- Spain

- /

- Communications

- /

- BME:AMP

Exploring 3 European High Growth Tech Stocks

Reviewed by Simply Wall St

As the European market experiences a positive shift with the STOXX Europe 600 Index rising by 0.90% amid easing inflation and favorable monetary policy adjustments by the European Central Bank, investors are increasingly focusing on high growth tech stocks that can capitalize on these conditions. In this environment, identifying promising tech stocks involves looking for companies that demonstrate strong innovation potential and can effectively navigate economic changes to sustain growth.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| argenx | 21.82% | 26.90% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

We'll examine a selection from our screener results.

Amper (BME:AMP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Amper, S.A. is a company that offers technological, industrial, and engineering solutions across defense, security, energy, sustainability, and telecommunications sectors both in Spain and internationally with a market capitalization of €233.18 million.

Operations: Amper, S.A. generates revenue primarily from its Energy and Sustainability segment (€339.33 million) and Defense, Security, and Telecommunications segment (€84.44 million).

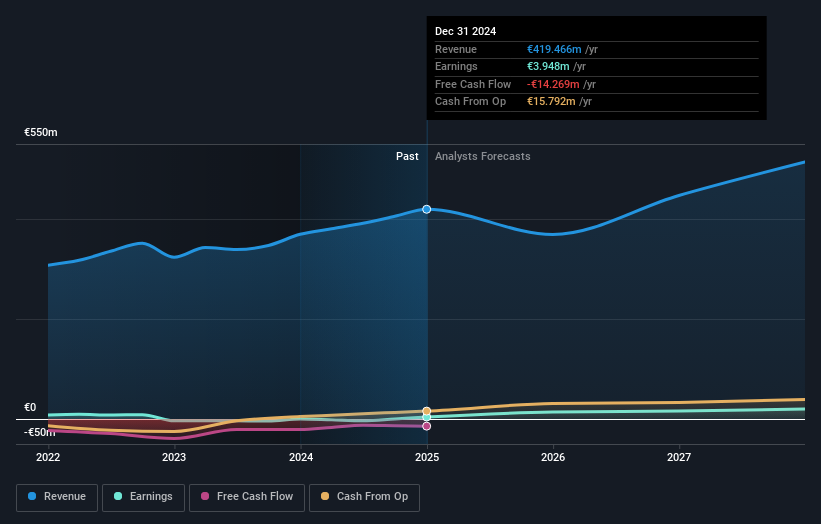

Amper's trajectory in the tech sector is marked by its robust revenue growth, forecasted at 9.2% annually, outpacing the broader Spanish market's 4.5%. This performance is complemented by an impressive expected annual earnings increase of 35.6%, significantly higher than the market average of 5.3%. Despite a challenging past punctuated by a one-off loss of €20.3 million, Amper has demonstrated remarkable resilience with earnings surging by an extraordinary 1893.9% over the last year, dwarfing the Communications industry's decline of -1.3%. These figures underscore Amper’s potential in harnessing high-growth opportunities despite existing financial volatilities and a highly fluctuating share price recently observed.

- Unlock comprehensive insights into our analysis of Amper stock in this health report.

Examine Amper's past performance report to understand how it has performed in the past.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. offers IT and software solutions on a global scale, with a market capitalization of €336.38 million.

Operations: Sword Group S.E. generates revenue through its IT and software services across regions, with significant contributions from Switzerland (€116.37 million), Belux (€109.25 million), and the United Kingdom (€97.39 million).

Sword Group's recent announcement of securing six new strategic contracts, valued potentially up to EUR 200 million, underscores its adeptness in fostering long-term client relationships and enhancing its market presence in critical sectors like cybersecurity and AI. This move aligns with a solid revenue uptick reported at EUR 323.02 million for the full year, marking a growth from the previous year’s EUR 288.13 million. Despite a slight dip in net income from EUR 22.82 million to EUR 21.81 million, the company's ability to secure substantial contracts suggests a robust strategy aimed at sustained growth and technological leadership within Europe’s tech landscape.

- Take a closer look at Sword Group's potential here in our health report.

Assess Sword Group's past performance with our detailed historical performance reports.

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qt Group Oyj provides cross-platform solutions for the software development lifecycle across Finland, Europe, the Asia Pacific, and North America, with a market cap of €1.46 billion.

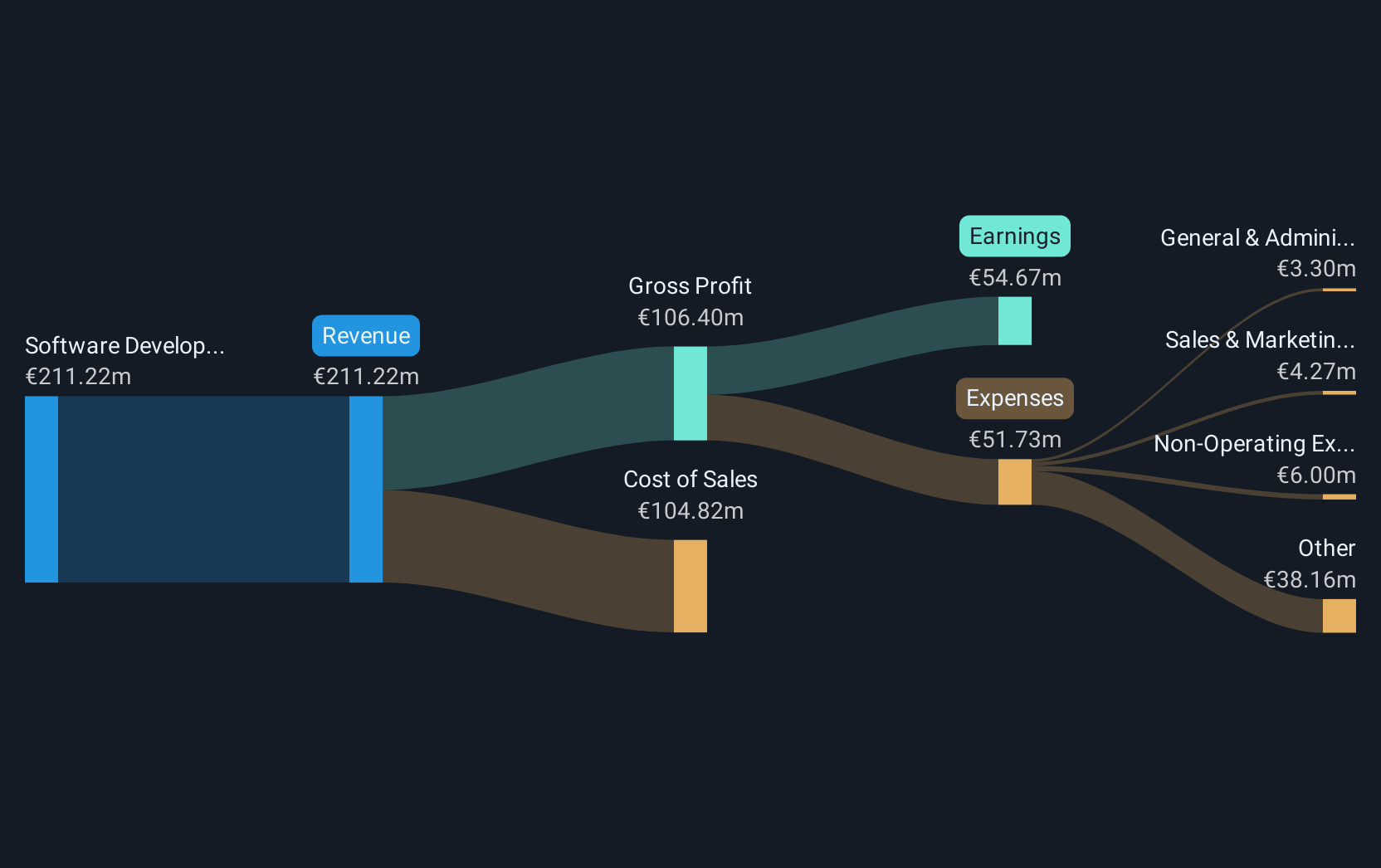

Operations: Qt Group Oyj generates revenue primarily through its Software Development Tools, which contributed €211.22 million. The company focuses on providing cross-platform solutions for the software development lifecycle across various regions including Finland, Europe, the Asia Pacific, and North America.

Qt Group Oyj is distinguishing itself in the high-growth tech sector in Europe with a strategic focus on expanding its platform across various programming languages and industries. Recently, at NVIDIA GTC Paris, Qt showcased its roadmap to become a technology-agnostic platform, promising to enhance software development across all devices. This initiative is complemented by an impressive 41.3% earnings growth over the past year and forecasts indicating an annual profit increase of 17.2%. Moreover, the company's commitment to R&D is evident from its latest innovations like the Figma to Qt plug-in and investments in AI tools aimed at boosting developer productivity. These efforts are set against a backdrop of expected revenue growth of 12.8% per year, outpacing the Finnish market's 3.6%, positioning Qt as a pivotal player in Europe’s evolving tech landscape.

- Get an in-depth perspective on Qt Group Oyj's performance by reading our health report here.

Understand Qt Group Oyj's track record by examining our Past report.

Turning Ideas Into Actions

- Discover the full array of 225 European High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AMP

Amper

Provides technological, industrial, and engineering solutions for the defense, security, energy, sustainability, and telecommunications markets in Spain and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives