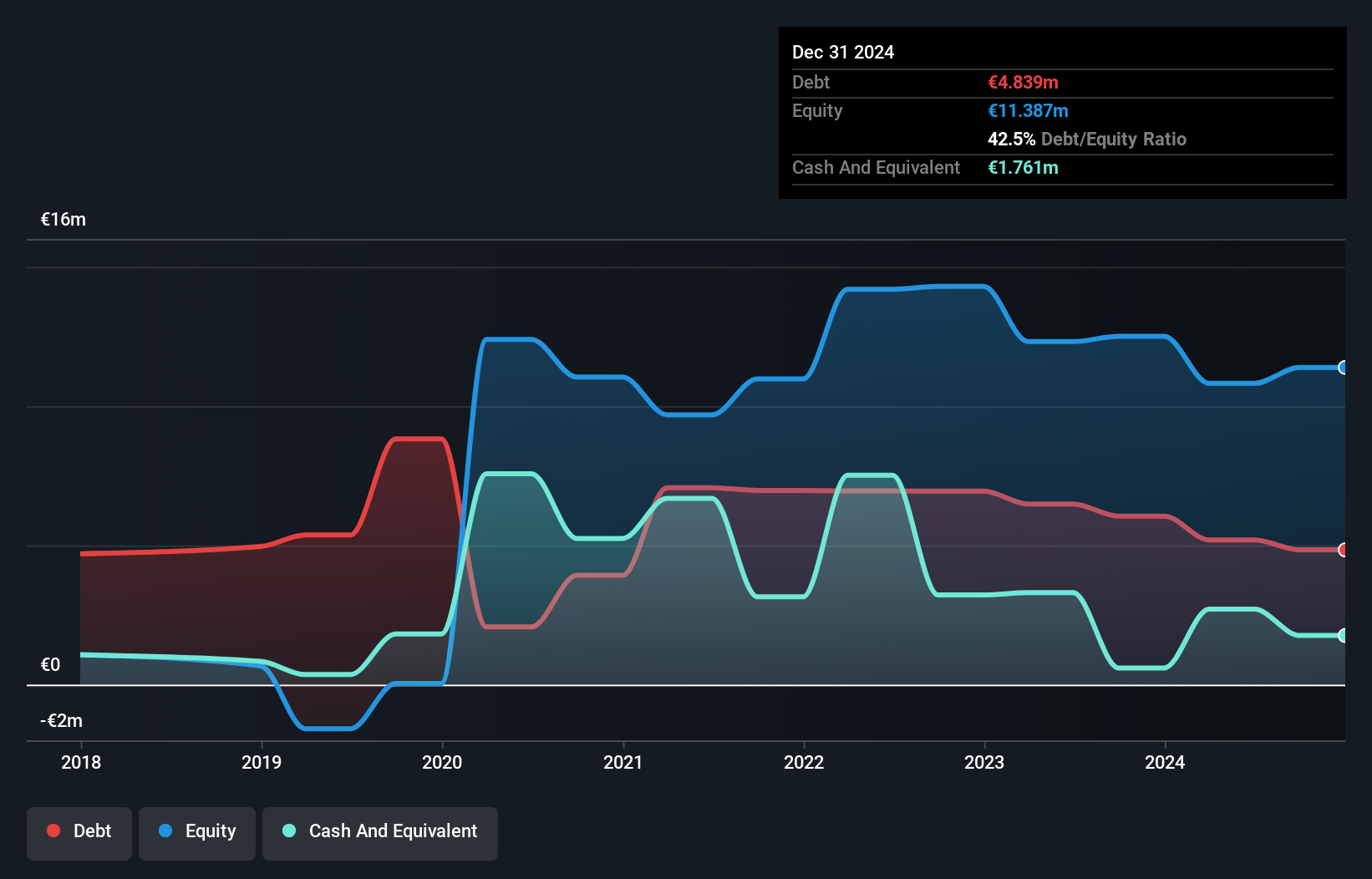

Francotyp-Postalia Holding AG, with a market cap of €49.37 million, shows resilience in the penny stock arena through stable financial management and modest growth. The company reported first-quarter sales of €46.46 million, up from €45.44 million year-on-year, with net income rising to €3.34 million from €2.62 million previously. Its debt reduction over five years has improved financial health significantly, while high-quality earnings and a robust return on equity of 21.5% add to its appeal despite recent board changes indicating potential strategic shifts ahead. However, earnings growth has slowed compared to its impressive five-year average increase rate.

- Get an in-depth perspective on Francotyp-Postalia Holding's performance by reading our balance sheet health report here.

- Understand Francotyp-Postalia Holding's track record by examining our performance history report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: q.beyond AG operates in the cloud, applications, artificial intelligence (AI), and security sectors both in Germany and internationally, with a market cap of €114.11 million.

Operations: The company does not report specific revenue segments.

Market Cap: €114.11M

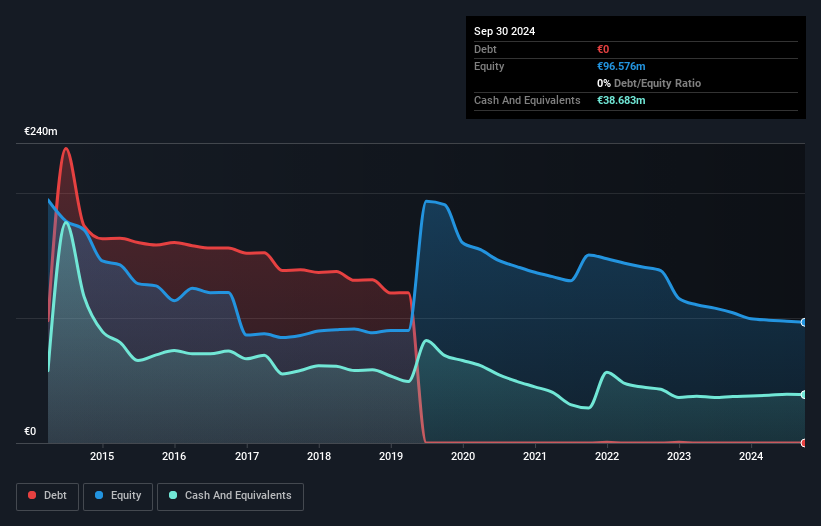

q.beyond AG, with a market cap of €114.11 million, is navigating the penny stock landscape by focusing on cloud and cybersecurity services. Despite being unprofitable, the company has shown progress by reducing its net loss from €1.01 million to €0.193 million in the recent quarter compared to last year. Its strategic expansion with a second Cyber Defence Center in Latvia highlights its commitment to enhancing IT security offerings amid rising demand for sovereign IT services. Debt-free and trading below estimated fair value, q.beyond's short-term assets significantly exceed liabilities, providing financial stability amidst ongoing revenue challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of q.beyond.

- Explore q.beyond's analyst forecasts in our growth report.

Next Steps

- Unlock our comprehensive list of 341 European Penny Stocks by clicking here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FPH

Francotyp-Postalia Holding

Develops, produces, and sells office products and solutions in Germany, the United States, the United Kingdom, Sweden, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives