As European markets face challenges from political instability and renewed tariff uncertainties, the pan-European STOXX Europe 600 Index recently ended lower, reflecting broader concerns about economic resilience. In this environment, growth companies with high insider ownership can offer a unique appeal, as insider commitment often signals confidence in a company's long-term potential amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.9% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's dive into some prime choices out of the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, furniture markets, and other industries globally, with a market cap of €857.05 million.

Operations: Revenue segments for the company are distributed as follows: €170.21 million from the Americas, €134.93 million from Asia-Pacific, and €220.52 million from EMEA (Europe, Middle East and Africa).

Insider Ownership: 12.7%

Earnings Growth Forecast: 21% p.a.

Lectra demonstrates potential as a growth company with high insider ownership, driven by significant earnings growth forecasted at 21% annually, outpacing the French market. Despite revenue growing slower than 20%, its trading value is notably below estimated fair value. Recent client implementations of Lectra's Valia Furniture platform highlight its role in optimizing production workflows and enhancing efficiency for clients like Walters and Edgecombe Furniture, underscoring Lectra's capacity to drive operational improvements through digital solutions.

- Click here to discover the nuances of Lectra with our detailed analytical future growth report.

- Our valuation report unveils the possibility Lectra's shares may be trading at a discount.

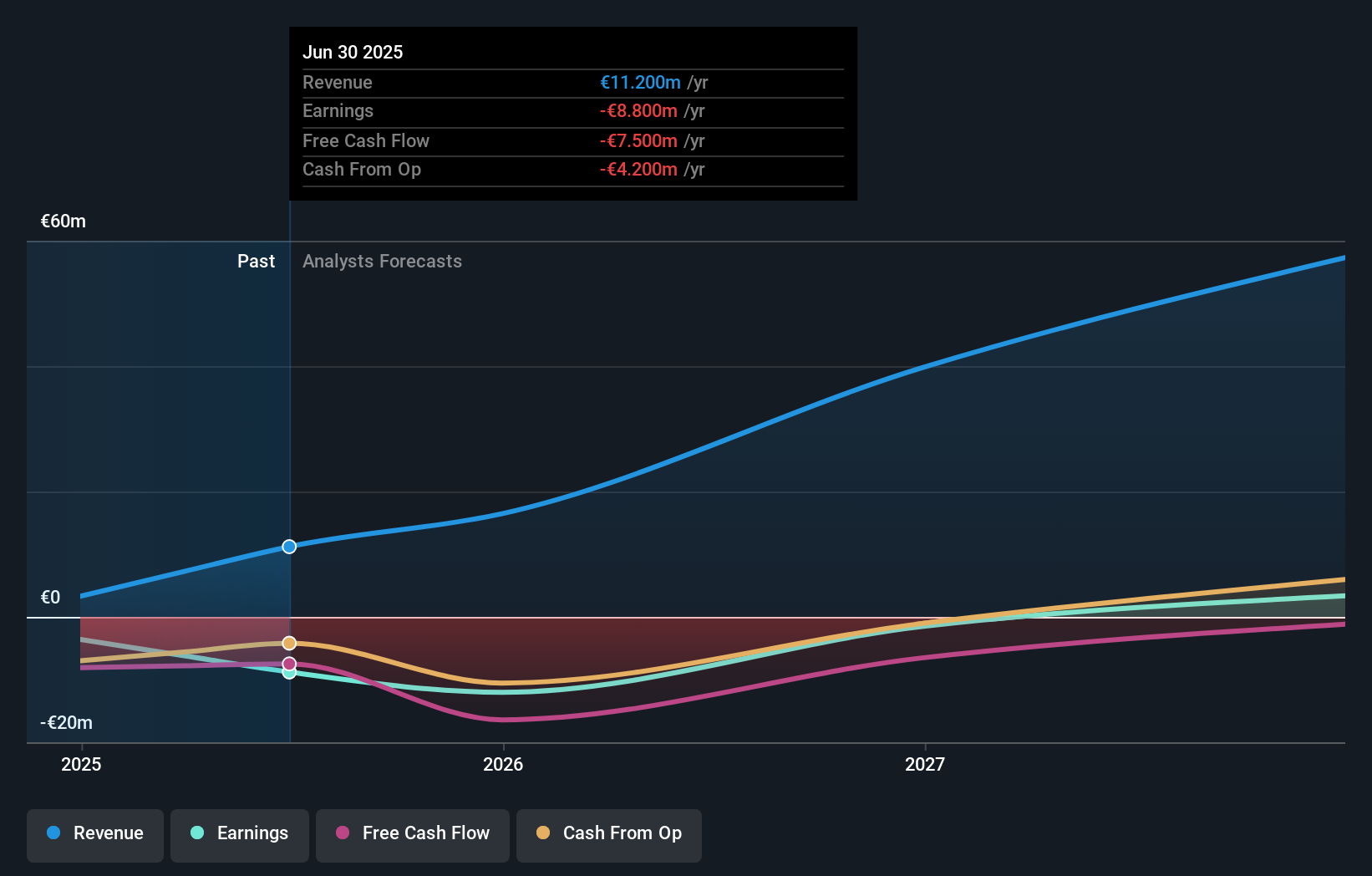

Canatu Oyj (HLSE:CANATU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canatu Oyj develops and sells carbon nanotubes and related products for the semiconductor, automotive, and medical diagnostics industries across Finland, the United States, Japan, and Taiwan with a market cap of €301.10 million.

Operations: Revenue Segments (in millions of €): Semiconductor Equipment and Services: 3.30

Insider Ownership: 12.5%

Earnings Growth Forecast: 53.5% p.a.

Canatu Oyj shows potential with its forecasted 38.9% annual revenue growth, surpassing the Finnish market average. Despite recent earnings guidance indicating a possible revenue decline for 2025, Canatu's strategic investments in semiconductor metrology and successful site acceptance of its CNT100 SEMI reactor position it well in the EUV pellicle market. The share price remains volatile, and past shareholder dilution is notable, yet the company trades significantly below estimated fair value, suggesting room for appreciation.

- Click here and access our complete growth analysis report to understand the dynamics of Canatu Oyj.

- The analysis detailed in our Canatu Oyj valuation report hints at an inflated share price compared to its estimated value.

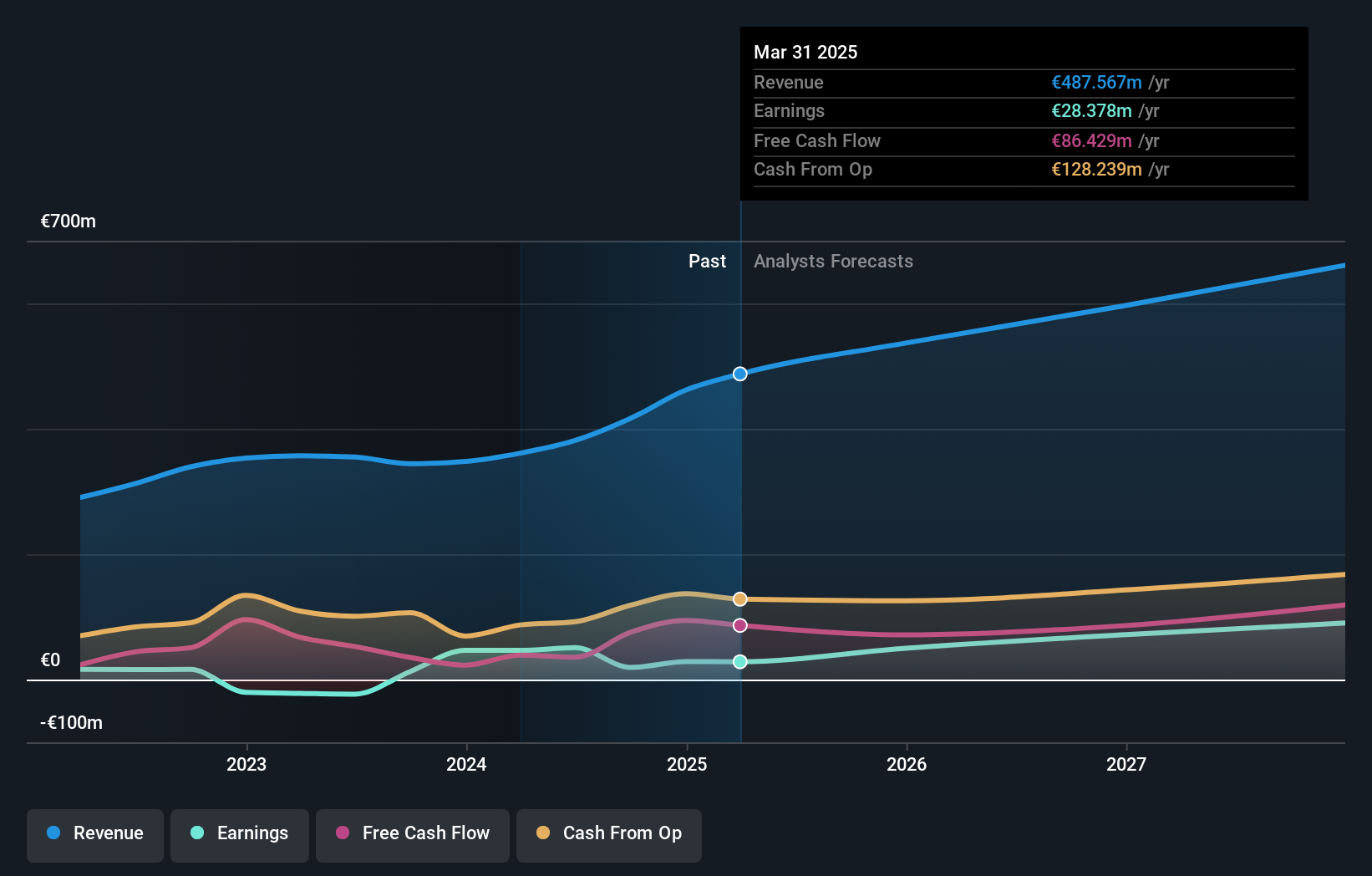

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE is a digital media company that provides ad-software solutions in North America and Europe, with a market cap of €419.41 million.

Operations: The company generates revenue through its Demand Side Platforms (DSP) at €130.94 million and Supply Side Platforms (SSP) at €399.07 million.

Insider Ownership: 24.5%

Earnings Growth Forecast: 42.3% p.a.

Verve Group SE demonstrates potential with forecasted annual earnings growth of 42.3%, outpacing the German market. Despite recent lowered revenue guidance due to technical and FX challenges, insider confidence remains as substantial shares have been bought in the past three months. The company trades significantly below its estimated fair value, though profit margins have decreased from last year. Recent leadership changes may influence strategic direction and operational efficiency moving forward.

- Take a closer look at Verve Group's potential here in our earnings growth report.

- Our expertly prepared valuation report Verve Group implies its share price may be lower than expected.

Taking Advantage

- Explore the 214 names from our Fast Growing European Companies With High Insider Ownership screener here.

- Contemplating Other Strategies? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M8G

Verve Group

A digital media company, engages in the provision of ad-software solutions in North America and Europe.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives