- Switzerland

- /

- Machinery

- /

- SWX:SRAIL

3 European Growth Companies With Insider Ownership Expecting Up To 115% Earnings Growth

Reviewed by Simply Wall St

The European stock market recently experienced a downturn, with the pan-European STOXX Europe 600 Index ending lower amid trade tensions and economic uncertainty. In this environment, growth companies with high insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.2% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| XTPL (WSE:XTP) | 23.3% | 143.7% |

| Elliptic Laboratories (OB:ELABS) | 25.8% | 79% |

Underneath we present a selection of stocks filtered out by our screen.

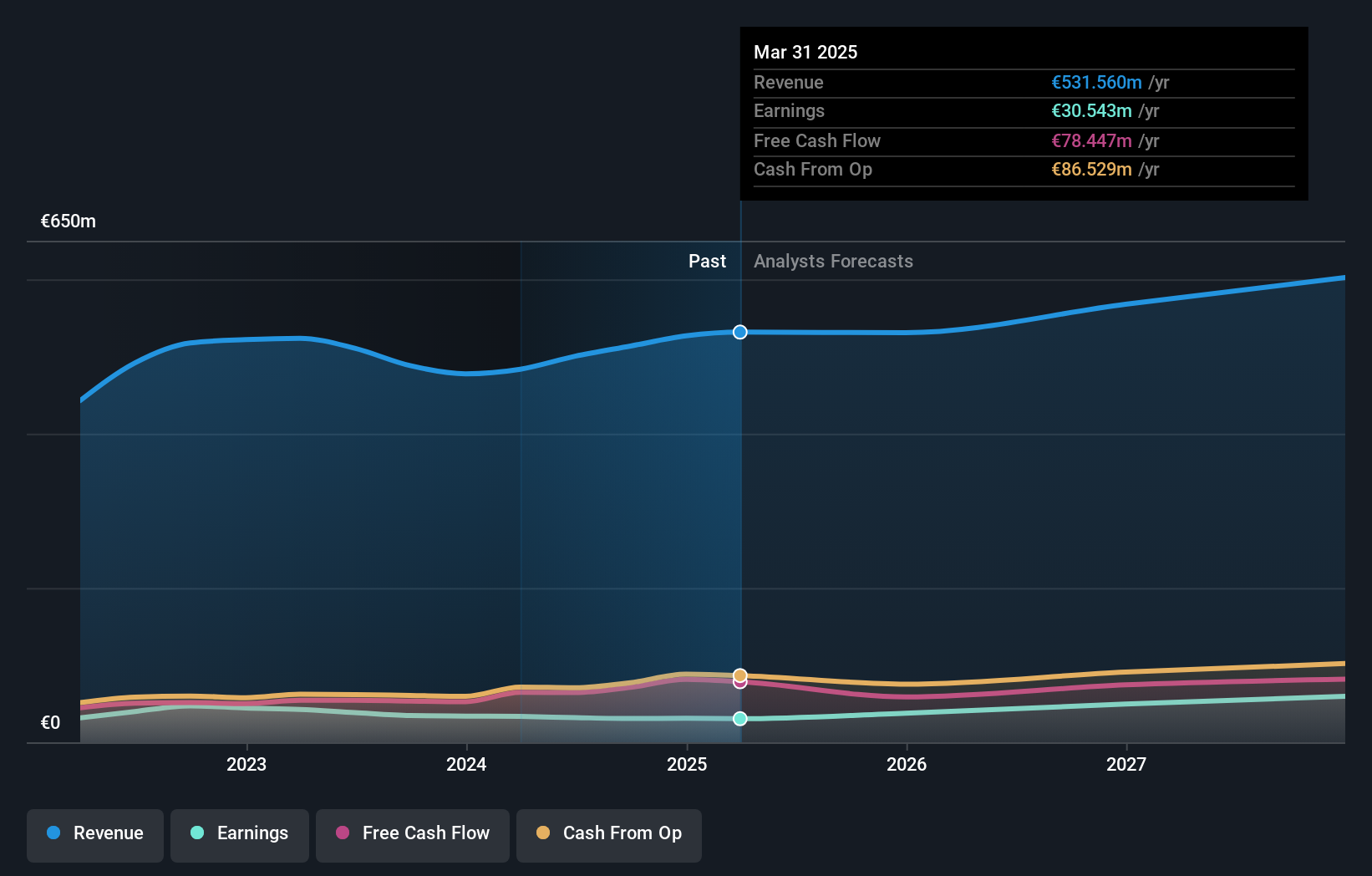

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, furniture markets, and other industries globally, with a market cap of €919.59 million.

Operations: The company's revenue is segmented geographically with €176.26 million from the Americas, €134.84 million from the Asia-Pacific region, and €220.46 million from EMEA (Europe, Middle East and Africa).

Insider Ownership: 12.7%

Earnings Growth Forecast: 20.8% p.a.

Lectra is poised for significant earnings growth, expected at 20.83% annually over the next three years, outpacing the French market. This aligns with its recent strategic expansion of the Valia Fashion platform into new global markets like Mexico and Brazil, enhancing production efficiency in apparel manufacturing. Despite a slight dip in Q1 earnings to €6.55 million from €7.17 million last year, analysts anticipate a 31.2% stock price increase, reflecting confidence in Lectra's growth trajectory and M&A potential.

- Click here to discover the nuances of Lectra with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Lectra shares in the market.

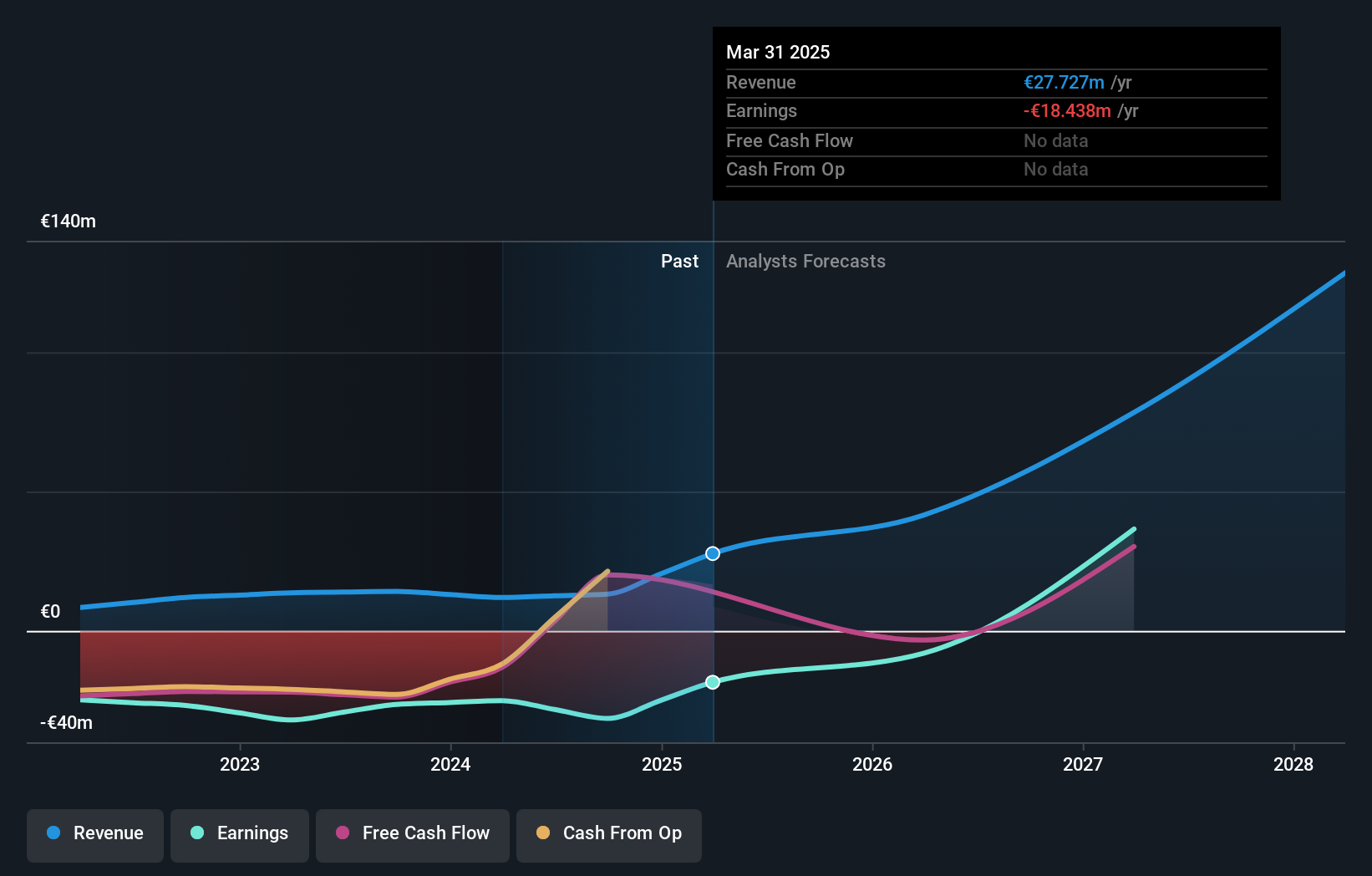

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that specializes in developing long-acting injectables across various therapeutic areas, with a market cap of €555.12 million.

Operations: MedinCell generates its revenue from the pharmaceuticals segment, amounting to €13.20 million.

Insider Ownership: 13.9%

Earnings Growth Forecast: 115.3% p.a.

MedinCell's growth prospects are strong, with revenue expected to rise 68.4% annually, significantly outpacing the French market. Recent strategic alliances and product developments, such as the long-acting injectable Macozinone for tuberculosis and Olanzapine LAI for schizophrenia in partnership with Teva, bolster its pipeline. Despite negative shareholder equity, analysts predict a 33.4% stock price increase. High insider ownership aligns management interests with shareholders during this growth phase.

- Unlock comprehensive insights into our analysis of MedinCell stock in this growth report.

- The analysis detailed in our MedinCell valuation report hints at an deflated share price compared to its estimated value.

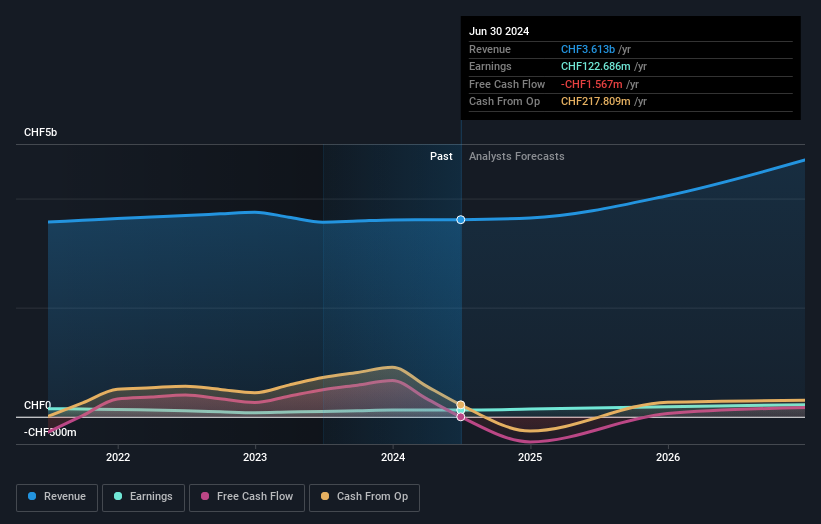

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stadler Rail AG, with a market cap of CHF2.12 billion, manufactures and sells trains across Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally through its subsidiaries.

Operations: Stadler Rail AG generates revenue through its segments: Signalling (CHF109.11 million), Rolling Stock (CHF2.74 billion), and Service & Components (CHF866.43 million).

Insider Ownership: 14.5%

Earnings Growth Forecast: 43.3% p.a.

Stadler Rail's growth outlook is promising, with earnings forecasted to grow significantly at 43.3% annually, surpassing the Swiss market average. Despite a decrease in net income and profit margins last year, revenue is expected to increase by 10.5% annually, outpacing the market's growth rate. The company's high insider ownership suggests alignment with shareholder interests as it navigates these challenges and opportunities for future expansion in the rail industry.

- Dive into the specifics of Stadler Rail here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Stadler Rail shares in the market.

Where To Now?

- Delve into our full catalog of 213 Fast Growing European Companies With High Insider Ownership here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SRAIL

Stadler Rail

Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives