- France

- /

- Specialty Stores

- /

- ENXTPA:ALLDL

Exploring Groupe LDLC Société Anonyme And Two More Top Dividend Stocks On Euronext Paris

Reviewed by Simply Wall St

Amidst a backdrop of rising optimism in European markets, with France's CAC 40 Index showing a notable increase of 3.29%, investors are keenly observing the performance of dividend stocks on Euronext Paris. In such a climate, understanding the characteristics that define resilient and potentially rewarding dividend stocks becomes crucial for those looking to enhance their portfolios.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Rubis (ENXTPA:RUI) | 6.16% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 8.70% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.43% | ★★★★★★ |

| Métropole Télévision (ENXTPA:MMT) | 9.47% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.51% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.15% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 3.55% | ★★★★★☆ |

| Carrefour (ENXTPA:CA) | 5.40% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.27% | ★★★★★☆ |

| Rexel (ENXTPA:RXL) | 4.37% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

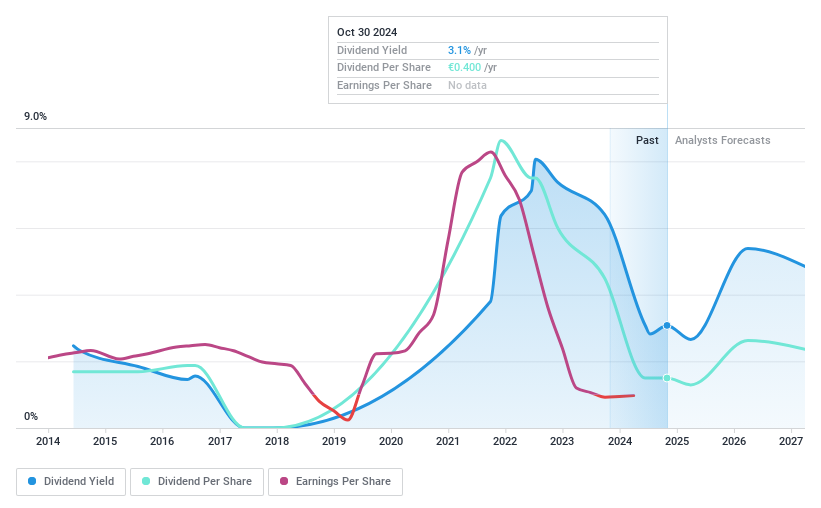

Groupe LDLC société anonyme (ENXTPA:ALLDL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe LDLC société anonyme is an online retailer specializing in IT and high-tech equipment, with a market capitalization of approximately €105.62 million.

Operations: Groupe LDLC société anonyme generates €580.38 million in revenue primarily through the distribution of computer equipment and related services.

Dividend Yield: 6.9%

Groupe LDLC offers a notable dividend yield of 6.86%, placing it in the top 25% of French dividend payers. However, its dividends are not well supported by earnings, indicating potential sustainability issues. While the stock trades slightly below estimated fair value and dividends have increased over the past decade, payments have been volatile and unreliable with earnings forecast to grow significantly at 84.05% annually. Cash flows cover the dividend well, despite an overall unprofitable status for the company.

- Dive into the specifics of Groupe LDLC société anonyme here with our thorough dividend report.

- The analysis detailed in our Groupe LDLC société anonyme valuation report hints at an deflated share price compared to its estimated value.

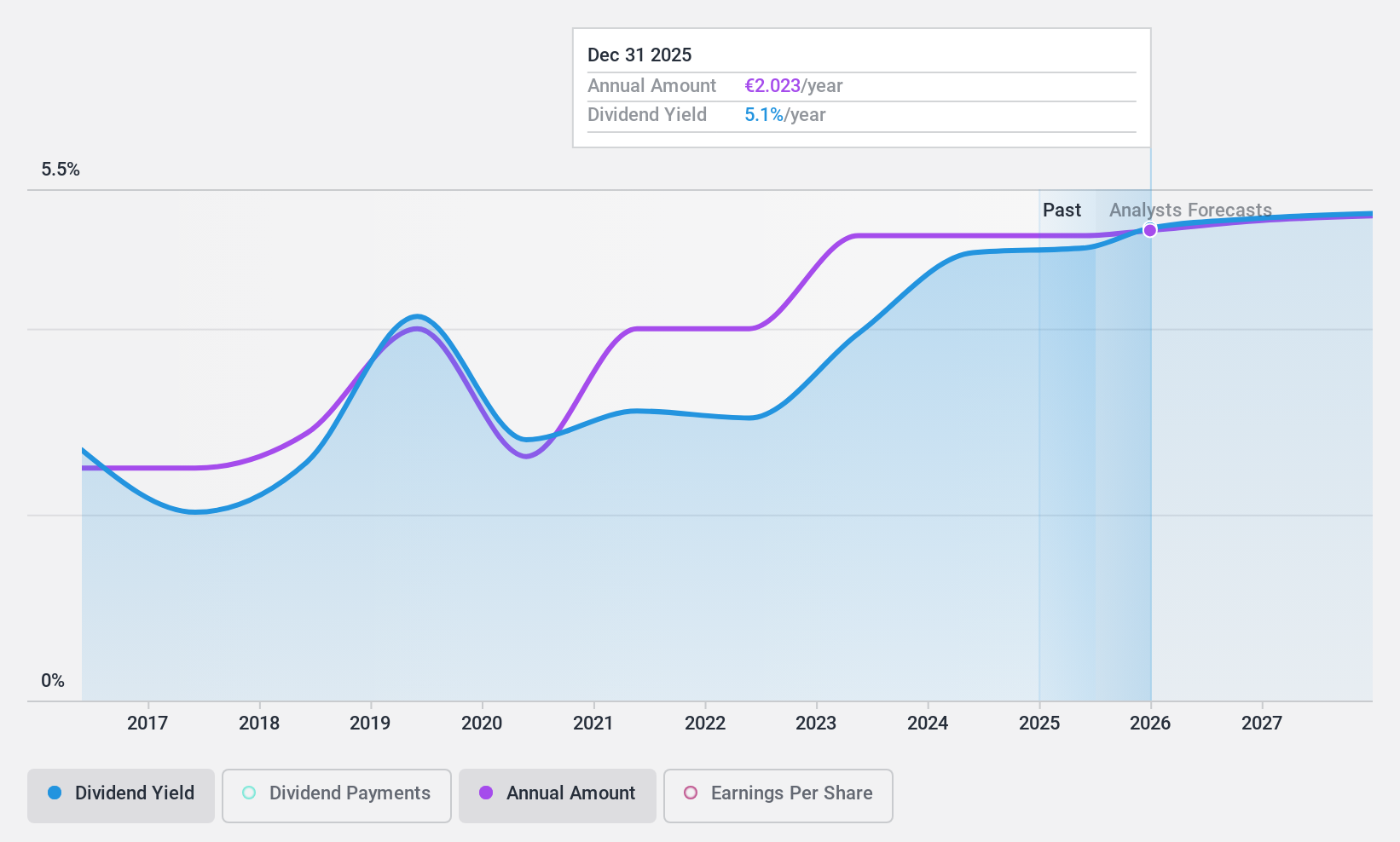

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA is a global provider of software solutions specializing in security, performance, and management, with a market capitalization of approximately €337.52 million.

Operations: Infotel SA generates revenue primarily through its Services segment, which brought in €296.02 million, and its Software segment, which contributed €11.53 million.

Dividend Yield: 4.1%

Infotel SA, with a dividend yield of 4.08%, falls below the top quartile of French dividend stocks at 5.13%. Despite this, its dividends are well-supported by both earnings and cash flows, with payout ratios of 76.2% and 63.3% respectively. The company's valuation indicates a trading price 42.6% under our fair value estimate, suggesting potential upside. However, its dividend history shows instability over the past decade, reflecting some risk in payment consistency despite recent revenue growth to €307.5 million in 2023 from €300.4 million the previous year.

- Unlock comprehensive insights into our analysis of Infotel stock in this dividend report.

- The valuation report we've compiled suggests that Infotel's current price could be quite moderate.

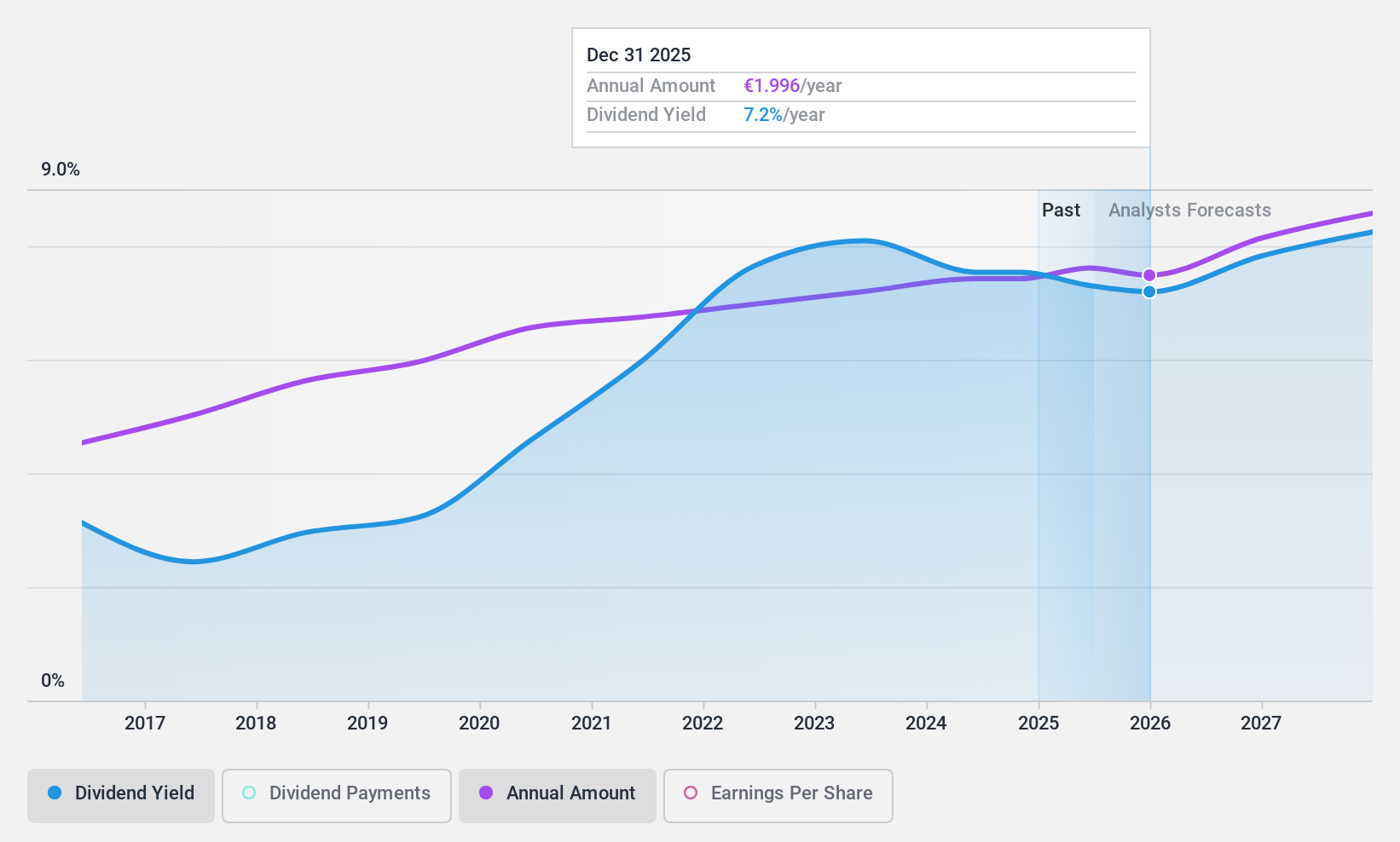

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market capitalization of approximately €3.33 billion.

Operations: Rubis generates revenue primarily through its Energy Distribution segment, which brought in €6.58 billion, and its Renewable Electricity Production segment, contributing €48.64 million.

Dividend Yield: 6.2%

Rubis offers a compelling dividend yield of 6.16%, ranking in the top 25% of French dividend payers. The company's dividends are well-supported, with a payout ratio of 57.7% from earnings and 73.4% from cash flows, indicating sustainability. Despite trading at a 34.7% discount to estimated fair value and experiencing a significant earnings growth of 34.5% last year, Rubis maintains stable dividends over the past decade but carries high debt levels which could impact future financial flexibility.

- Delve into the full analysis dividend report here for a deeper understanding of Rubis.

- Upon reviewing our latest valuation report, Rubis' share price might be too pessimistic.

Make It Happen

- Dive into all 31 of the Top Euronext Paris Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALLDL

Groupe LDLC société anonyme

Operates as an online IT and technology equipment retailer.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion