- Netherlands

- /

- Biotech

- /

- ENXTAM:PHARM

High Growth Tech And These 3 Dynamic Stocks with Promising Expansion

Reviewed by Simply Wall St

Recent global market developments have been marked by tariff uncertainties and mixed economic signals, with U.S. stocks experiencing a decline amid trade tensions and cooling job growth, while European markets showed resilience against similar concerns. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate strong earnings potential and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pharming Group N.V. is a biopharmaceutical company focused on developing and commercializing protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and internationally, with a market cap of approximately €568.06 million.

Operations: The company generates revenue primarily from its Recombinant Human C1 Esterase Inhibitor business, which reported $285.75 million. Its focus is on developing and commercializing therapies for rare diseases, targeting markets in the United States, Europe, and internationally.

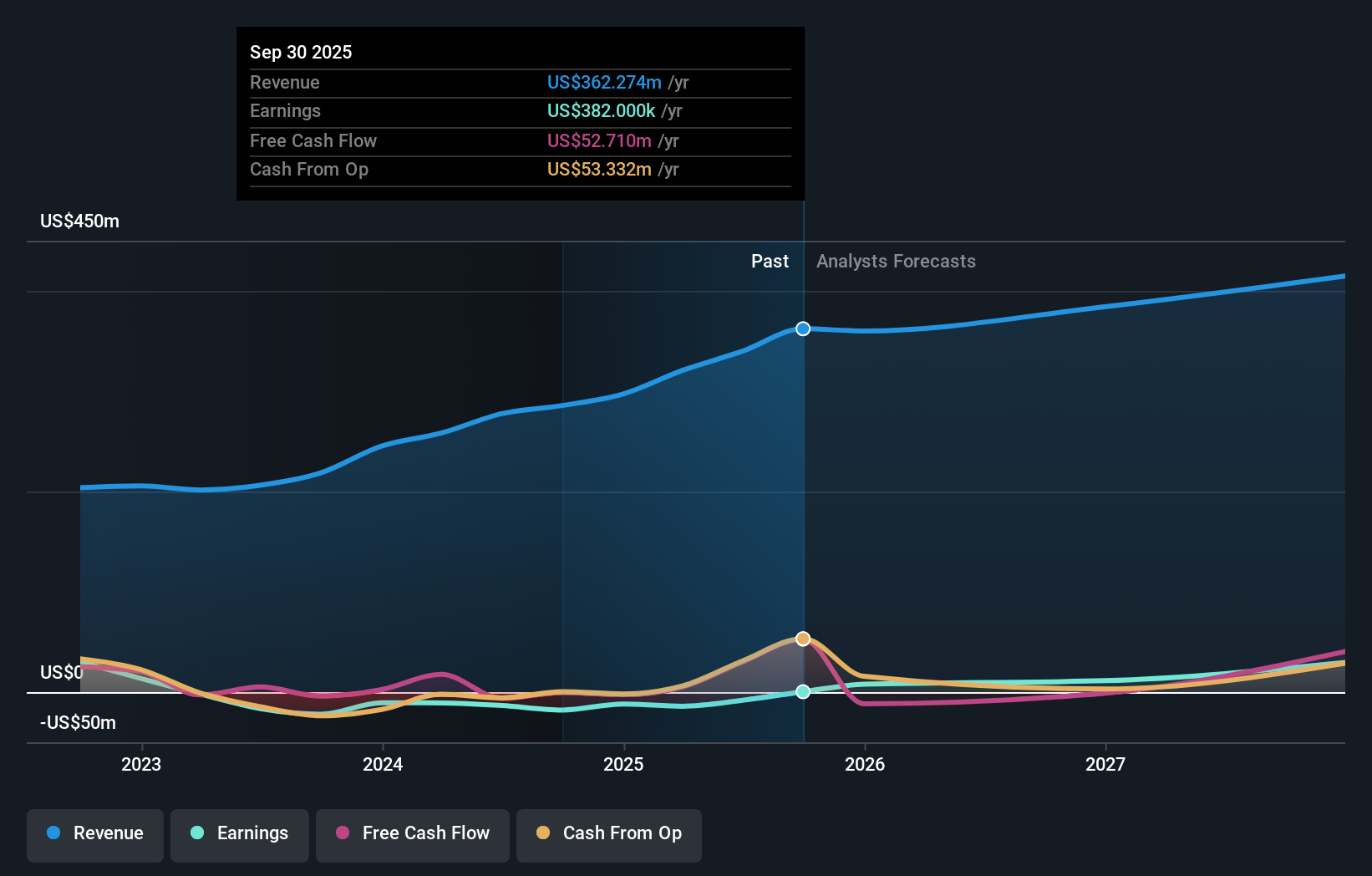

Pharming Group's strategic focus on rare diseases is underscored by its recent advancements in drug development, notably with leniolisib for APDS, a condition first characterized only a decade ago. The company's commitment to innovation is evident from its significant R&D investments, aligning with industry trends towards targeted therapies. Despite current unprofitability and market volatility, Pharming's projected annual earnings growth of 57.21% and revenue growth at 7.9% suggest potential for future profitability, supported by positive Phase III trial outcomes and planned regulatory filings starting in 2025 for pediatric use approvals worldwide. This trajectory is further reinforced by their recent acquisition move to expand their portfolio, indicating an aggressive growth strategy amidst challenging market conditions.

- Delve into the full analysis health report here for a deeper understanding of Pharming Group.

Explore historical data to track Pharming Group's performance over time in our Past section.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. is a company that offers IT and software solutions globally, with a market capitalization of €330.42 million.

Operations: The company generates revenue through its IT and software services across three main regions: Belux (€104.26 million), Switzerland (€105.75 million), and the United Kingdom (€88.88 million).

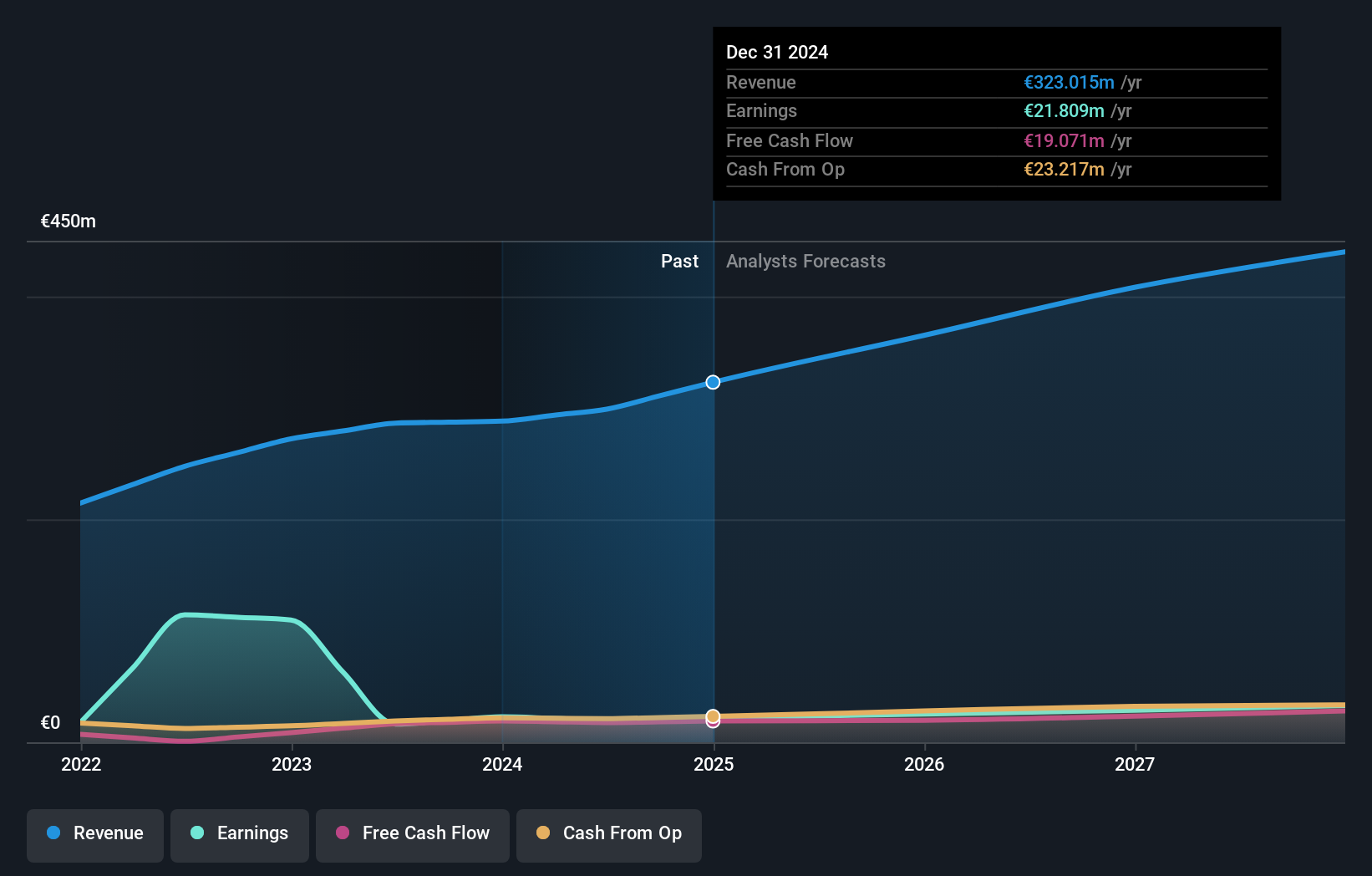

Sword Group, advancing in the competitive tech landscape, has shown a robust annual revenue growth of 13.5% and an impressive earnings increase of 17.3% per year, outpacing the French market averages of 5.9% and 12.5%, respectively. Their strategic emphasis on R&D is evident with significant investments amounting to €120 million last year, representing about 15% of their total revenue, which underscores their commitment to innovation and positions them well for future technological advancements. This focus on development is crucial as they continue expanding their software solutions across various industries, potentially enhancing long-term growth prospects in a rapidly evolving digital environment.

- Navigate through the intricacies of Sword Group with our comprehensive health report here.

Assess Sword Group's past performance with our detailed historical performance reports.

CS Communication & Systemes (ENXTPA:SX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CS Communication & Systemes SA specializes in designing, integrating, and operating mission-critical systems globally, with a market cap of €281.82 million.

Operations: The company focuses on designing, integrating, and operating mission-critical systems worldwide. It operates with a market capitalization of €281.82 million.

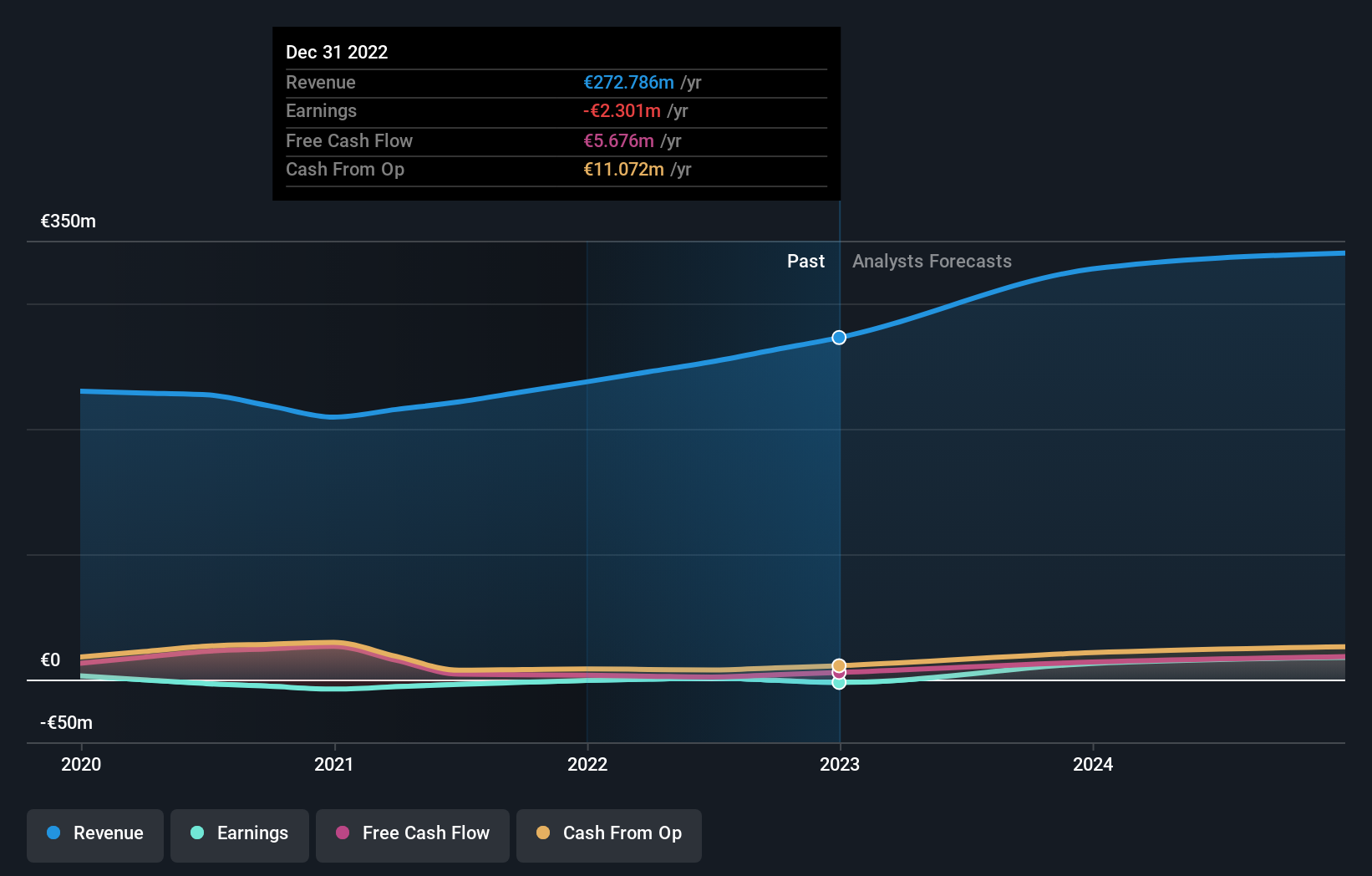

CS Communication & Systemes is navigating the tech sector with a notable focus on innovation, as evidenced by their R&D spending which aligns closely with industry demands for continuous advancement. Despite being currently unprofitable, the company's revenue is expected to grow at 10.4% annually, outpacing the French market's 5% growth rate. This growth is supported by a forecasted significant earnings increase of 88.23% per year over the next three years, highlighting potential for profitability and competitive positioning in an evolving digital landscape. Their strategic investments in technology development are crucial as they aim to capitalize on emerging opportunities within high-tech sectors, ensuring relevance and potential market share expansion amidst fierce competition.

Taking Advantage

- Click here to access our complete index of 1212 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHARM

Pharming Group

A biopharmaceutical company, develops and commercializes protein replacement therapies and precision medicines for the treatment of rare diseases in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives