Alten (EPA:ATE) Shareholders Have Enjoyed An Impressive 211% Share Price Gain

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. Long term Alten SA (EPA:ATE) shareholders would be well aware of this, since the stock is up 211% in five years. Meanwhile the share price is 3.5% higher than it was a week ago.

View our latest analysis for Alten

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

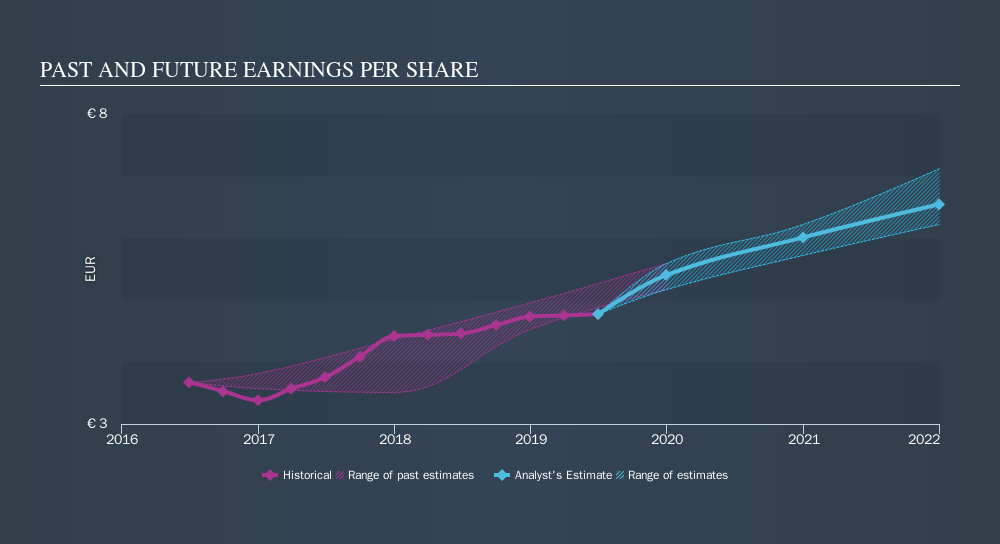

During five years of share price growth, Alten achieved compound earnings per share (EPS) growth of 17% per year. This EPS growth is lower than the 25% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time.

Dive deeper into Alten's key metrics by checking this interactive graph of Alten's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Alten the TSR over the last 5 years was 236%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Alten shareholders have received a total shareholder return of 17% over one year. That's including the dividend. Having said that, the five-year TSR of 27% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before forming an opinion on Alten you might want to consider these 3 valuation metrics.

But note: Alten may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ATE

Alten

Operates as an engineering and technology consultancy company in France, North America, Germany, Scandinavia, Benelux, Iberian, Spain, Italy, the United Kingdom, the Asia-Pacific, Switzerland, Eastern Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives