- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

Top Growth Companies With High Insider Ownership On Euronext Paris August 2024

Reviewed by Simply Wall St

Despite recent global market volatility and economic uncertainties, the French stock market has shown resilience, with the CAC 40 Index experiencing a moderate decline of 3.54% last week. Amid these fluctuations, investors often seek out growth companies with high insider ownership as they tend to align management interests with shareholder value. In this context, identifying stocks where insiders have significant stakes can be particularly compelling. High insider ownership often indicates confidence in the company's future prospects and can serve as a stabilizing factor in turbulent markets.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 28.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 71.1% |

Here we highlight a subset of our preferred stocks from the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €965.92 million.

Operations: Revenue segments for Lectra SA are: Americas (€172.65 million), Asia-Pacific (€118.54 million), and Segment Adjustment (€209.13 million).

Insider Ownership: 19.6%

Lectra's recent earnings report shows sales of €262.29 million for the first half of 2024, up from €239.55 million last year, though net income dropped to €12.51 million from €14.47 million. Despite this, earnings are forecast to grow significantly at 32.6% annually over the next three years, outpacing the French market's growth rate of 12.2%. The stock trades at good value compared to peers and is priced well below its fair value estimate.

- Click here to discover the nuances of Lectra with our detailed analytical future growth report.

- Our expertly prepared valuation report Lectra implies its share price may be lower than expected.

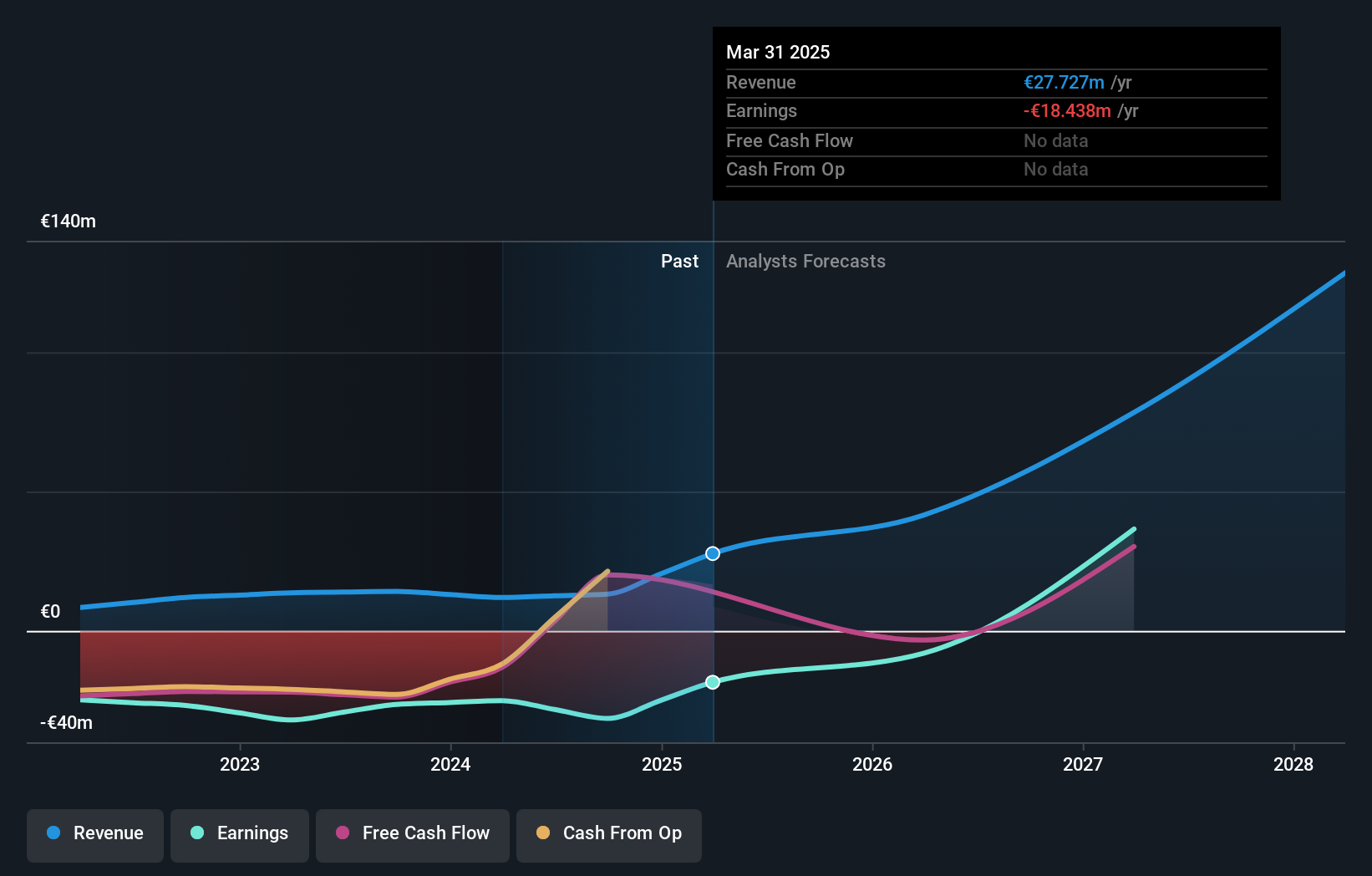

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €450.86 million.

Operations: MedinCell S.A. generates its revenue primarily from its pharmaceuticals segment, which accounted for €11.95 million.

Insider Ownership: 15.8%

MedinCell, a growth company with high insider ownership in France, reported a net loss of €25.04 million for the year ending March 31, 2024, an improvement from the previous year's €32.01 million loss. Despite missing primary endpoints in its Phase 3 trial for F14, secondary outcomes showed promising results in pain management and knee function post-Total Knee Replacement. The company is expected to achieve profitability within three years and has forecasted revenue growth significantly above market averages at 44.7% annually.

- Take a closer look at MedinCell's potential here in our earnings growth report.

- Our valuation report unveils the possibility MedinCell's shares may be trading at a premium.

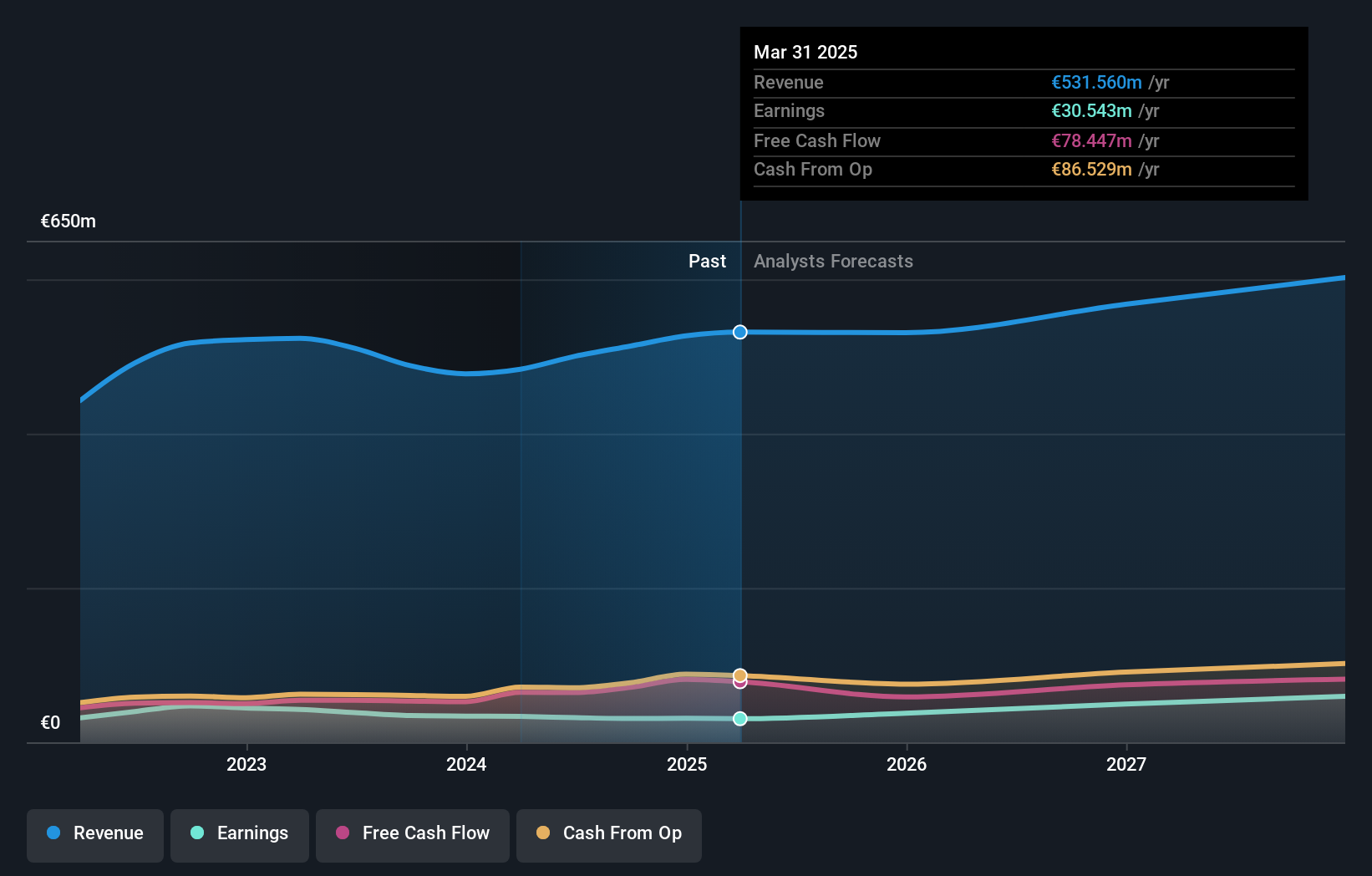

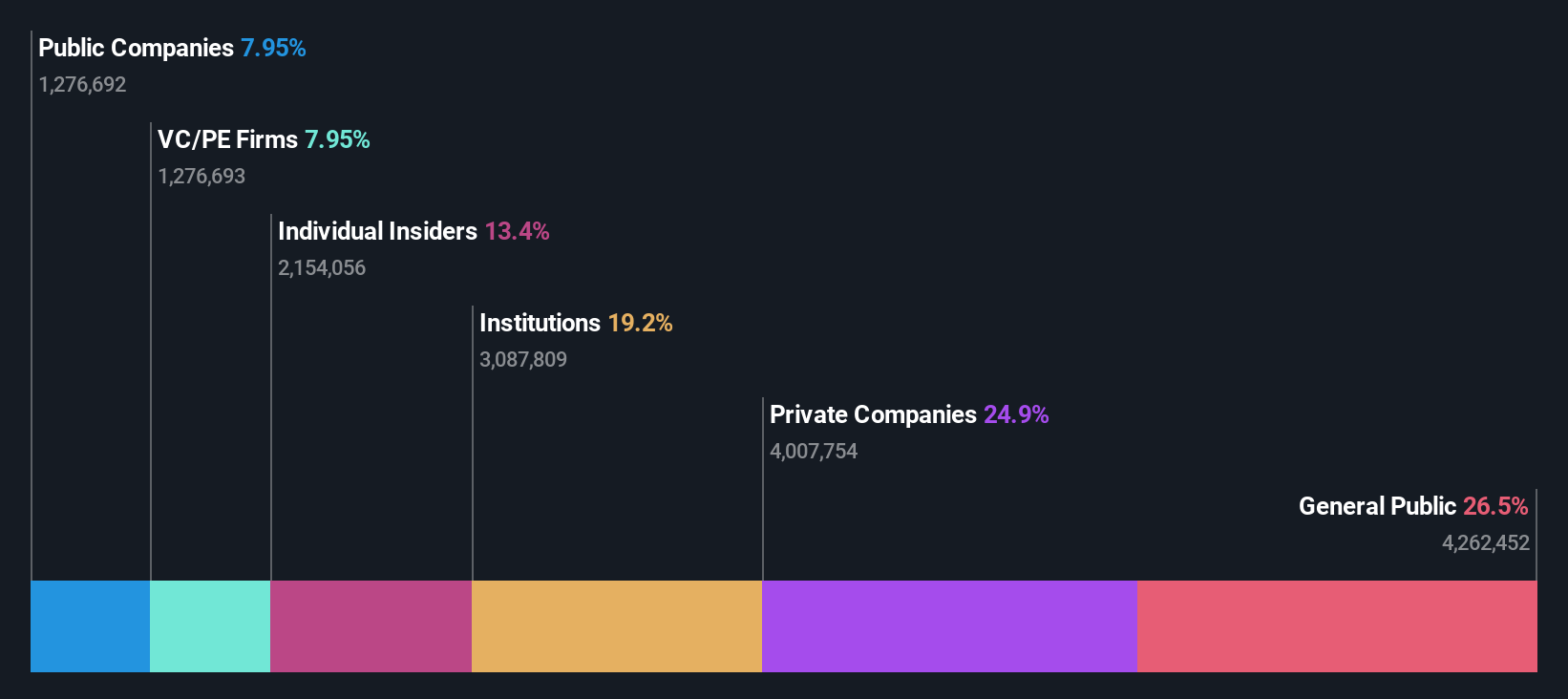

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €2.15 billion.

Operations: VusionGroup S.A. generates €801.96 million from installing and maintaining electronic shelf labels across its markets in Europe, Asia, and North America.

Insider Ownership: 13.4%

VusionGroup's earnings are forecast to grow at 25.74% annually, outpacing the French market's 12.2%, with revenue expected to increase by 21.3% per year, surpassing the market average of 5.8%. Recent partnerships with Ace Hardware and Hy-Vee highlight VusionGroup's advanced digital shelf label technology, enhancing operational efficiencies and customer experience across thousands of retail locations. Analysts project a significant stock price rise of 44.3%, reflecting strong growth potential and high insider ownership stability.

- Get an in-depth perspective on VusionGroup's performance by reading our analyst estimates report here.

- Our valuation report here indicates VusionGroup may be overvalued.

Taking Advantage

- Embark on your investment journey to our 23 Fast Growing Euronext Paris Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Provides digitalization solutions for commerce in Europe, Asia, and North America.

Exceptional growth potential with outstanding track record.