- Sweden

- /

- Entertainment

- /

- OM:MTG B

High Growth Tech Stocks To Watch In June 2025

Reviewed by Simply Wall St

In recent weeks, the European market has faced a downturn, with the pan-European STOXX Europe 600 Index falling by 1.54%, influenced by ongoing Middle East tensions and economic uncertainties. Amidst these challenges, identifying high-growth tech stocks requires focusing on companies that demonstrate resilience through innovative solutions and adaptability to changing economic conditions.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.17% | 58.57% | ★★★★★★ |

| argenx | 21.73% | 26.84% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA specializes in industrial intelligence solutions for the fashion, automotive, and furniture industries globally, with a market cap of €912.06 million.

Operations: The company's revenue streams are primarily derived from its operations in the EMEA region (€220.46 million), followed by the Americas (€176.26 million) and Asia-Pacific (€134.84 million).

Lectra's strategic expansion of its Valia Fashion platform into new global markets underscores its commitment to leading the digital transformation in the fashion industry. With a focus on Industry 4.0 technologies, Lectra is not just streamlining production but also enhancing real-time decision-making capabilities for manufacturers. Despite a challenging year with earnings growth at -8.7%, the company's forward-looking initiatives, such as potential M&A activities highlighted in recent executive statements, suggest a robust approach to overcoming market adversities and leveraging high-quality earnings. This blend of innovation and strategic market expansion positions Lectra uniquely within Europe’s tech landscape, especially as it eyes significant annual earnings growth of 21.4% and maintains an R&D investment strategy aligned with its core business objectives.

- Take a closer look at Lectra's potential here in our health report.

Review our historical performance report to gain insights into Lectra's's past performance.

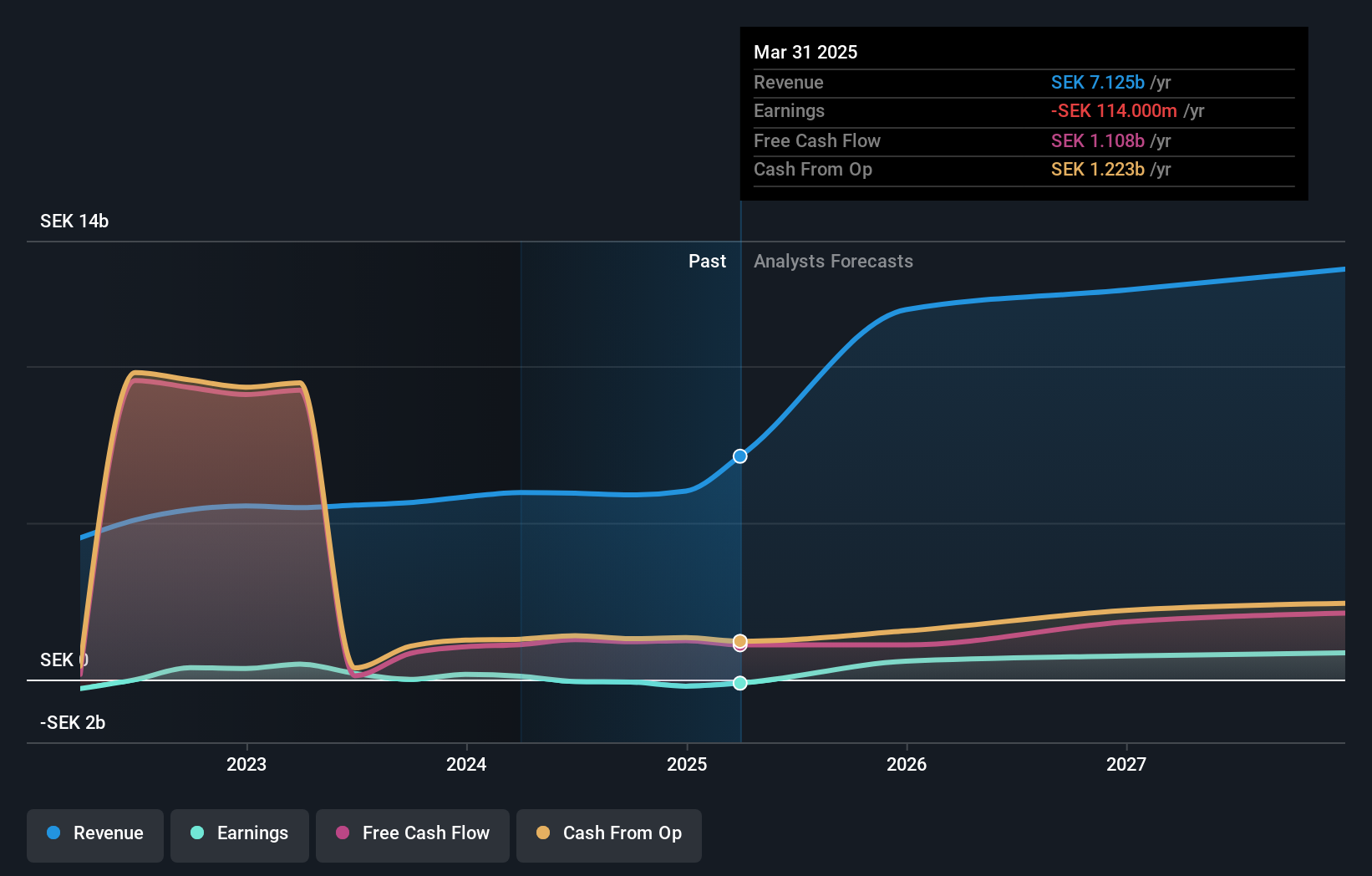

Modern Times Group MTG (OM:MTG B)

Simply Wall St Growth Rating: ★★★★☆☆

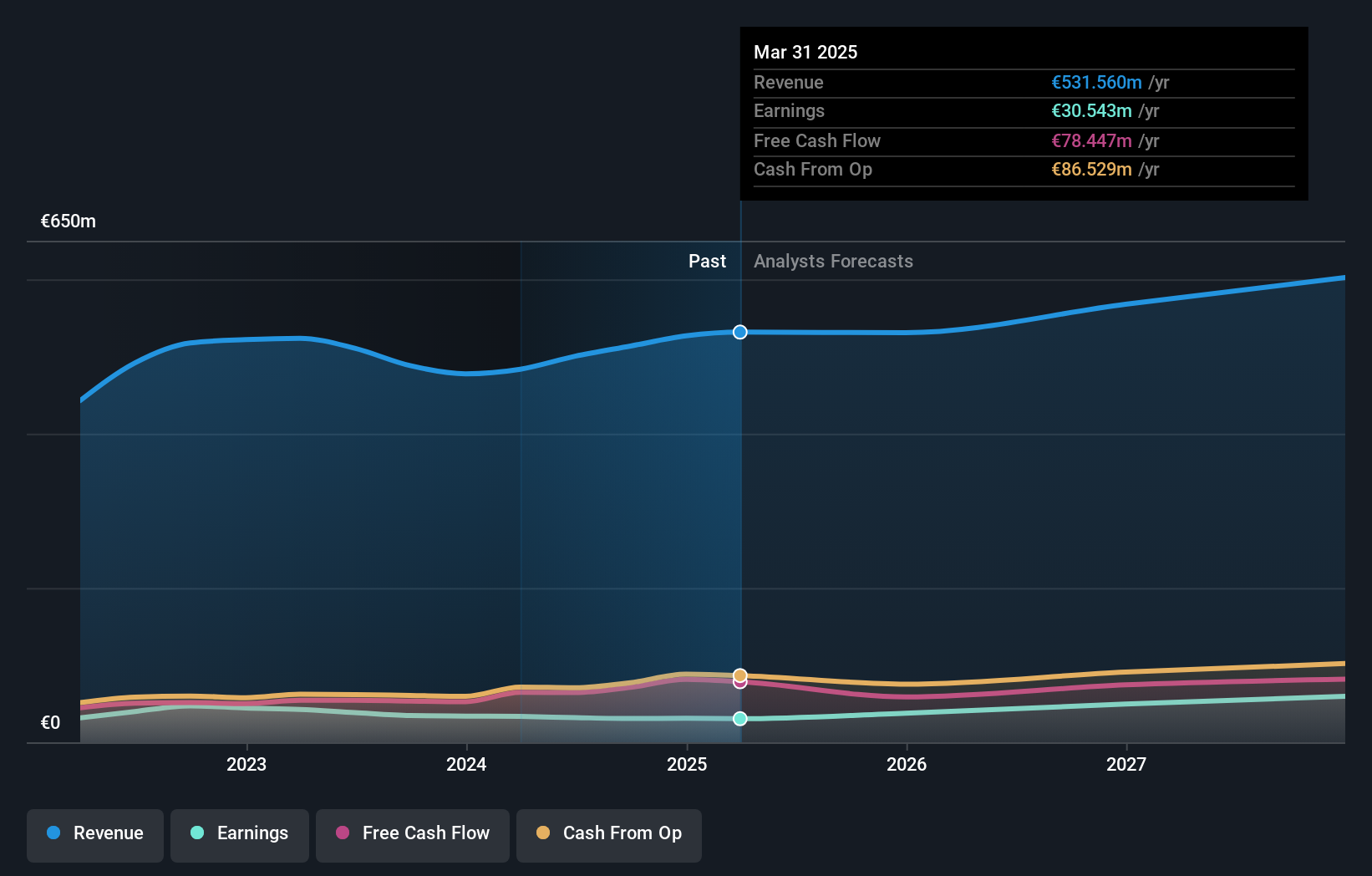

Overview: Modern Times Group MTG AB operates through its subsidiaries to provide game franchises across various countries including Sweden, the United Kingdom, Germany, and others with a market capitalization of SEK12.68 billion.

Operations: MTG generates revenue primarily from its Broadcasting segment, which accounts for SEK7.13 billion. The company operates across various regions including Europe, Asia, and the Americas.

Modern Times Group MTG AB, in its recent strides, has demonstrated a robust trajectory with an 18.1% annual revenue growth forecast, outpacing the Swedish market's average of 4.3%. This growth is bolstered by strategic board enhancements and a positive shift in earnings, transitioning from a net loss to a net income of SEK 65 million in Q1 2025—a stark contrast to the previous year. With new leadership poised to steer future expansions and an earnings growth projection of 62.35% annually, MTG is setting itself apart by not only reversing past downturns but also positioning itself as a potential leader in entertainment technology amidst evolving market demands.

- Get an in-depth perspective on Modern Times Group MTG's performance by reading our health report here.

Evaluate Modern Times Group MTG's historical performance by accessing our past performance report.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

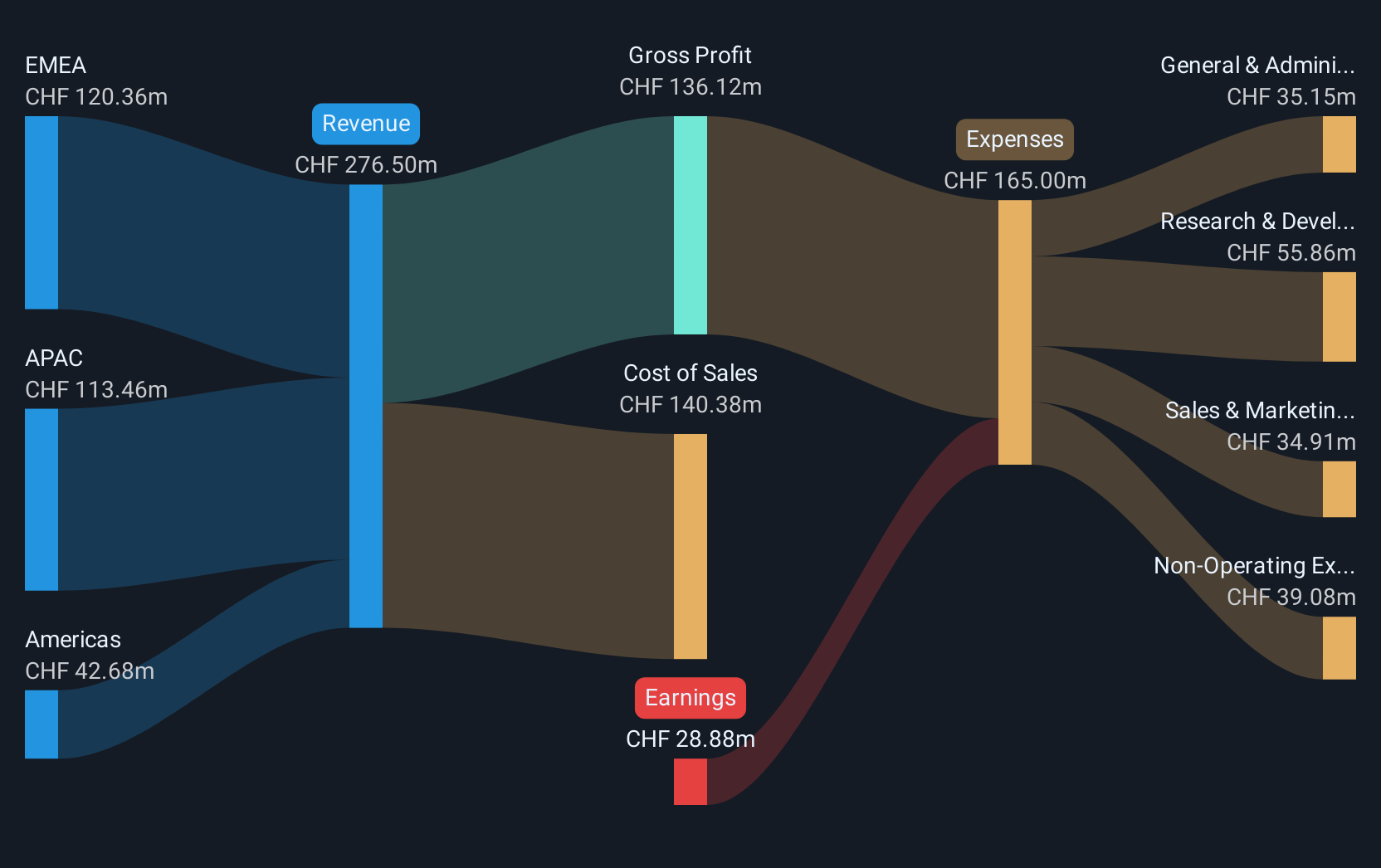

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components across various regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF1.19 billion.

Operations: With a market capitalization of CHF1.19 billion, Sensirion Holding AG focuses on sensor systems, modules, and components, generating revenue of CHF276.50 million.

Sensirion Holding AG is navigating a transformative landscape with its recent partnership with Sintropy.ai, highlighting its strategic pivot towards AI-driven automation solutions. This collaboration, leveraging Sensirion's high-quality sensors, underscores the company's commitment to innovation and positions it well within the tech ecosystem for potential growth in data-centric applications. Despite a volatile share price and current unprofitability, Sensirion is forecasted to become profitable within three years with an expected earnings growth of 70.66% annually. The appointment of Mirjana Blume as chair of the Audit Committee further strengthens governance, aligning with its forward-looking growth strategies in high-tech industries.

- Delve into the full analysis health report here for a deeper understanding of Sensirion Holding.

Gain insights into Sensirion Holding's past trends and performance with our Past report.

Summing It All Up

- Take a closer look at our European High Growth Tech and AI Stocks list of 228 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTG B

Modern Times Group MTG

Through its subsidiaries, engages in the provision of game franchises in Sweden, the United Kingdom, Germany, rest of Europe, Singapore, India, the United States, and New Zealand.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives