As global markets navigate the uncertainties surrounding the incoming Trump administration and its potential impact on economic policies, key indices like the S&P 500 and Nasdaq Composite have experienced notable fluctuations, reflecting broader market sentiment. In this environment of shifting dynamics, identifying high-growth tech stocks requires a keen understanding of factors such as innovation potential, adaptability to regulatory changes, and resilience in volatile conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.66% | 31.69% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1303 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Planisware SAS (ENXTPA:PLNW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Planisware SAS is a business-to-business software-as-a-service provider with operations across Europe, the Americas, the Asia-Pacific, and internationally, and has a market capitalization of €1.59 billion.

Operations: Planisware SAS generates revenue primarily from its Software & Programming segment, which contributes €170.48 million. The company operates as a business-to-business software-as-a-service provider across multiple regions.

Planisware SAS, amidst a competitive tech landscape, is demonstrating robust growth with its revenue projected to increase by 14.4% annually, outpacing the French market's 5.6% growth rate. This performance is underpinned by significant R&D investments which reflect in their latest earnings results where sales surged to €86.63 million from €72.2 million year-over-year. Despite a slight dip in net income from €18.66 million to €15.98 million, the company's commitment to innovation and expansion in software solutions remains clear. With an anticipated profit growth of 17.6% per year, Planisware continues to exceed average market expectations and solidifies its position through strategic reinvestments back into core technologies and client services.

- Get an in-depth perspective on Planisware SAS' performance by reading our health report here.

Explore historical data to track Planisware SAS' performance over time in our Past section.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company offering software solutions for property developers in China, with a market capitalization of approximately HK$4.90 billion.

Operations: Ming Yuan Cloud Group Holdings generates revenue primarily from two segments: Cloud Services, contributing CN¥1.32 billion, and On-premise Software and Services, adding CN¥281.71 million. The company focuses on providing software solutions tailored for property developers in China.

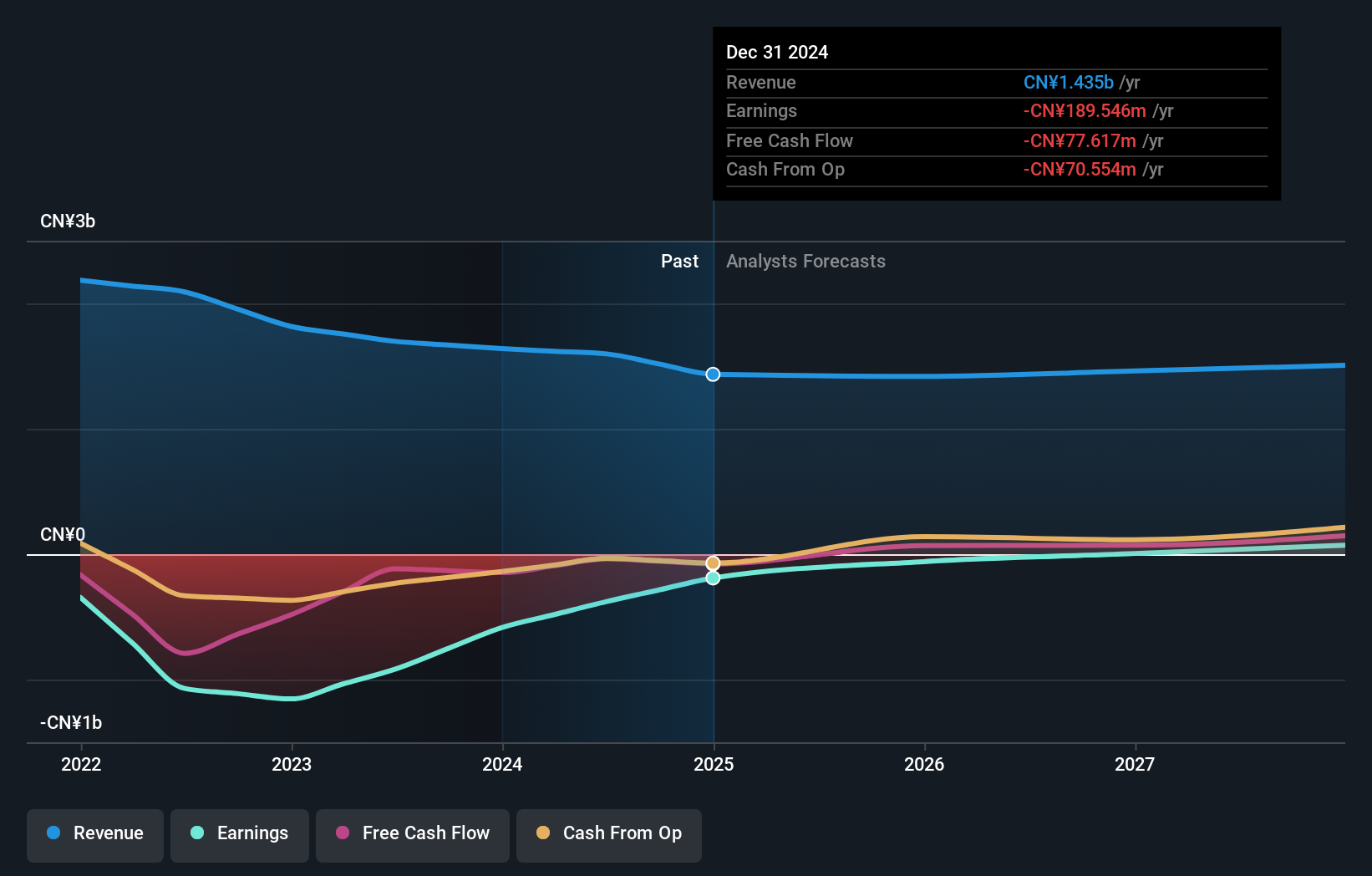

Ming Yuan Cloud Group Holdings, navigating through a dynamic tech landscape, is poised for significant growth with its revenue expected to increase by 10.1% annually, outpacing the Hong Kong market's average of 7.8%. This growth trajectory is supported by an aggressive R&D strategy which has seen expenses soar to enhance technological capabilities and product offerings. Notably, earnings are projected to surge by an impressive 74.4% per year, reflecting the company's commitment to leveraging its software solutions in cloud services—a sector witnessing rapid expansion globally. Despite recent executive changes and operational shifts like relocating their principal business address, Ming Yuan’s focus on innovation and market adaptation remains steadfast, setting a robust foundation for future scalability in high-demand tech arenas.

Sygnity (WSE:SGN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sygnity S.A. specializes in the manufacturing and sale of IT products and services both within Poland and internationally, with a market capitalization of PLN1.64 billion.

Operations: The company generates revenue through the manufacturing and sale of IT products and services across Poland and international markets.

Sygnity S.A. has demonstrated a robust growth trajectory, with its recent earnings report showcasing a significant increase in revenue to PLN 71.35 million for Q3 2024, up from PLN 51.95 million in the same period last year. This aligns with an annual revenue growth forecast of 15.2%, surpassing the Polish market average of 4%. The firm's commitment to innovation is evident from its R&D strategy, which is crucial as it competes in the high-stakes IT sector; however, specific figures on R&D expenses were not disclosed in the latest reports. Moreover, Sygnity's earnings are expected to grow by an impressive 23% annually, outpacing the broader market's projection of 16.1%, indicating potential resilience and adaptability despite market fluctuations.

Taking Advantage

- Gain an insight into the universe of 1303 High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:909

Ming Yuan Cloud Group Holdings

An investment holding company, provides cloud services and on-premises software and services in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion