As the global markets react to the recent U.S. Federal Reserve rate cut, European indices have shown mixed performance, with France's CAC 40 Index seeing a modest gain. Amid this backdrop of cautious optimism and monetary policy shifts, dividend stocks on Euronext Paris present an intriguing opportunity for investors seeking steady income. In such a dynamic market environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be crucial for building a resilient portfolio.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.93% | ★★★★★★ |

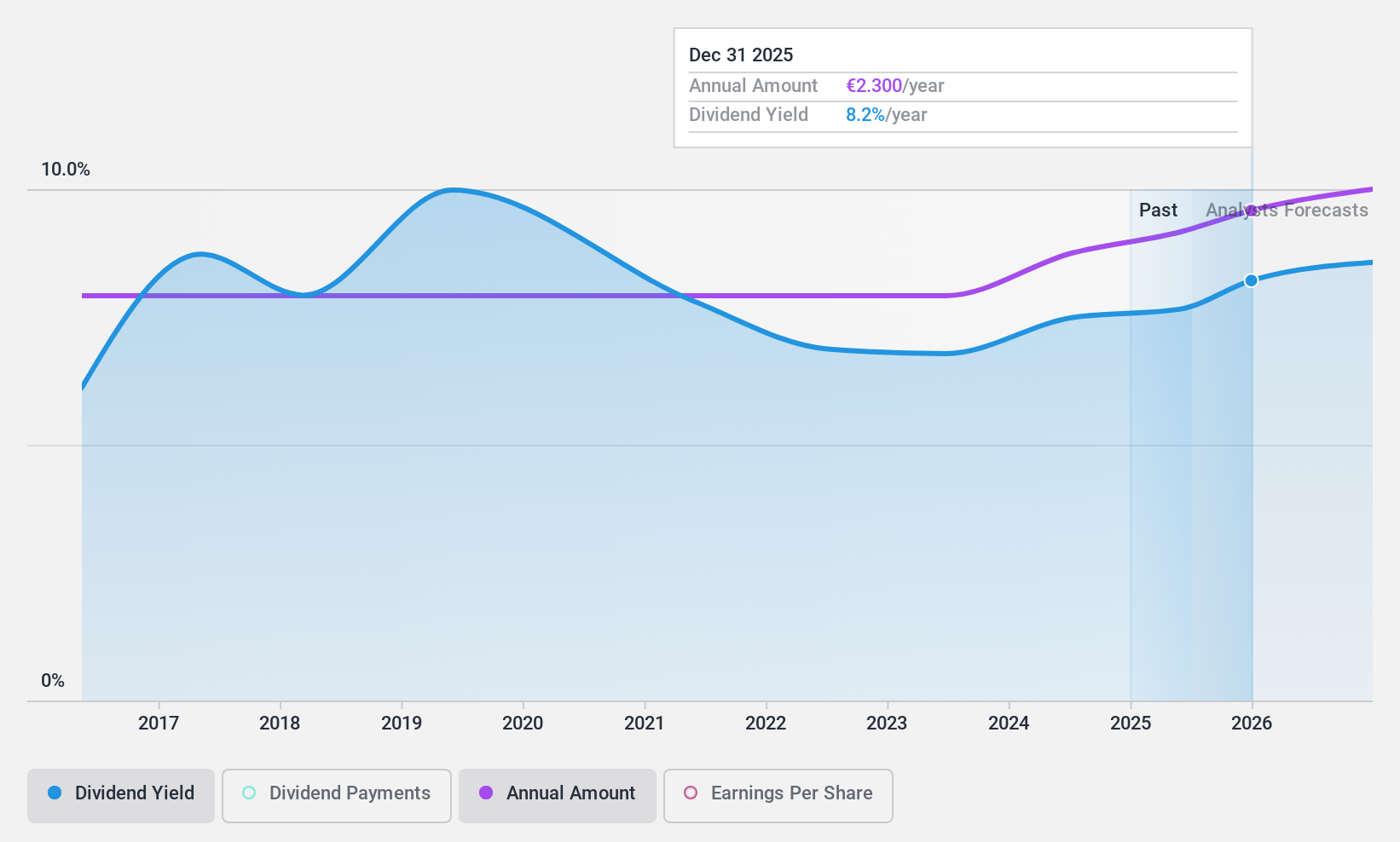

| Rubis (ENXTPA:RUI) | 8.26% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.08% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.83% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.26% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.72% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.72% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.31% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.69% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 4.93% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Société Marseillaise du Tunnel Prado Carénage (ENXTPA:ALTPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société Marseillaise du Tunnel Prado Carénage constructs and operates tunnels in France, with a market cap of €165.79 million.

Operations: Société Marseillaise du Tunnel Prado Carénage generates revenue primarily from the construction and operation of tunnels in France.

Dividend Yield: 7.4%

Société Marseillaise du Tunnel Prado Carénage's dividend yield of 7.39% ranks in the top 25% of French market payers. However, recent earnings showed a decline in net income to €4.65 million from €6.68 million year-over-year, raising concerns about sustainability as the payout ratio stands at 102.6%. Despite this, cash flows cover dividends with a reasonable cash payout ratio of 74.6%, although historical volatility and unreliable payments over the past decade warrant caution for investors seeking stable income.

- Get an in-depth perspective on Société Marseillaise du Tunnel Prado Carénage's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Société Marseillaise du Tunnel Prado Carénage is priced lower than what may be justified by its financials.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client groups in France, with a market cap of €929.51 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates revenue through various banking products and services tailored to individuals, professionals, associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

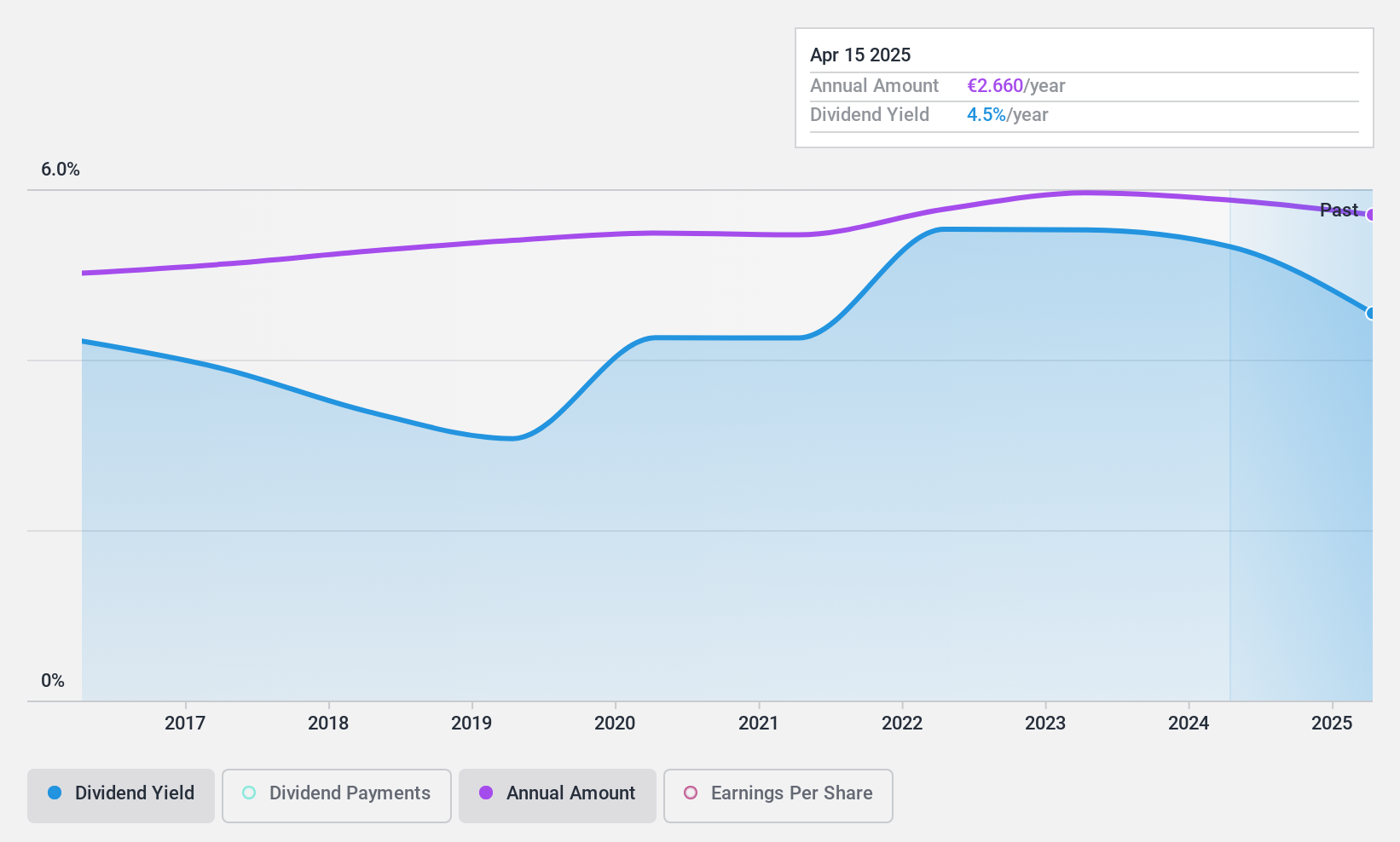

Dividend Yield: 5.8%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a high and reliable dividend yield of 5.83%, placing it in the top 25% of French dividend payers. With a stable and growing dividend history over the past decade, its payout ratio is comfortably low at 29.8%, ensuring dividends are well covered by earnings. Recent earnings showed net income growth to €114.91 million for H1 2024, up from €108.47 million year-over-year, supporting its robust dividend profile despite trading at a significant discount to estimated fair value.

- Navigate through the intricacies of Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's current price could be quite moderate.

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA designs, develops, markets, and maintains software solutions focused on security, performance, and management worldwide with a market cap of €281.45 million.

Operations: Infotel SA's revenue segments include €296.02 million from Services and €11.53 million from Software.

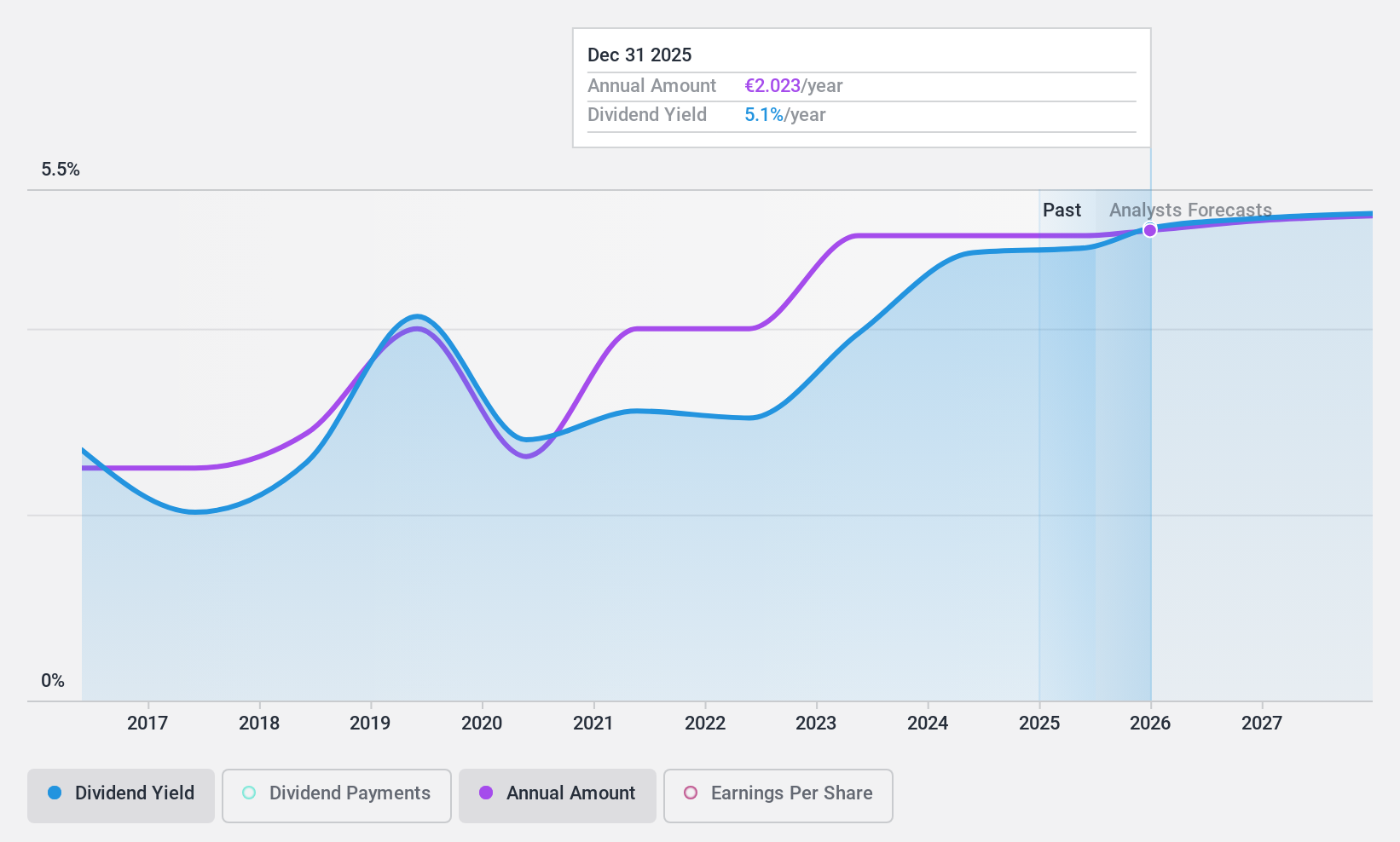

Dividend Yield: 4.9%

Infotel's dividend payments have been volatile and unreliable over the past decade, with an unstable track record. Despite this, its dividends are covered by earnings (payout ratio: 76.2%) and cash flows (cash payout ratio: 63.7%). Trading at 49.6% below fair value, it offers a lower yield (4.93%) compared to top French dividend payers but has seen dividend growth over ten years. Earnings are forecast to grow by 10.78% annually, potentially supporting future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Infotel.

- Our valuation report unveils the possibility Infotel's shares may be trading at a discount.

Turning Ideas Into Actions

- Click this link to deep-dive into the 35 companies within our Top Euronext Paris Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:INF

Infotel

Designs, develops, markets, and maintains software solutions in the areas of security, performance, and management worldwide.

Excellent balance sheet, good value and pays a dividend.