Euronext Paris Stocks That May Be Priced Below Estimated Value In October 2024

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate, European markets have seen a notable decline, with France's CAC 40 Index dropping by over 3% amid investor caution. In this climate of uncertainty and potential economic shifts, identifying stocks that may be undervalued offers an intriguing opportunity for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SPIE (ENXTPA:SPIE) | €34.76 | €53.64 | 35.2% |

| NSE (ENXTPA:ALNSE) | €29.40 | €57.54 | 48.9% |

| Vivendi (ENXTPA:VIV) | €10.30 | €18.02 | 42.8% |

| Lectra (ENXTPA:LSS) | €28.80 | €53.23 | 45.9% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.05 | €5.11 | 40.3% |

| EKINOPS (ENXTPA:EKI) | €3.70 | €6.62 | 44.1% |

| Solutions 30 (ENXTPA:S30) | €1.306 | €2.43 | 46.2% |

| Exail Technologies (ENXTPA:EXA) | €17.84 | €29.96 | 40.4% |

| Vogo (ENXTPA:ALVGO) | €3.22 | €6.35 | 49.3% |

| OVH Groupe (ENXTPA:OVH) | €6.70 | €11.91 | 43.7% |

We'll examine a selection from our screener results.

Edenred (ENXTPA:EDEN)

Overview: Edenred SE operates a digital platform offering services and payment solutions for companies, employees, and merchants globally, with a market cap of €8.45 billion.

Operations: The company's revenue from Business Services amounts to €2.50 billion.

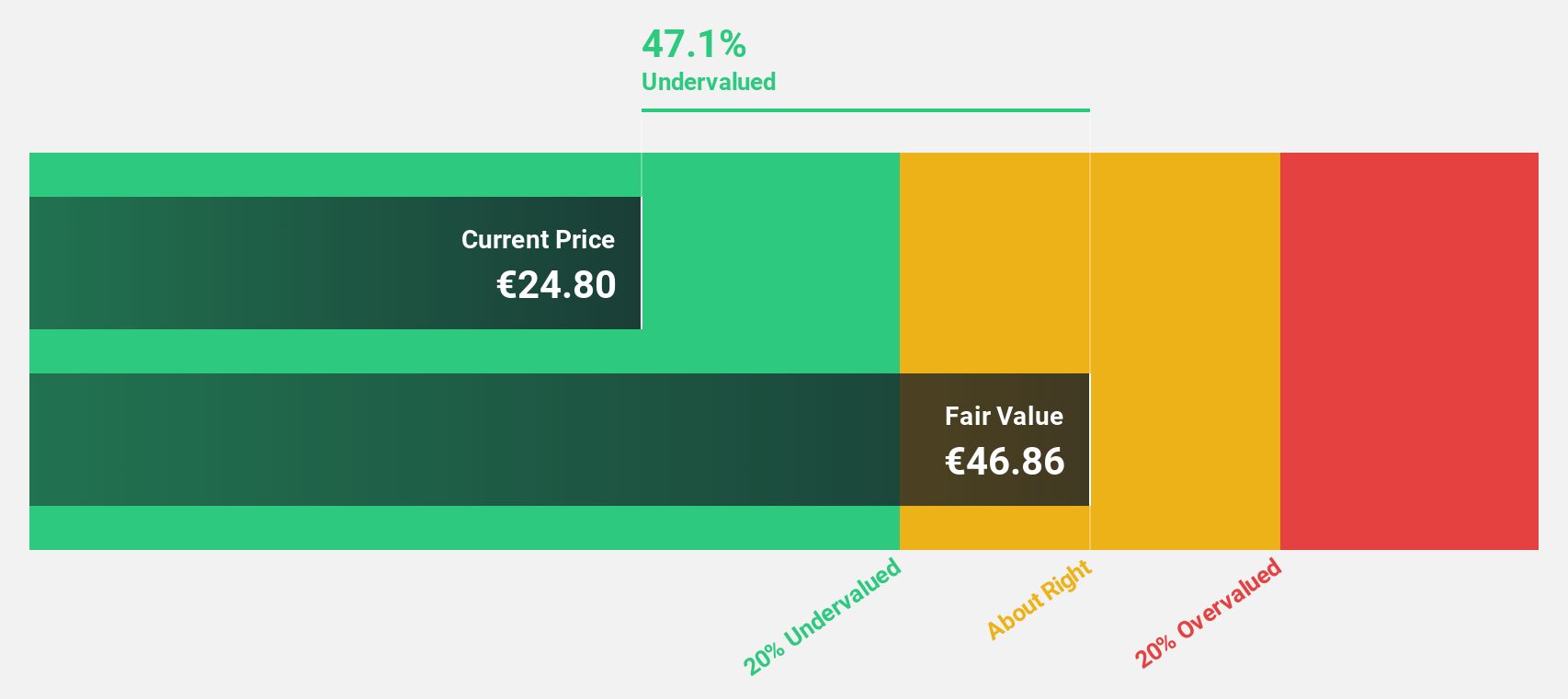

Estimated Discount To Fair Value: 16.5%

Edenred SE's recent earnings report shows strong revenue growth, with sales reaching €1.27 billion for the first half of 2024, up from €1.08 billion a year ago. Despite a high debt level and profit margins decreasing to 12% from 19.6%, the stock trades at €34.62, below its estimated fair value of €41.44, indicating undervaluation based on cash flows. The company completed a share buyback worth €115 million, enhancing shareholder value further.

- Our growth report here indicates Edenred may be poised for an improving outlook.

- Click here to discover the nuances of Edenred with our detailed financial health report.

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.09 billion.

Operations: The company's revenue segments are distributed as follows: €172.65 million from the Americas and €118.54 million from the Asia-Pacific region.

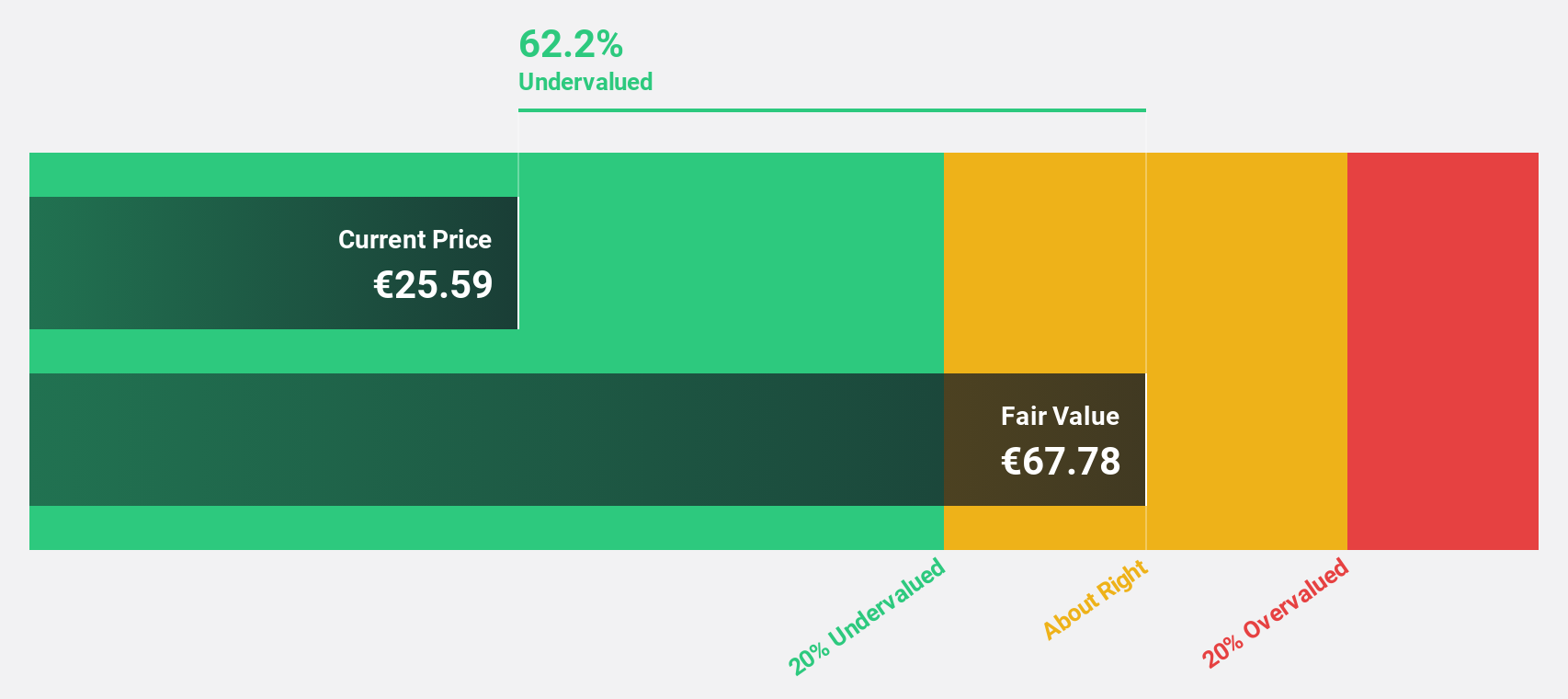

Estimated Discount To Fair Value: 45.9%

Lectra is trading at €28.8, significantly below its estimated fair value of €53.23, suggesting it is undervalued based on cash flows. Despite being dropped from the S&P Global BMI Index, analysts agree the stock price could rise by 20.1%. Earnings are expected to grow at a robust rate of 29.3% annually over the next three years, outpacing the French market's forecast growth rate of 12.2%, though revenue growth remains moderate at 10.4% annually.

- The analysis detailed in our Lectra growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Lectra.

SPIE (ENXTPA:SPIE)

Overview: SPIE SA offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally with a market cap of €5.80 billion.

Operations: The company's revenue segments include North-Western Europe at €1.89 billion and Global Services Energy at €684.90 million.

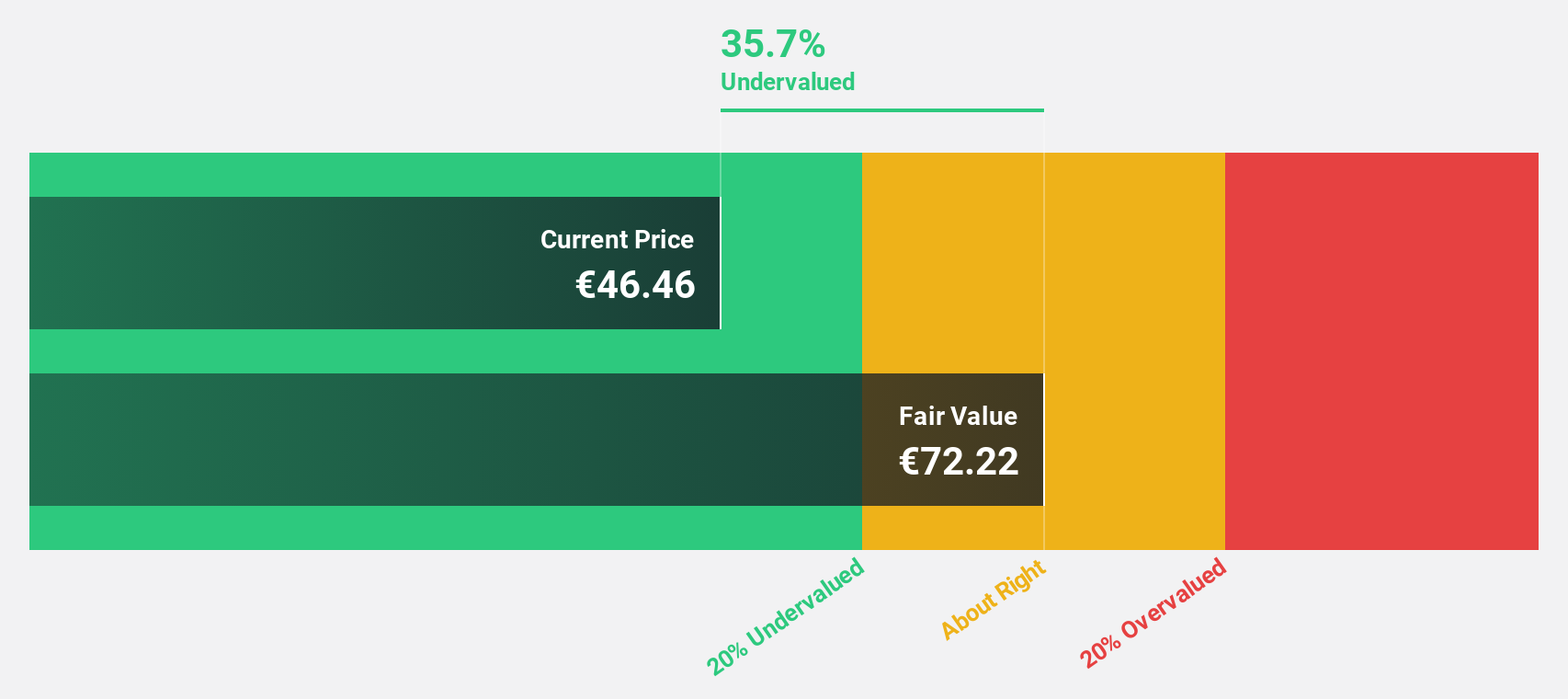

Estimated Discount To Fair Value: 35.2%

SPIE is trading at €34.76, significantly below its estimated fair value of €53.64, highlighting its potential undervaluation based on cash flows. Despite a high debt level and an unstable dividend track record, SPIE's earnings are projected to grow by 20.1% annually over the next three years, outpacing the French market's 12.2%. Recent half-year results showed increased sales but decreased net income due to large one-off items impacting financial outcomes.

- In light of our recent growth report, it seems possible that SPIE's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in SPIE's balance sheet health report.

Make It Happen

- Navigate through the entire inventory of 21 Undervalued Euronext Paris Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, furniture markets, and other industries in Europe, the Americas, the Asia Pacific, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives