Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Neurones (EPA:NRO). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Neurones

Neurones's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Neurones has grown EPS by 11% per year. That's a good rate of growth, if it can be sustained.

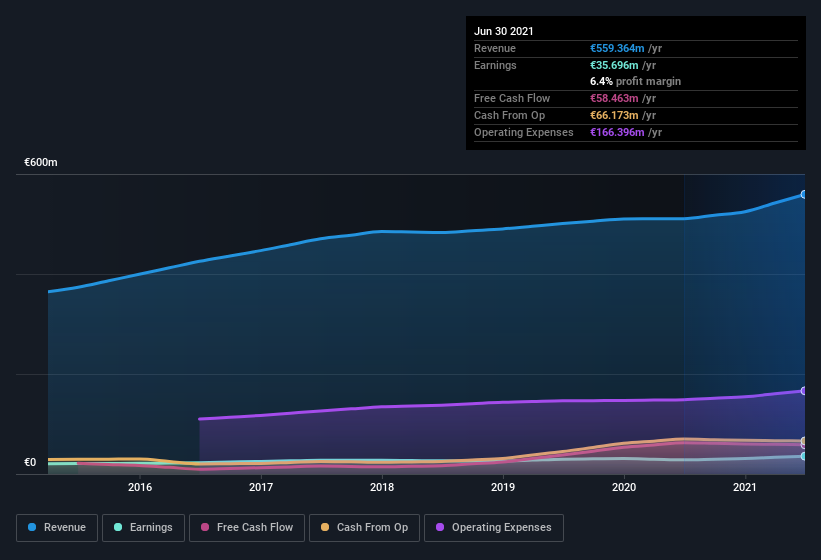

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Neurones maintained stable EBIT margins over the last year, all while growing revenue 9.5% to €559m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Neurones's forecast profits?

Are Neurones Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Neurones insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 66%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling €541m. That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations between €355m and €1.4b, like Neurones, the median CEO pay is around €464k.

The Neurones CEO received total compensation of just €220k in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Neurones Deserve A Spot On Your Watchlist?

One positive for Neurones is that it is growing EPS. That's nice to see. Earnings growth might be the main game for Neurones, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Of course, just because Neurones is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although Neurones certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Neurones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NRO

Neurones

Provides infrastructure, application, and consulting services in France.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success