Unveiling Exclusive Networks And Two More Euronext Paris Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of political shifts and economic recalibrations, the French market has shown resilience with the CAC 40 Index climbing significantly. In such a climate, growth companies with high insider ownership on Euronext Paris stand out as potentially compelling avenues for investors seeking alignment with management's interests in robust market conditions.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.2% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 70.4% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market capitalization of approximately €2.09 billion.

Operations: Exclusive Networks' revenue is primarily generated from three geographical segments: €420 million from APAC, €4.04 billion from EMEA, and €689 million from the Americas.

Insider Ownership: 13.2%

Earnings Growth Forecast: 28.4% p.a.

Exclusive Networks, a French company with high insider ownership, shows promising growth prospects despite recent revenue declines (€393 million in Q1 2024 from €399 million year ago). The firm anticipates sales growth between 10% and 12% for FY2024. Recent events include a proposed acquisition by Permira Advisers and Clayton, Dubilier & Rice for €2.2 billion and auditor change to KPMG. With earnings expected to grow at 28.44% annually, faster than the market, its financial outlook remains robust albeit with a forecasted low return on equity of 14.3%.

- Click to explore a detailed breakdown of our findings in Exclusive Networks' earnings growth report.

- Upon reviewing our latest valuation report, Exclusive Networks' share price might be too optimistic.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

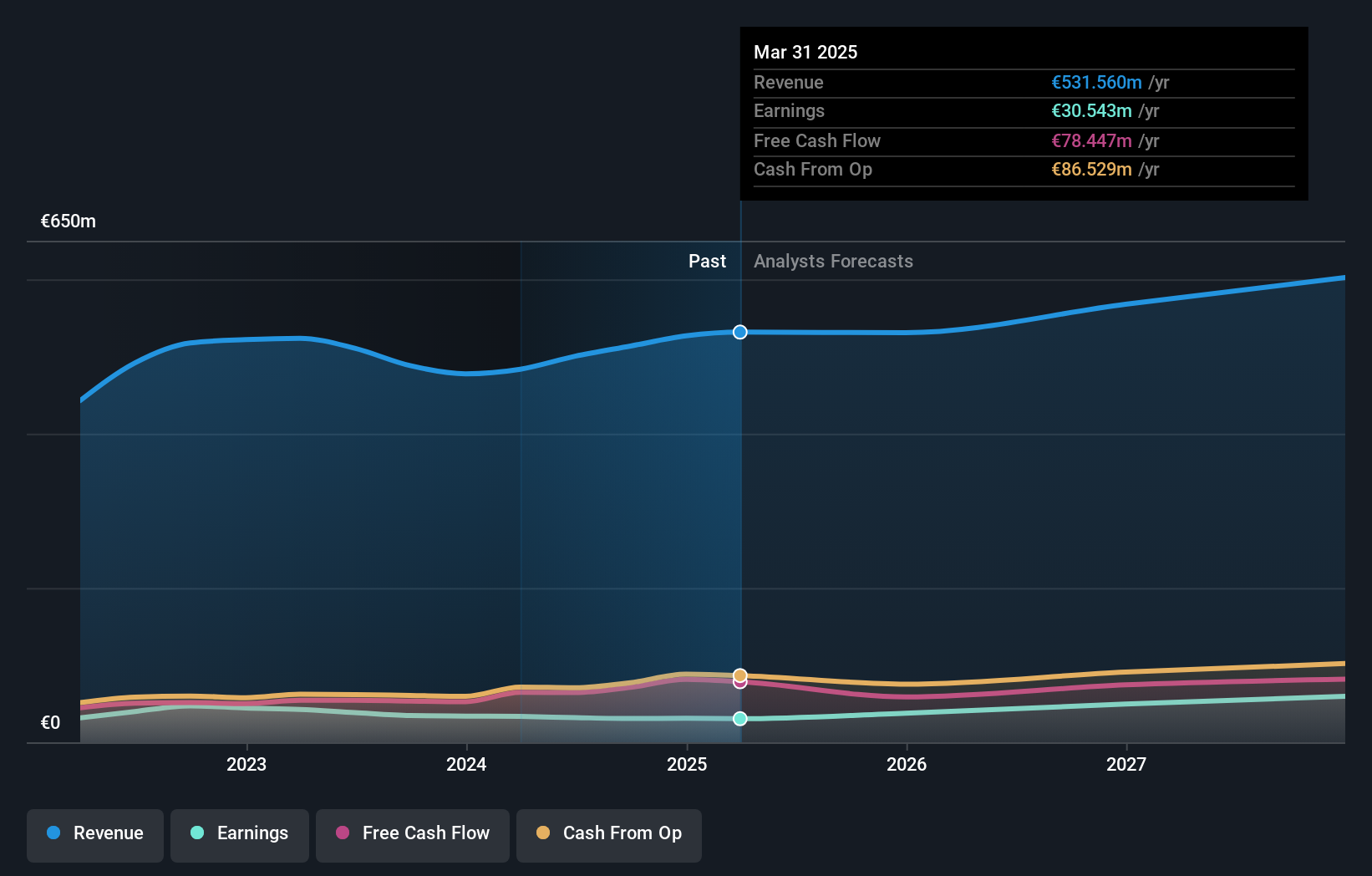

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture sectors across Northern Europe, Southern Europe, the Americas, and Asia Pacific, with a market capitalization of approximately €1.11 billion.

Operations: The company generates revenue from the Americas and Asia-Pacific regions, amounting to €170.33 million and €110.28 million respectively.

Insider Ownership: 19.6%

Earnings Growth Forecast: 28.6% p.a.

Lectra, a French firm with significant insider ownership, reported a slight dip in Q1 2024 earnings with net income at €7.17 million from €7.63 million year-over-year and sales increasing to €129.56 million. Despite this, the company is poised for robust growth with revenue and earnings expected to outpace the French market significantly at 11.3% and 28.6% per year respectively. However, its return on equity is projected to remain low at 13.3%. Trading at 33.4% below its estimated fair value suggests potential undervaluation.

- Delve into the full analysis future growth report here for a deeper understanding of Lectra.

- Our expertly prepared valuation report Lectra implies its share price may be lower than expected.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

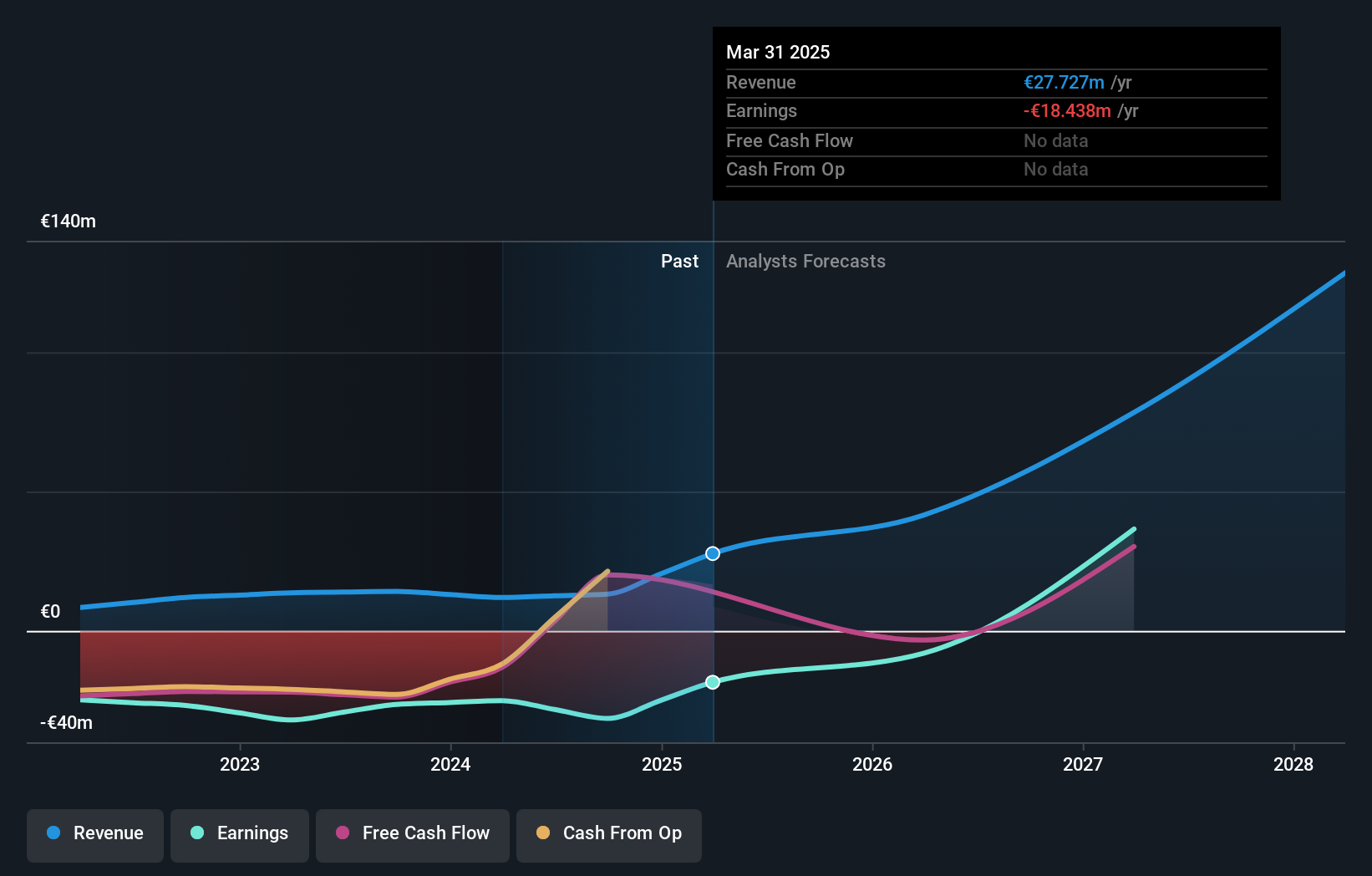

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable treatments across multiple therapeutic areas, with a market capitalization of approximately €431.26 million.

Operations: The company generates its revenues primarily from the pharmaceutical sector, totaling €11.95 million.

Insider Ownership: 16.4%

Earnings Growth Forecast: 70.4% p.a.

MedinCell, a French growth company with high insider ownership, faces challenges despite potential. Recently reporting a net loss reduction from €32.01 million to €25.04 million year-over-year and a slight revenue decrease, its financial health shows signs of strain. However, MedinCell is expected to become profitable within three years, with projected earnings growth of 70.38% annually and revenue growth outpacing the market at 43.8% per year—indicative of its recovery trajectory and innovation strength in pharmaceutical development.

- Unlock comprehensive insights into our analysis of MedinCell stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of MedinCell shares in the market.

Summing It All Up

- Unlock our comprehensive list of 21 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential and slightly overvalued.