Will Raised Growth Guidance Transform Capgemini's (ENXTPA:CAP) Long-Term Profit Outlook?

Reviewed by Sasha Jovanovic

- Capgemini recently raised its full-year revenue growth guidance to 2.0%–2.5% at constant currency, following stronger-than-expected performance in its North America, U.K., and Ireland divisions during the third quarter of 2025.

- This upward revision signals improved market momentum and management confidence in the company’s operating outlook, following nearly flat revenue over the first nine months of the year.

- We'll explore how Capgemini's upgraded revenue growth outlook may reshape expectations for long-term earnings and profit margin trends.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Capgemini Investment Narrative Recap

Being a shareholder in Capgemini means believing in the company’s ability to drive profitable growth amid a competitive IT services market, especially through leadership in cloud, AI, and digital transformation. The latest lift in full-year revenue growth guidance suggests short-term momentum in North America and the UK is improving, but margin pressures and slow recovery in key European markets remain the main risks. Overall, while this update provides some relief around growth, it does not fully alleviate concerns about persistent regional stagnation and margin constraints.

Among recent announcements, Capgemini’s debt financing of €4,000,000,000 for the WNS acquisition highlights its focus on scaling capabilities through M&A and investing in higher-value digital and AI services. This aligns with its growth catalysts, but it also raises questions about integration risk and the impact on cash flow at a time when operational risks and regional demand weakness linger.

In contrast, investors should be aware of ongoing downward margin pressure from pricing competition and client cost expectations, especially as...

Read the full narrative on Capgemini (it's free!)

Capgemini's outlook forecasts €24.5 billion in revenue and €2.0 billion in earnings by 2028. This projection assumes a 3.6% annual revenue growth rate and a €0.4 billion increase in earnings from the current €1.6 billion.

Uncover how Capgemini's forecasts yield a €169.57 fair value, a 28% upside to its current price.

Exploring Other Perspectives

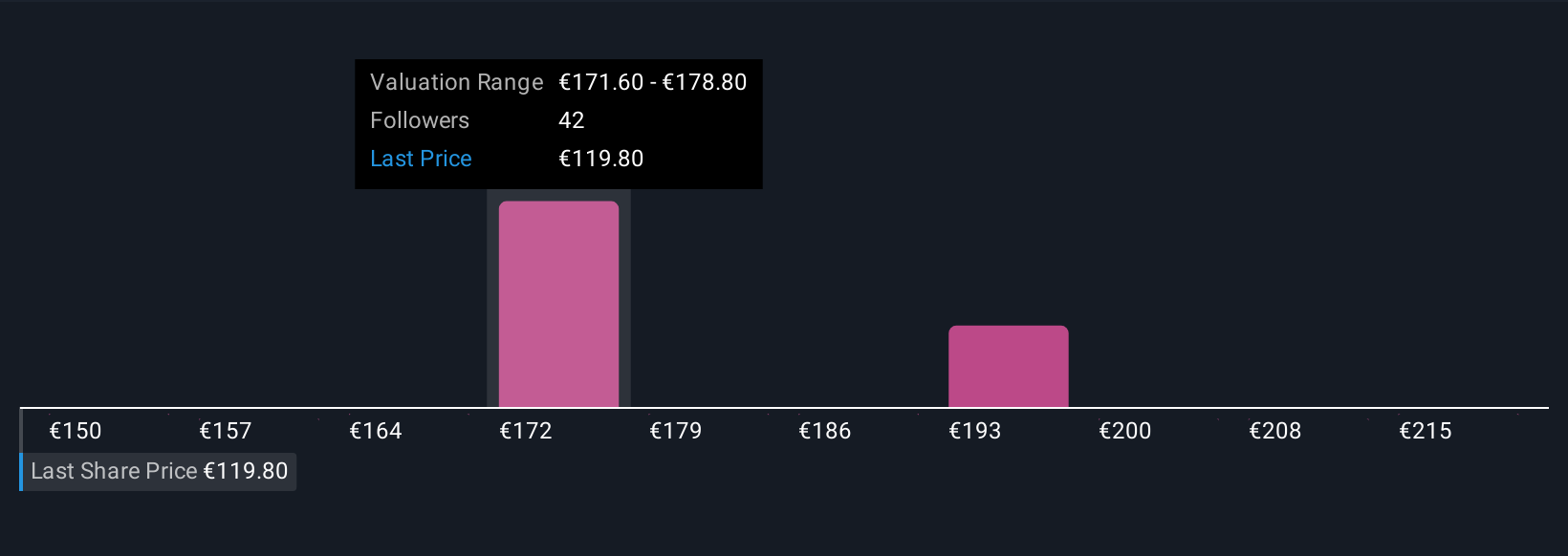

Simply Wall St Community members shared seven fair value estimates for Capgemini stock, all ranging from €150 to €212.10. With persistent pricing and margin headwinds still top of mind, expect wide-ranging views on where the business goes next, explore several perspectives for a fuller picture.

Explore 7 other fair value estimates on Capgemini - why the stock might be worth as much as 60% more than the current price!

Build Your Own Capgemini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capgemini research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Capgemini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capgemini's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CAP

Capgemini

Provides consulting, digital transformation, technology, and engineering services primarily in North America, France, the United Kingdom, Ireland, the rest of Europe, the Asia-Pacific, and Latin America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives