As the pan-European STOXX Europe 600 Index recently ended 1.80% lower due to escalating Middle East tensions, France's CAC 40 Index also saw a decline of 3.21%, reflecting cautious investor sentiment amid geopolitical uncertainties and anticipation of an ECB rate cut due to slowing growth and inflation. In this environment, identifying high-growth tech stocks in France requires focusing on companies with strong innovation potential and resilience against macroeconomic pressures, as these attributes may help navigate the current volatile market landscape effectively.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 25.98% | 77.41% | ★★★★★☆ |

| Valneva | 28.00% | 25.49% | ★★★★★☆ |

| Munic | 42.94% | 174.09% | ★★★★★☆ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| Valbiotis | 33.52% | 39.79% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.72% | ★★★★★★ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

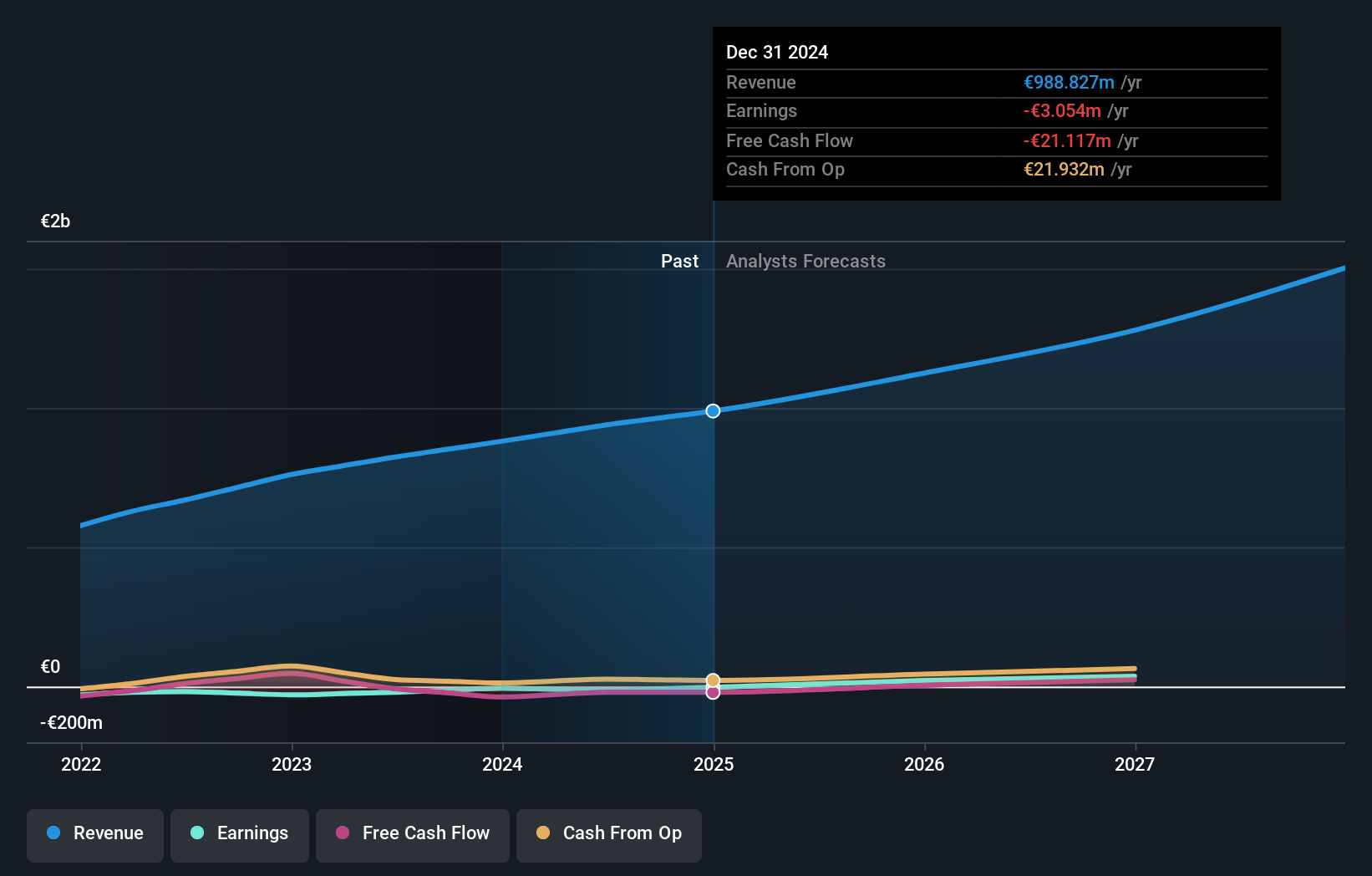

Overview: Believe S.A. offers digital music services for independent labels and local artists across various regions including Europe, the Americas, Asia, Oceania, and the Pacific with a market capitalization of approximately €1.51 billion.

Operations: The company generates revenue primarily through Premium Solutions, contributing €877.53 million, and Automated Solutions, adding €61.50 million.

Believe S.A., amidst a challenging fiscal period with a reported net loss of EUR 7.57 million for the first half of 2024, contrasts starkly with its prior year's modest profit. Despite this setback, the company's revenue trajectory remains promising, marking a significant increase to EUR 474.13 million from EUR 415.42 million, reflecting a robust growth rate of 13.1% year-over-year. This growth outpaces the broader French market's average of 5.7%. Looking ahead, Believe is not just expected to reverse its current unprofitable status but is also projected to expand earnings at an impressive annual rate of approximately 56.8%. Such potential is underpinned by substantial investments in R&D which are crucial for sustaining innovation and competitiveness in the fast-evolving tech landscape.

- Click here to discover the nuances of Believe with our detailed analytical health report.

Gain insights into Believe's past trends and performance with our Past report.

Genfit (ENXTPA:GNFT)

Simply Wall St Growth Rating: ★★★★☆☆

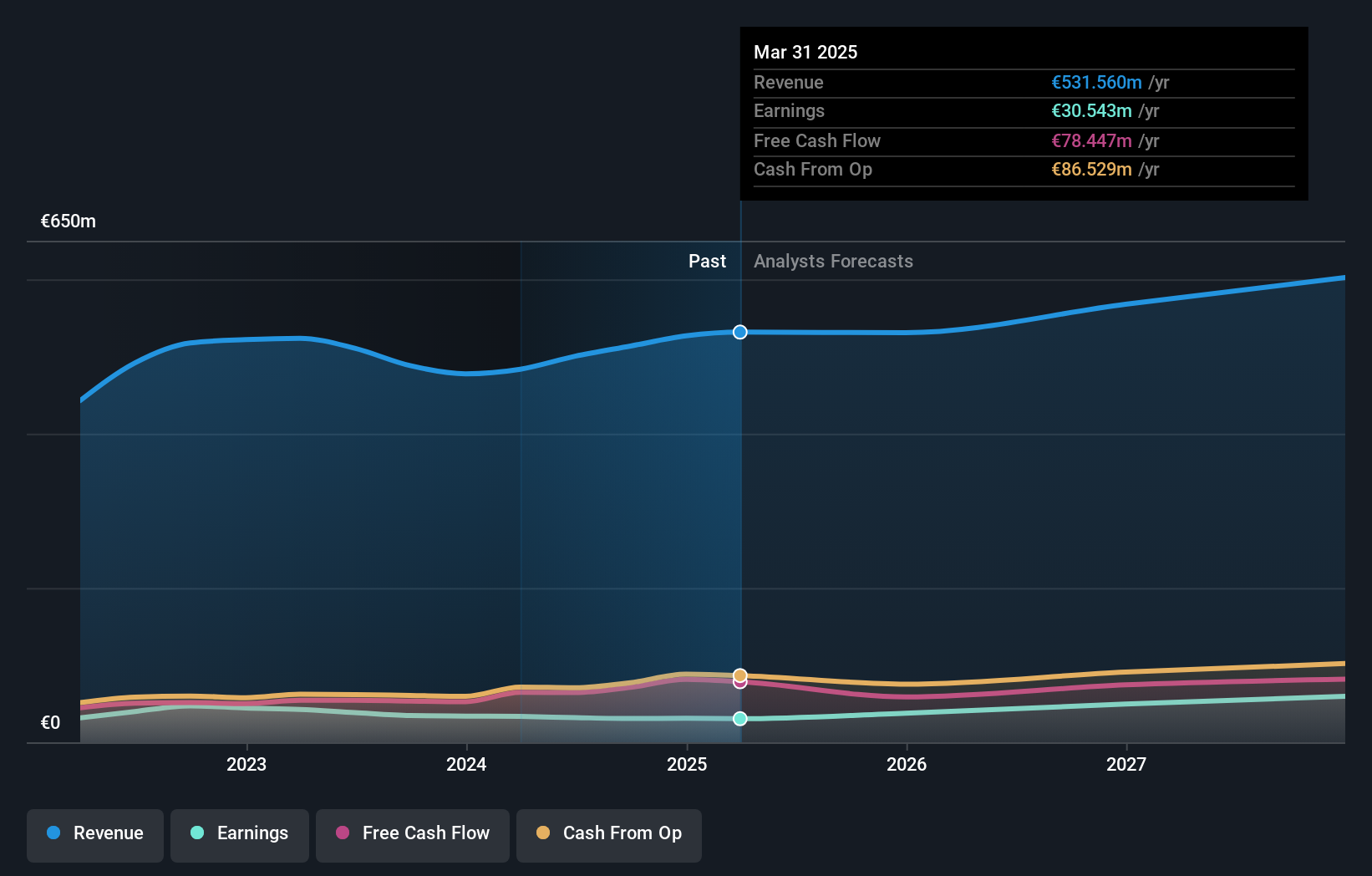

Overview: Genfit S.A. is a late-stage biopharmaceutical company focused on discovering and developing drug candidates and diagnostic solutions for metabolic and liver-related diseases, with a market cap of €249.04 million.

Operations: Genfit's revenue is primarily derived from its research and development activities in innovative medicines and diagnostic solutions, amounting to €80.47 million. The company operates within the biopharmaceutical sector, concentrating on metabolic and liver-related diseases.

Genfit S.A. has demonstrated a remarkable turnaround, transitioning from a net loss to posting a net income of EUR 30.31 million in the first half of 2024, contrasting sharply with the previous year's EUR 20.85 million loss. This resurgence is reflected in its revenue surge to EUR 61.2 million from just EUR 15.37 million, marking an impressive growth rate of nearly 300%. Notably, Genfit's commitment to innovation is evident in its R&D spending, crucial for maintaining competitiveness in the biotech sector where it recently increased expenditure by 17.8%. Looking forward, the company's earnings are expected to grow by an annual rate of 33.8%, potentially outpacing broader market trends and solidifying its position in high-growth tech sectors within France.

- Take a closer look at Genfit's potential here in our health report.

Examine Genfit's past performance report to understand how it has performed in the past.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions tailored for the fashion, automotive, and furniture sectors across Northern and Southern Europe, the Americas, and the Asia Pacific, with a market cap of €1.09 billion.

Operations: Lectra SA generates revenue primarily from the Americas and Asia-Pacific regions, with contributions of €172.65 million and €118.54 million, respectively. The company focuses on providing industrial intelligence solutions to specific sectors such as fashion, automotive, and furniture across multiple continents.

Lectra, a French tech entity, recently experienced a slight dip in net income to EUR 12.51 million from EUR 14.47 million year-over-year, despite an increase in sales to EUR 262.29 million from EUR 239.55 million as reported in mid-2024. This contrasts with its removal from the S&P Global BMI Index, potentially impacting investor perception negatively. However, Lectra's commitment to innovation is underscored by its substantial R&D investments which align with an expected robust annual profit growth of 29.3%. Furthermore, projected revenue growth at a rate of 10.4% annually outpaces the broader French market's growth rate of 5.7%, indicating potential resilience and adaptability in evolving tech landscapes.

- Delve into the full analysis health report here for a deeper understanding of Lectra.

Review our historical performance report to gain insights into Lectra's's past performance.

Make It Happen

- Unlock our comprehensive list of 39 Euronext Paris High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GNFT

Genfit

A late-stage biopharmaceutical company, discovers and develops drug candidates and diagnostic solutions for metabolic and liver-related diseases.

High growth potential with excellent balance sheet.