Amidst a backdrop of fluctuating global markets and ongoing trade tensions, France's CAC 40 Index has experienced a notable decline, shedding 2.46% recently. In such an environment, dividend stocks on the Euronext Paris can offer investors potential stability and attractive yields up to 8.5%, making them compelling considerations for those looking to navigate through current market volatility with potentially steadier income streams.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Rubis (ENXTPA:RUI) | 7.01% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.84% | ★★★★★★ |

| SCOR (ENXTPA:SCR) | 8.67% | ★★★★★☆ |

| Métropole Télévision (ENXTPA:MMT) | 9.75% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.70% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.20% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.05% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.02% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.41% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.55% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA is a company based in France that specializes in designing, manufacturing, and marketing swimming pools and related products globally, with a market capitalization of approximately €105 million.

Operations: Piscines Desjoyaux SA generates its revenue from the design, manufacture, and sale of swimming pools and related products across France and other international markets.

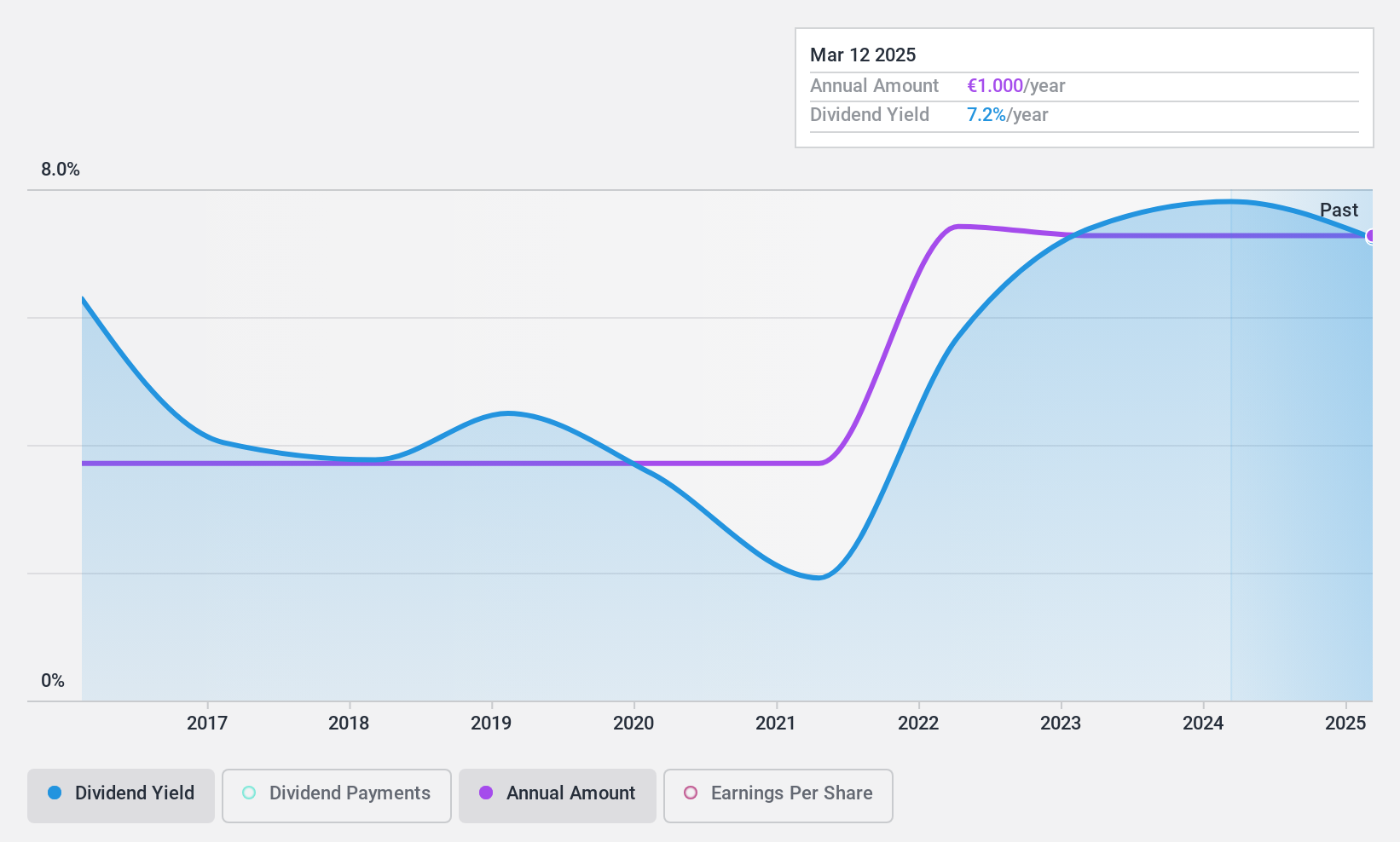

Dividend Yield: 8.5%

Piscines Desjoyaux, a French pool constructor, reported a significant drop in sales and net income for the half-year ended February 2024, with revenues declining to €49.1 million from €61.54 million the previous year and net income falling to €2.51 million from €6.28 million. Despite this downturn, the company has maintained stable dividends over the past decade and offers a high dividend yield of 8.55%, ranking in the top 25% of French dividend payers. However, its dividend sustainability is questionable as both earnings and cash flows currently do not cover dividend payments adequately, evidenced by a high cash payout ratio of 486.2%.

- Get an in-depth perspective on Piscines Desjoyaux's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Piscines Desjoyaux is trading behind its estimated value.

Vinci (ENXTPA:DG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA operates in concessions, energy, and construction sectors across France and globally, with a market capitalization of approximately €60.32 billion.

Operations: Vinci SA's revenue is primarily derived from its VINCI Construction segment, which includes Eurovia, generating €31.46 billion, followed by VINCI Energies at €19.33 billion, and its concessions activities with VINCI Autoroutes and VINCI Airports contributing €6.88 billion and €4.23 billion respectively.

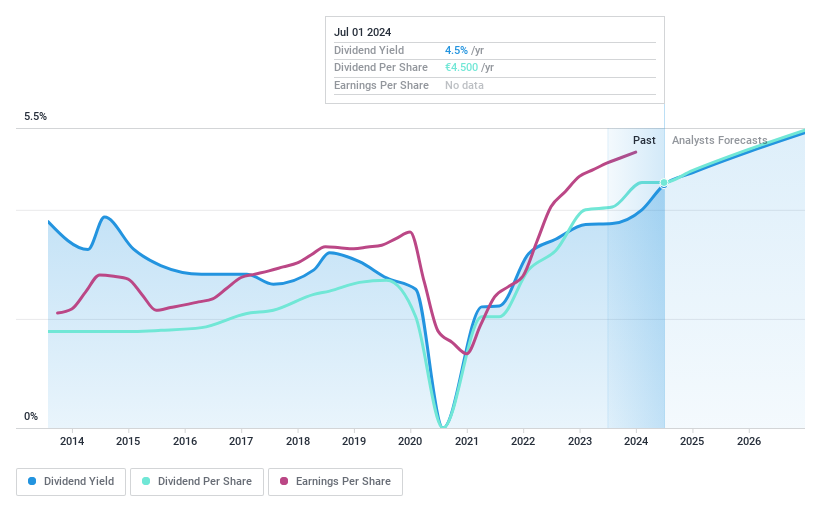

Dividend Yield: 4.2%

Vinci SA, a major player in infrastructure and construction, has recently secured significant contracts, including a €74 million project with Thyssenkrupp for green hydrogen-based steel production and a role in developing offshore energy conversion platforms in the North Sea. While Vinci's dividend yield of 4.23% is below the top French dividend payers, its dividends are sustainable with a payout ratio of 54.4% and cash payout ratio of 35.4%. However, Vinci's dividend track record over the past decade has been unstable, reflecting some volatility in payments despite overall earnings growth of 10.4% over the past year.

- Take a closer look at Vinci's potential here in our dividend report.

- Upon reviewing our latest valuation report, Vinci's share price might be too pessimistic.

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA operates globally, specializing in the design, development, marketing, and maintenance of software solutions focused on security, performance, and management, with a market capitalization of approximately €280.76 million.

Operations: Infotel SA generates revenue primarily through its Services segment, which brought in €296.02 million, and its Software segment, which contributed €11.53 million.

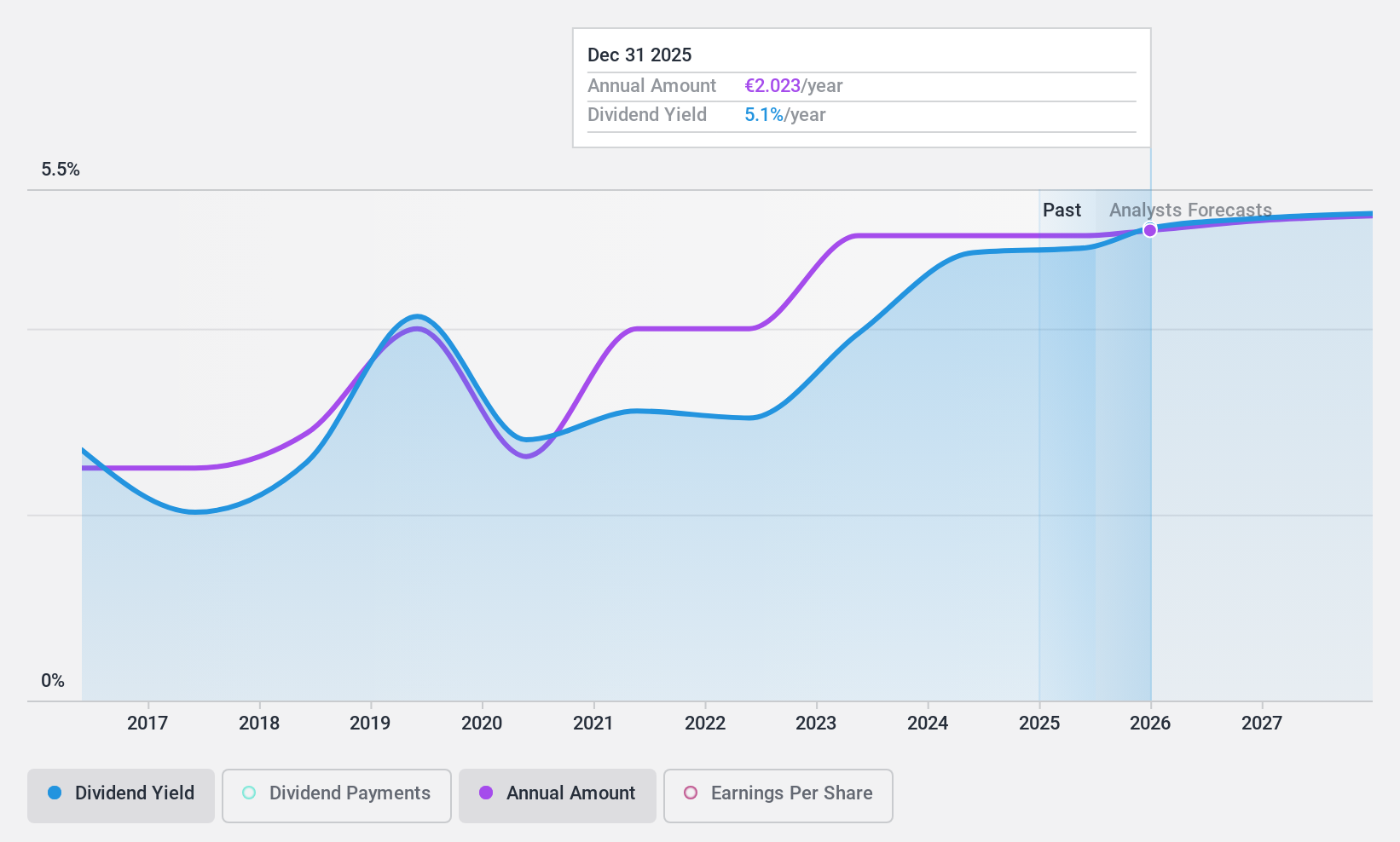

Dividend Yield: 4.9%

Infotel offers a dividend yield of 4.94%, slightly below the top quartile in the French market at 5.35%. The company trades at a significant discount, valued 41.9% below estimated fair value, and analysts predict a potential price increase of 32.2%. Dividends are well-supported with a payout ratio of 76.2% and cash payout ratio of 63.7%, though its history shows some volatility in dividend payments over the past decade despite an overall increase in dividends during this period.

- Dive into the specifics of Infotel here with our thorough dividend report.

- Our valuation report unveils the possibility Infotel's shares may be trading at a discount.

Where To Now?

- Gain an insight into the universe of 38 Top Euronext Paris Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALPDX

Piscines Desjoyaux

Designs, manufactures, and markets swimming pools and related products worldwide.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026