If You Had Bought Blockchain Group (EPA:ALTBG) Stock Five Years Ago, You'd Be Sitting On A 97% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The Blockchain Group (EPA:ALTBG) shareholders will doubtless be very grateful to see the share price up 30% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 97%. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Blockchain Group

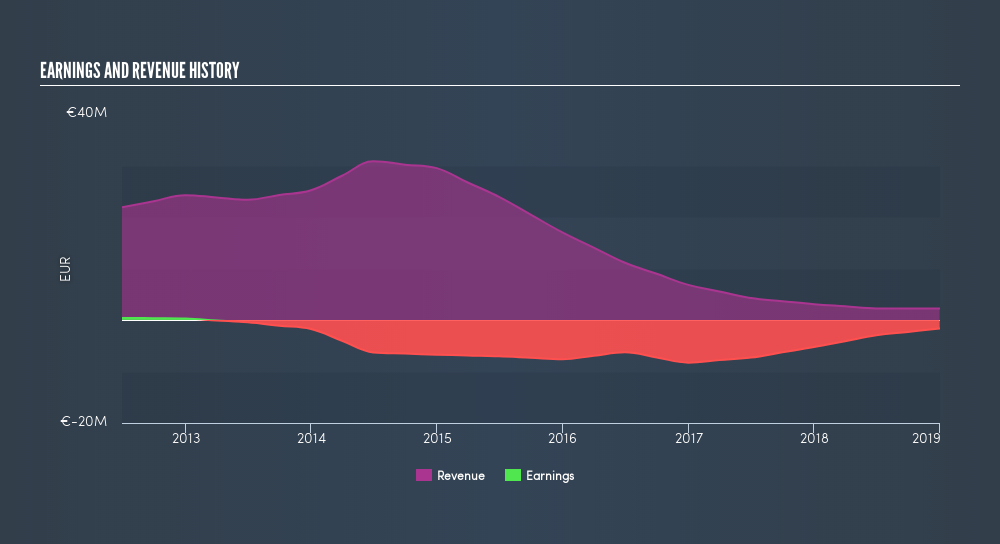

Blockchain Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Blockchain Group reduced its trailing twelve month revenue by 48% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 51% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

If you are thinking of buying or selling Blockchain Group stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Blockchain Group's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Blockchain Group hasn't been paying dividends, but its TSR of -96% exceeds its share price return of -97%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Blockchain Group has rewarded shareholders with a total shareholder return of 22% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 48% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ALCPB

Blockchain Group

Develops and markets blockchain technologies in France and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives