Dassault Systèmes (ENXTPA:DSY): Valuation Insights as New Industry Leaders Join 3DEXPERIENCE Cloud Platform

Reviewed by Kshitija Bhandaru

Dassault Systèmes (ENXTPA:DSY) just caught broader attention with major client wins, including new multi-year agreements with Grundfos and NCC to adopt its 3DEXPERIENCE platform on the cloud. These long-term partnerships are more than routine sales and underscore the company’s rising influence in sectors where digital transformation and sustainability are becoming central strategies. For investors weighing their next move, these announcements provide tangible proof that Dassault Systèmes’ software is critical for organizations seeking to modernize operations and drive innovation at scale.

Against this backdrop of headline-grabbing client deals, the stock’s journey this year tells a different part of the story. Dassault Systèmes’ shares have climbed just over 3% in the past month but are still down around 20% compared to twelve months ago, continuing a multi-year slide. Even as new partnerships hint at momentum in digitalization, recent returns show that long-term performance has lagged. This raises questions about whether the market is still digesting past challenges or if sentiment is beginning to turn.

After these recent wins and the year’s stock movements, is Dassault Systèmes a rare value opportunity in a growth-driven sector, or is the current price already reflecting all that future potential?

Most Popular Narrative: 21.3% Undervalued

According to the most widely followed narrative, Dassault Systèmes is seen as significantly undervalued. This view is based on expectations of solid earnings and margin improvements that could justify a considerably higher share price.

"Rapid expansion into high-growth verticals such as sustainable infrastructure (nuclear, rail, data centers), space and defense, and 'lab-to-fab' transitions in life sciences is broadening Dassault Systèmes' addressable market and is likely to drive double-digit earnings growth over the next several years, supporting higher long-term revenue growth."

Want to know the growth catalyst fueling this bullish valuation? The narrative points to expansion into fast-growing industries along with a runway of rising profits and cash flow. Which bold forecasts are setting the bar for Dassault Systèmes’ fair value? You may be surprised at just how high analysts see this company's financial potential.

Result: Fair Value of €35.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, weak performance in Life Sciences and delayed adoption of new cloud offerings could present challenges to the optimistic outlook for Dassault Systèmes’ growth story.

Find out about the key risks to this Dassault Systèmes narrative.Another View: Market Signals Say Full Price

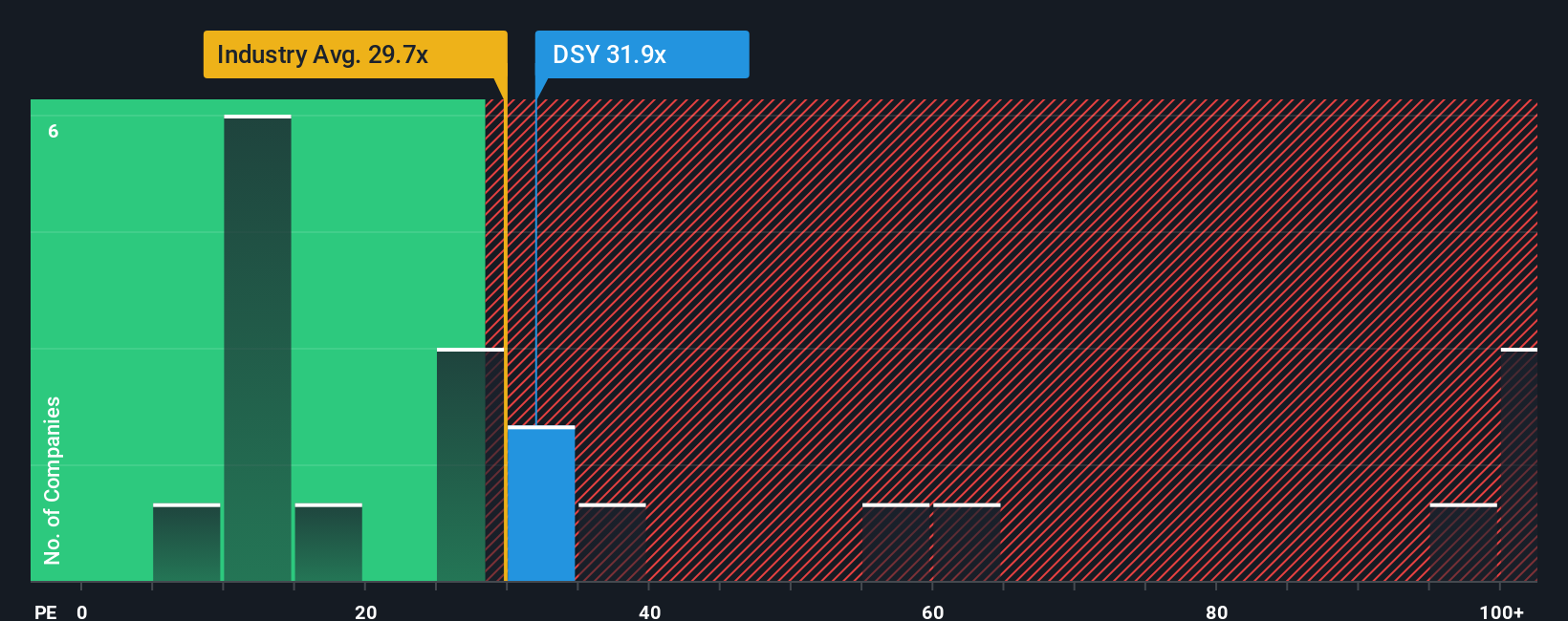

Looking through the lens of market ratios, the picture is quite different. By this measure, Dassault Systèmes currently trades at a higher valuation than the industry average, suggesting investors may already be paying up for its growth. So does the market see hidden risks or is it simply betting bigger on future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Dassault Systèmes to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Dassault Systèmes Narrative

If you have a different perspective, or want to dig deeper into the numbers yourself, it’s easy to craft a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dassault Systèmes.

Looking for More Investment Ideas?

If you want an edge this year, don’t limit yourself to a single opportunity. Seize your chance to spot emerging trends with the right investment tools.

- Tap into tomorrow’s breakthroughs in healthcare technology and see which innovators are shaking up medicine with healthcare AI stocks.

- Catch high-yield opportunities and strengthen your portfolio’s income stream with leading names from dividend stocks with yields > 3%.

- Ride the wave of financial innovation and join the frontrunners capitalizing on digital assets through cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DSY

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives