- France

- /

- Real Estate

- /

- ENXTPA:ORIA

Discovering France's Undiscovered Gems This August 2024

Reviewed by Simply Wall St

As global markets experience heightened volatility and economic data from the U.S. and Europe spark concerns about growth, investors are increasingly looking towards small-cap stocks for potential opportunities. Despite broader market challenges, France's small-cap sector remains a fertile ground for discovering undervalued gems that could offer significant upside. In this environment, identifying strong candidates involves focusing on companies with robust fundamentals, innovative business models, and resilience to economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally with a market cap of €1.03 billion.

Operations: Neurones generates revenue primarily from infrastructure services (€468.49 million), application services (€219.47 million), and consulting (€53.21 million). The company has a market cap of €1.03 billion, reflecting its significant presence in the IT services sector across France and internationally.

Neurones, a relatively small player in the IT sector, has shown impressive growth with earnings up 11.7% over the past year, outpacing the industry’s -9.9%. Its debt to equity ratio climbed from 0.1% to 1.8% in five years but remains manageable as it holds more cash than total debt. Trading at 17.1% below its estimated fair value, Neurones expects €800 million in revenues for 2024 and an operating profit around 9.5%.

- Navigate through the intricacies of Neurones with our comprehensive health report here.

Gain insights into Neurones' historical performance by reviewing our past performance report.

Fiducial Real Estate (ENXTPA:ORIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fiducial Real Estate SA operates and manages real estate properties in France, with a market cap of €427.28 million.

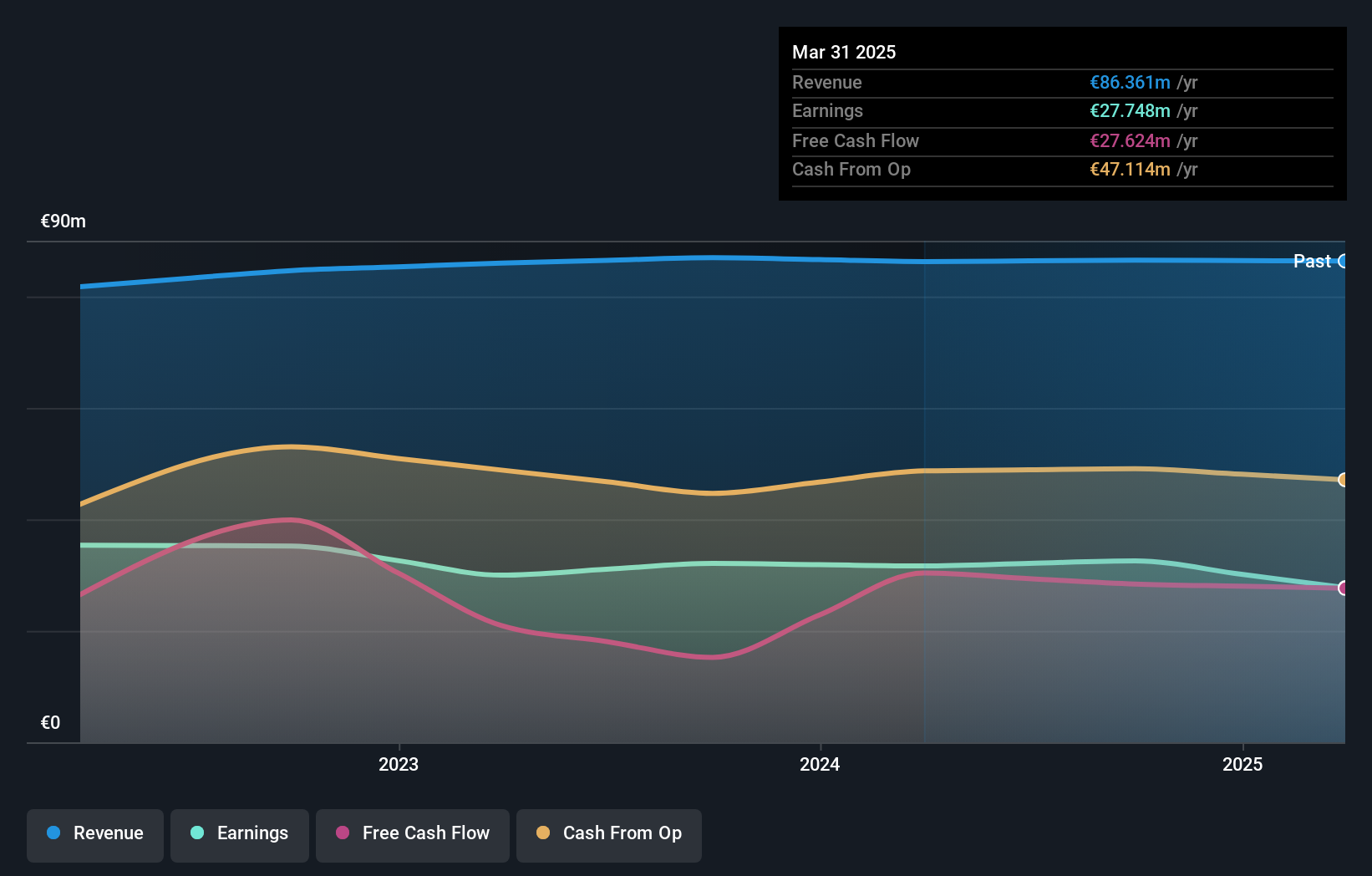

Operations: The company's revenue streams include €71.21 million from land activities and €23.01 million from service provider activity, offset by intersector sales of -€7.95 million.

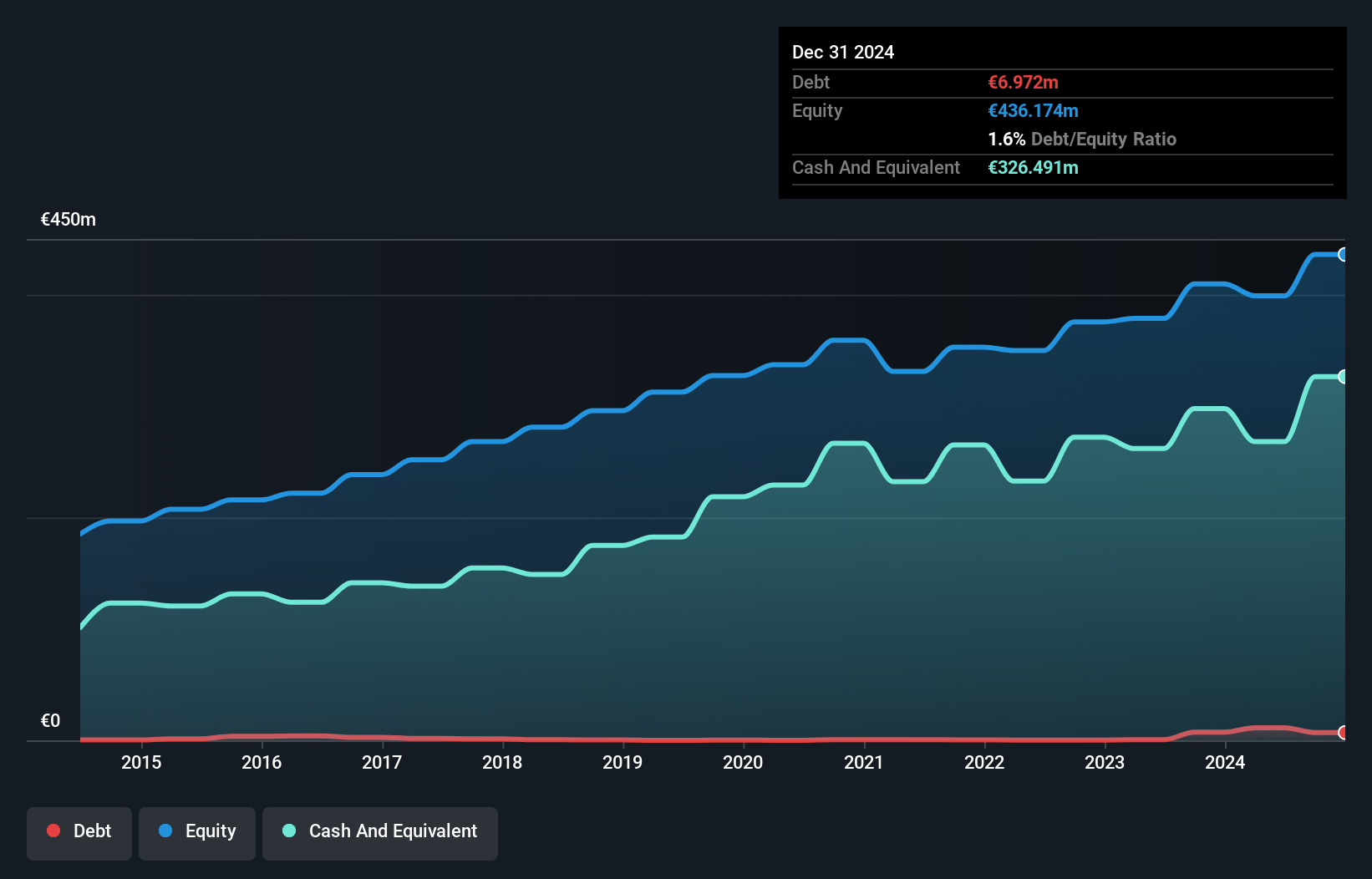

Fiducial Real Estate, a small cap player in the French market, has shown resilience with earnings growth of 5.6% over the past year, outpacing the industry’s -12%. The company’s net debt to equity ratio stands at a satisfactory 29.6%, down from 81.2% five years ago. Recent half-year results reported EUR 42.86 million in sales and EUR 14.99 million in net income, with basic earnings per share at EUR 6.26 compared to EUR 6.4 last year.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Savencia SA produces, distributes, and markets dairy and cheese products in France, the rest of Europe, and internationally with a market cap of €668.69 million.

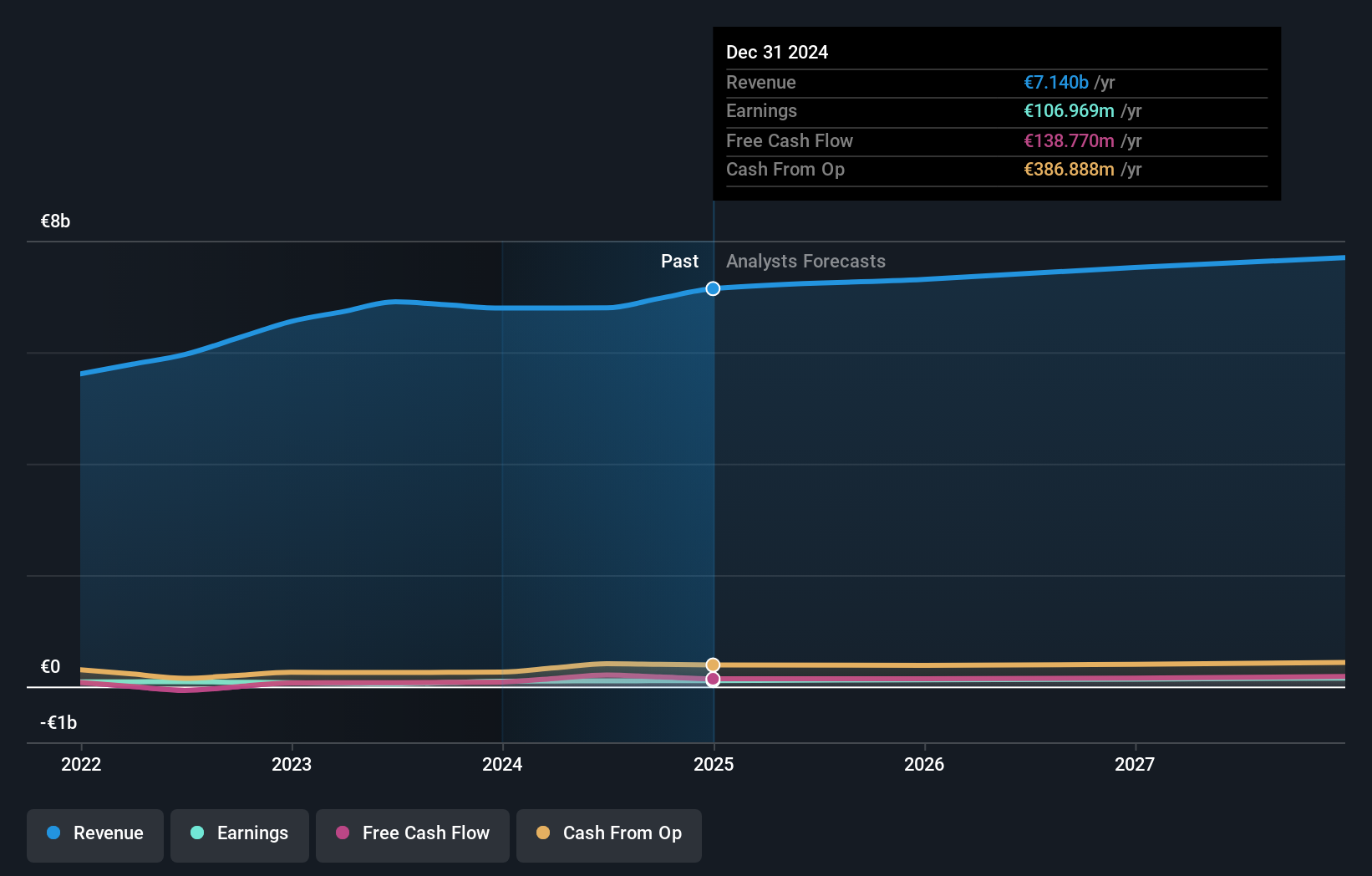

Operations: Savencia generates revenue primarily from Cheese Products (€4.08 billion) and Other Dairy Products (€2.92 billion). The company's net profit margin is not provided in the text.

Savencia's price-to-earnings ratio of 6.9x is notably below the French market average of 14.6x, indicating potential undervaluation. Over the past five years, its debt-to-equity ratio has improved from 75.7% to 61.5%, showing a healthier balance sheet. However, a significant one-off loss of €43.6M impacted recent financial results, despite earnings growing at an annual rate of 4.3%. Additionally, EBIT coverage for interest payments stands strong at 18.3x.

- Take a closer look at Savencia's potential here in our health report.

Gain insights into Savencia's past trends and performance with our Past report.

Seize The Opportunity

- Explore the 34 names from our Euronext Paris Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ORIA

Fiducial Real Estate

Operates and manages real estate properties in France.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives