A Look at Atos (ENXTPA:ATO) Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

See our latest analysis for Atos.

Looking beyond the recent climb, Atos has seen its share price surge 114.7% year-to-date and a remarkable 95.2% over the past 90 days, suggesting renewed optimism in the company’s turnaround plans. However, the longer-term story is more sobering, with a 3-year total shareholder return of -92.7%. Momentum is clearly building, but the stock still has ground to recover after years of underperformance.

If this kind of sharp rebound has you rethinking your approach, now might be the perfect time to discover fast growing stocks with high insider ownership

The question for investors now is whether Atos shares are still trading at a compelling discount, or if the market has already factored in its recovery prospects. This could mean there is little room for upside from here.

Most Popular Narrative: 36% Overvalued

While Atos's most widely followed narrative sets a fair value notably below the last close, the market appears to be running well ahead of analyst consensus. This disconnect has sharpened the debate over whether current optimism can be sustained, or if the stock is pricing in too much too soon.

Ongoing restructuring, significant country exits, and pending divestitures are required to restore profitability. However, these actions also create business disruption and uncertainty. This operational upheaval could impact customer retention, slow pipeline conversion, and further pressure short-to-medium term earnings.

Curious why the most popular narrative is several steps ahead of where the stock price trades today? The assumptions driving this calculation lean on bold expectations about earnings stabilization and margin recovery. Want to uncover the specific levers analysts believe will move the market? Dive in to see the crucial details behind this controversial fair value.

Result: Fair Value of €39.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks that could shift sentiment, such as successful restructuring progress or unexpectedly strong customer renewals that support a more resilient earnings outlook.

Find out about the key risks to this Atos narrative.

Another View: What Do the Numbers Say?

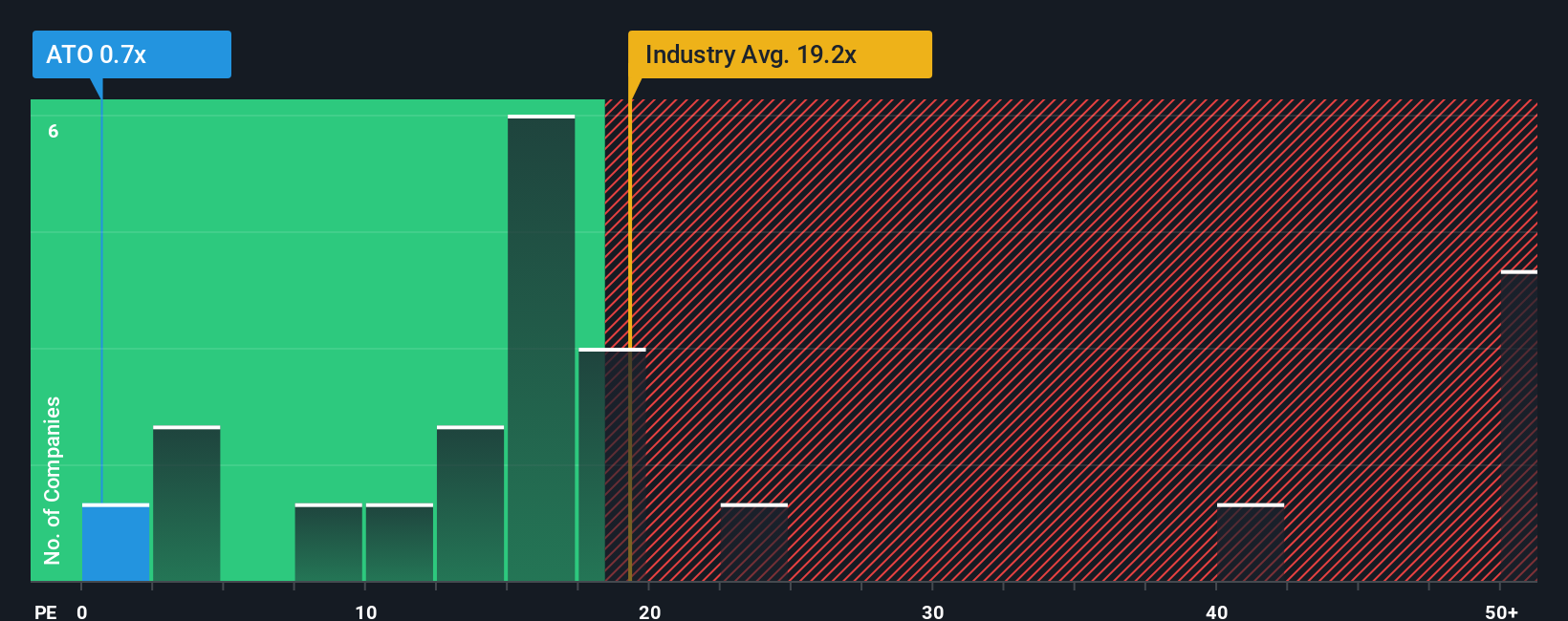

Looking at Atos through the lens of earnings ratios, the stock trades at just 0.7 times earnings. This is substantially lower than both the European IT industry average (19.2x) and the peer average (16.6x). Even relative to its fair ratio of 4.9x, the gap is striking. Does this deep discount suggest an overlooked opportunity, or does it flag concerns that the market has yet to fully price in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atos Narrative

If you see the story differently, or want a hands-on approach, you can craft your own view using our tools in under three minutes. Do it your way

A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let promising opportunities pass you by. Simply Wall Street’s screeners spotlight standout stocks across fast-growing industries and overlooked niches, tailored for real investors.

- Spot high-potential companies redefining automation and intelligent systems by checking out these 24 AI penny stocks.

- Supercharge your portfolio’s growth with these 878 undervalued stocks based on cash flows that may be trading below their intrinsic value right now.

- Boost your passive income with these 18 dividend stocks with yields > 3%, featuring stocks offering solid yields for income-focused strategies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives