- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALAUR

Subdued Growth No Barrier To AURES Technologies S.A. (EPA:ALAUR) With Shares Advancing 37%

Those holding AURES Technologies S.A. (EPA:ALAUR) shares would be relieved that the share price has rebounded 37% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 72% share price decline over the last year.

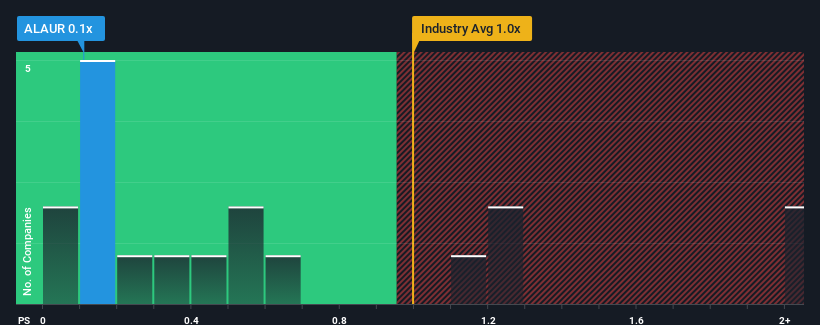

Even after such a large jump in price, it's still not a stretch to say that AURES Technologies' price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Electronic industry in France, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for AURES Technologies

How AURES Technologies Has Been Performing

AURES Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AURES Technologies.How Is AURES Technologies' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AURES Technologies' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.9%. The last three years don't look nice either as the company has shrunk revenue by 8.6% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 5.6% during the coming year according to the only analyst following the company. That's not great when the rest of the industry is expected to grow by 22%.

With this information, we find it concerning that AURES Technologies is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Its shares have lifted substantially and now AURES Technologies' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that AURES Technologies currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AURES Technologies (1 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on AURES Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALAUR

AURES Technologies

Engages in manufacture of hardware and digital application solutions for point of sale and retail industry.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026