The European market has recently faced challenges, with the pan-European STOXX Europe 600 Index dropping by 1.57% amid renewed uncertainty surrounding U.S. trade policy and escalating geopolitical tensions in the Middle East, while major stock indexes like Germany's DAX and Italy's FTSE MIB also experienced declines. In such a volatile environment, identifying high-growth tech stocks with promising potential involves looking for companies that demonstrate resilience through innovation and have a strong position to capitalize on technological advancements despite broader economic uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| argenx | 21.84% | 26.93% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Promotora de Informaciones (BME:PRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Promotora de Informaciones, S.A., with a market cap of €524.89 million, operates in the media industry through its subsidiaries both in Spain and internationally.

Operations: The company generates revenue primarily through its media operations, focusing on both domestic and international markets.

Promotora de Informaciones (PRS) is navigating a challenging landscape with its recent financials showing a dip in sales to €232 million from €256 million year-over-year and a shift from a net income of €19 million to a net loss of €4 million. Despite these setbacks, the company's forward-looking indicators suggest potential for recovery and growth. PRS's revenue is expected to grow at 6.6% annually, outpacing the Spanish market's 4.6%. More promisingly, earnings are projected to surge by approximately 79.63% annually over the next three years, signaling an above-average market growth trajectory. This forecast aligns with PRS’s strategic initiatives including recent equity offerings aimed at bolstering its financial position and sustaining future expansions. While current profitability challenges persist, these strategic moves could set the stage for improved performance in the evolving media landscape.

CS Communication & Systemes (ENXTPA:SX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CS Communication & Systemes SA specializes in designing, integrating, and operating mission-critical systems globally, with a market cap of €281.82 million.

Operations: The company focuses on providing comprehensive solutions for mission-critical systems across various industries worldwide. With a market cap of €281.82 million, it leverages its expertise in system design and integration to support complex operational requirements globally.

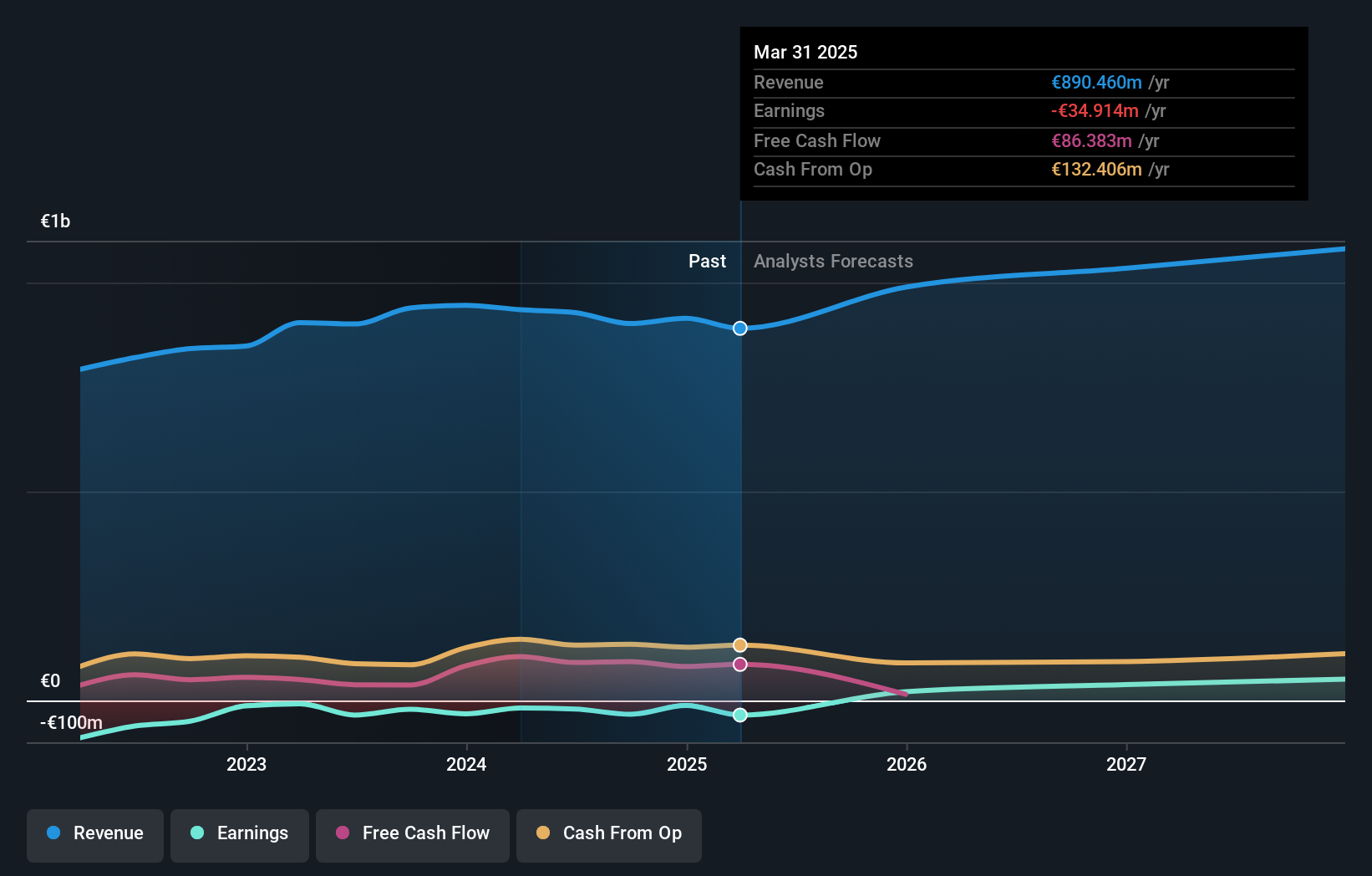

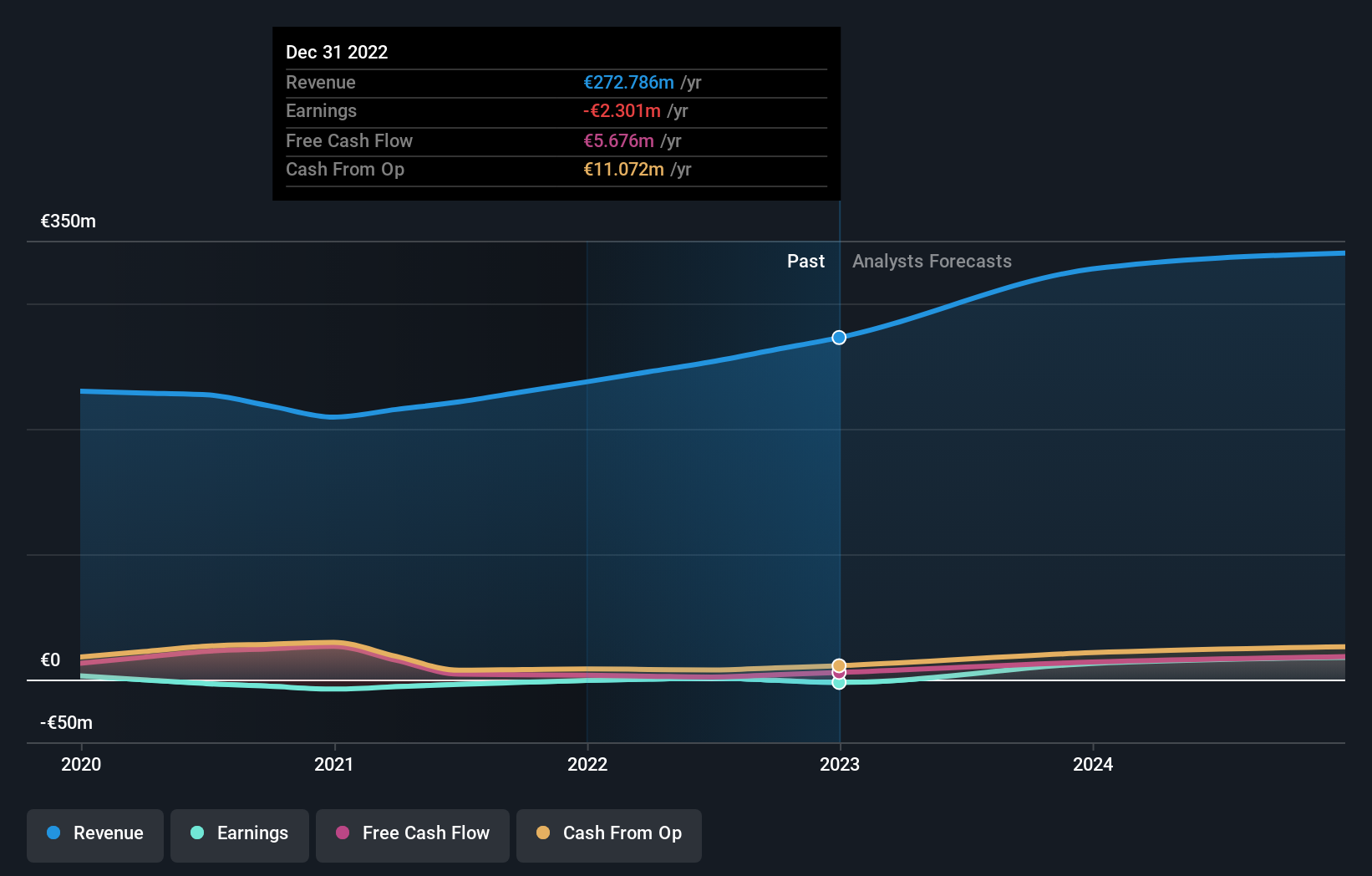

CS Communication & Systemes is making strides in the European tech scene, characterized by a robust annual revenue growth of 10.4% and an impressive projected earnings increase of 88.2% per year. This growth trajectory is supported by significant investments in R&D, which amount to €5 million annually, aligning with its strategic focus on developing cutting-edge technologies. The company's pivot towards high-demand sectors like cybersecurity and cloud services positions it well amidst evolving market demands, despite not being the top performer in high-growth tech across Europe. Additionally, CS's commitment to innovation is evident as they channel substantial resources into research, ensuring their offerings remain competitive and responsive to client needs such as those from major government contracts. With these dynamics at play, CS Communication & Systemes appears poised for future advancements within the tech industry.

- Click to explore a detailed breakdown of our findings in CS Communication & Systemes' health report.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market capitalization of €253.86 million.

Operations: The company generates revenue primarily from its Software & Programming segment, totaling €36.24 million. It focuses on delivering cloud-based software and automation solutions in Finland.

Admicom Oyj, amid a challenging backdrop with a recent earnings dip, still shows promising signs with expected annual revenue growth of 9.8% and earnings growth of 21.5%. Despite a one-off loss of €3.7M affecting its last financial year, the company is steering towards robust future profitability with an anticipated return on equity of 26.8% in three years. The firm's commitment to innovation is reflected in its R&D spending trends, crucial for sustaining its competitive edge in the software industry where rapid technological advancements are commonplace. This strategic focus on research and development not only fuels Admicom's product enhancements but also aligns well with industry shifts towards more integrated software solutions, positioning it favorably for future growth despite current market volatilities.

- Dive into the specifics of Admicom Oyj here with our thorough health report.

Gain insights into Admicom Oyj's historical performance by reviewing our past performance report.

Taking Advantage

- Investigate our full lineup of 225 European High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SX

CS Communication & Systemes

CS Communication & Systemes SA designs, integrates, and operates mission critical systems worldwide.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives