The 12% return this week takes Streamwide's (EPA:ALSTW) shareholders five-year gains to 173%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Streamwide S.A. (EPA:ALSTW) which saw its share price drive 173% higher over five years. And in the last month, the share price has gained 17%. But the price may well have benefitted from a buoyant market, since stocks have gained 6.9% in the last thirty days.

Since it's been a strong week for Streamwide shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Streamwide

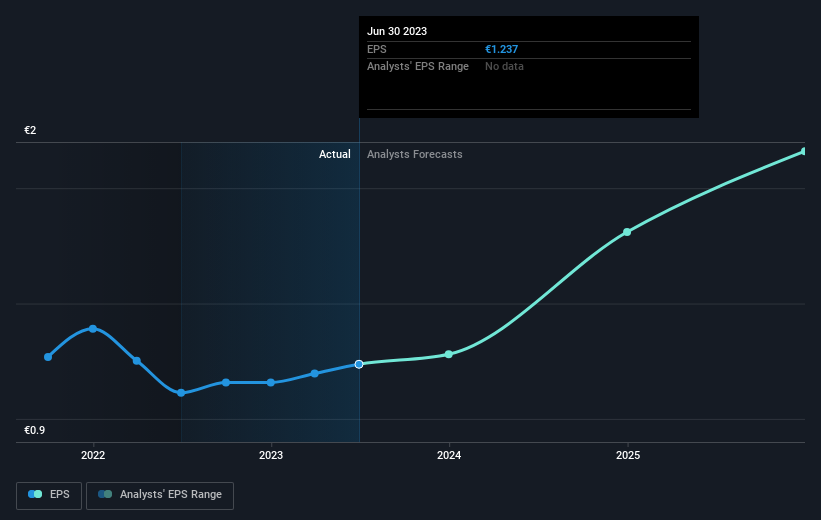

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Streamwide moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. In fact, the Streamwide stock price is 14% lower in the last three years. In the same period, EPS is up 23% per year. So there seems to be a mismatch between the positive EPS growth and the change in the share price, which is down -5% per year.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Streamwide has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

Streamwide provided a TSR of 4.3% over the last twelve months. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 22% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Streamwide better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Streamwide .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALSTW

Streamwide

Designs, develops, markets, and maintains a set of service software for telecommunication operators, landlines, and mobiles worldwide.

Excellent balance sheet and fair value.

Market Insights

Community Narratives